Are you a Mortgage Broker, Finance Broker, or Bank looking to streamline your business loan application process? Our comprehensive business loan application form is perfect for you.

Designed for small and medium-sized businesses, this online form gathers necessary information to assess the applicant's eligibility for financing. Save time and improve efficiency by utilizing this ready-to-use form tailored to your needs.

Tired of chasing people to fill out your forms? Try Content Snare

Questions to include on your business loan application form

1. Applicant Information

This section collects basic information about the individual or business applying for the loan.

- What is the full name of the main applicant?

- What is the main applicant's date of birth?

- What is the contact email address?

- What is the contact phone number?

- What is the registered business name?

- What is the business registration number?

2. Loan Details

In this section, we gather information about the loan that the applicant is requesting.

- What is the purpose of the loan? (Purchase Equipment, Expand Business, Refinance Existing Loan, Working Capital, Other)

- How much money are you requesting for the loan?

- What is your preferred loan term? (1-3 Years, 3-5 Years, 5-10 Years)

3. Financial Information

These questions help us understand the applicant's financial situation and ability to repay the loan.

- What is the current annual revenue of the business?

- What is the net profit of the business for the last financial year?

- Are there any existing loans or debts? (Yes, No)

- If yes, please provide details of existing loans or debts.

The question about existing loans or debts is important to assess the applicant's current financial commitments and evaluate their ability to handle additional debt.

4. Collateral Information

This part gathers information about collateral the applicant can provide as security for the loan.

- Do you have any assets to offer as collateral for the loan? (Yes, No)

- If yes, please provide details of the collateral, including its estimated value.

The question about collateral helps determine the applicant's risk level and provides additional security for the loan.

5. Supporting Documents

This section allows the applicant to upload essential documents for the application process.

- Please upload a copy of your business registration document.

- Please upload your business financial statements for the last two years.

- Please upload a list of your business assets and liabilities, including any outstanding loans or debts.

- Please upload a detailed business plan for the loan.

These supporting documents are crucial for evaluating the applicant's business performance, financial stability, and the potential success of the loan's purpose.

Things to consider

- Accessibility - Ensure the form is accessible to users with disabilities by including proper labels, using clear language, and following accessibility guidelines.

- User-friendly Design - Design the form with a clean layout, logical question order, and responsive design so that it's easy to complete on various devices.

- Error Messages - Implement clear, specific error messages that guide users when they make mistakes or leave required fields blank.

- Progress Indicators - Use progress indicators to show users how far they are in completing the form, which can improve completion rates and user experience.

- Save and Resume - Allow users to save their progress and return to complete the form later, especially if the form is lengthy or requires time-consuming information.

- Conditional Logic - Use conditional logic to hide or reveal questions based on the user's previous answers, making the form seem shorter and more relevant to their situation.

- Security Measures - Protect sensitive data by implementing secure form features, such as SSL encryption and password protection, to ensure the confidentiality of submitted information.

How to create your business loan application form

Now that you know what questions you should include, it's time to build your form!

The only problem is that traditional forms tools are inefficient.

People will forget to fill out your form. They'll get stuck halfway and not be able to finish it. Or they'll send you the wrong stuff. You end up wasting hours chasing people down over email.

That's why you should give Content Snare a try.

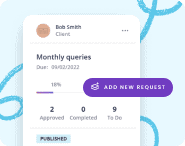

Content Snare is packed with advanced features that will have you hours:

- Automatic reminders - Remind people to complete their form with fully customizable reminders.

- Reject incorrect information - If a single question is filled out incorrectly, ask your client to re-do just that one item.

- Autosaving - No progress gets lost. People can fill out forms in multiple sittings.

- Comments and questions - If the person filling the form gets stuck, they can ask a question without having to email you.

Give it a go by signing up for your free 14-day trial.