Looking to streamline your mortgage application process? Banks, mortgage brokers, and finance companies can benefit from using the KYC form.

This comprehensive list of questions will help you collect essential information about your clients, assess their creditworthiness, and make informed lending decisions. Get started with these personalized questions and create an efficient, customer-friendly application experience.

Tired of chasing people to fill out your forms? Try Content Snare

Questions to include on your KYC form

1. Personal Information

Collecting personal information is crucial for verifying the identity of the applicant and ensuring that they meet legal requirements.

- Full name

- Date of Birth

- Social Security Number

- Residential address

- Email address

- Phone number

2. Employment Information

Employment information helps assess the applicant's job stability and income, which play a significant role in their ability to repay the mortgage.

- Current employer's name

- Job title

- Employment status (Full-time, Part-time, Self-employed, Unemployed)

- Annual income

- Duration of employment

3. Financial Information

Financial information helps evaluate the applicant's creditworthiness and ability to repay the loan, which is essential for risk management.

- Credit score

- Outstanding debts (e.g., credit cards, personal loans)

- Assets (e.g., savings, investments)

- Monthly expenses (e.g., rent, utilities)

4. Mortgage Information

Gathering information about the applicant's preferred mortgage terms and property details helps in tailoring a suitable mortgage product for them.

- Loan amount requested

- Preferred mortgage term (15 years, 20 years, 30 years, Other)

- Type of property to be purchased (Single-family, Multi-family, Condo, Co-op)

- Property value

- Down payment amount

5. Supporting Documents

Requesting supporting documents allows for verifying the information provided by the applicant and assessing their mortgage eligibility.

- Upload proof of identification (e.g., passport, driver's license)

- Upload proof of income (e.g., pay stubs, tax returns)

- Upload proof of financial assets (e.g., bank statements, investment account statements)

Questions like property value and down payment amount are essential for determining the loan-to-value ratio, which helps lenders assess the risk associated with the mortgage. Additionally, collecting supporting documents allows for more accurate evaluation of the applicant's financial situation and eligibility.

Things to consider

- Mobile Responsiveness - Optimize your form for different devices, including smartphones and tablets, to ensure a smooth user experience for all applicants.

- Progress Indicators - Include a progress bar or a step indicator to show users how far along they are in the process and how many sections are remaining, as it helps in managing their expectations and time.

- Error Validation - Implement real-time error validation to alert users about any incorrect or incomplete information during the form filling process. This reduces the chances of submission errors and helps users avoid frustration.

- Auto-save Feature - Implement an auto-save functionality that saves the user's input as they progress through the form. This will prevent data loss in case of technical issues or accidental page reloads.

- Optional Fields - Clearly mark which fields are required and which are optional. This will save time for applicants and make the form filling process more efficient.

- Conditional Logic - Use conditional logic to show or hide fields based on the user's previous inputs. This will make your form more dynamic and relevant, preventing users from encountering irrelevant questions.

- Data Security - Ensure the security of the data collected by implementing encryption, secure data storage, and compliance with data protection regulations. This will build trust with the applicants and protect their sensitive information.

How to create your KYC form

Now that you know what questions you should include, it's time to build your form!

The only problem is that traditional forms tools are inefficient.

People will forget to fill out your form. They'll get stuck halfway and not be able to finish it. Or they'll send you the wrong stuff. You end up wasting hours chasing people down over email.

That's why you should give Content Snare a try.

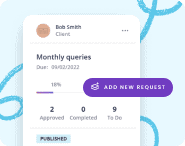

Content Snare is packed with advanced features that will have you hours:

- Automatic reminders - Remind people to complete their form with fully customizable reminders.

- Reject incorrect information - If a single question is filled out incorrectly, ask your client to re-do just that one item.

- Autosaving - No progress gets lost. People can fill out forms in multiple sittings.

- Comments and questions - If the person filling the form gets stuck, they can ask a question without having to email you.

Give it a go by signing up for your free 14-day trial.