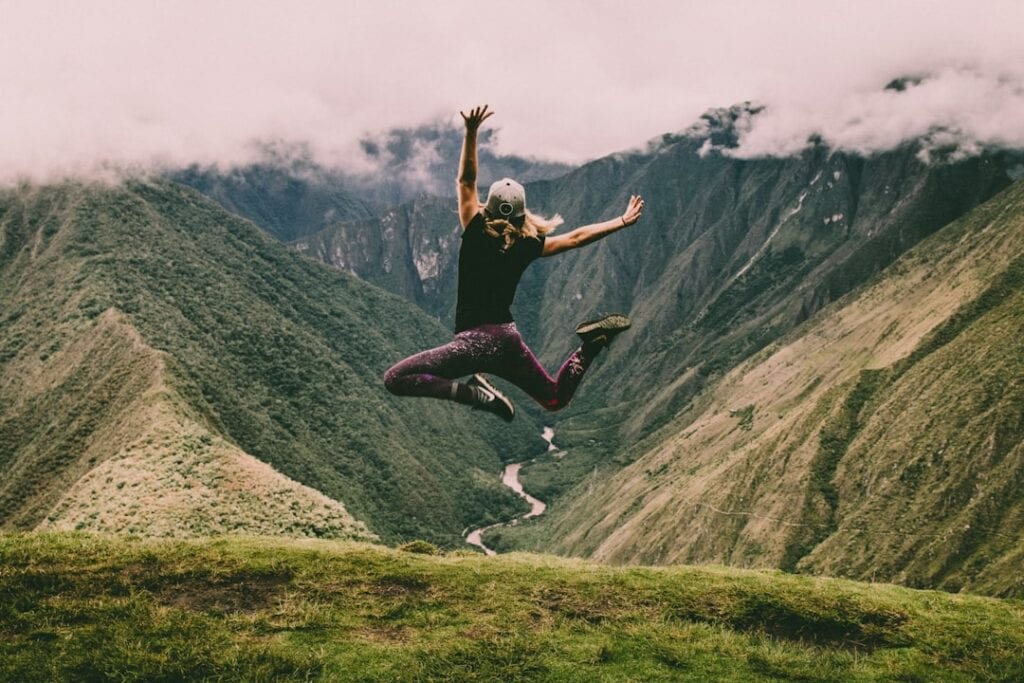

Ready to level up your insurance brokerage?

Our Life insurance needs assessment form is tailor-made for businesses like yours. Whether you're an independent broker or part of a larger firm, you can use this form to gather important client details. It's designed to help you make accurate insurance recommendations, boosting your credibility and customer satisfaction.

Sounds good, right? Let's get started!

Tired of chasing people to fill out your forms? Try Content Snare

Questions to include on your Life insurance needs assessment form

1. Personal Information

Since you'll need to have a clear understanding of the client's personal situation, we'll begin by collecting their basic personal information.

- Full Name

- Date of Birth

- Gender (Male, Female)

- Occupation

- Smoker (Yes, No)

The question about smoking is important as it significantly impacts life insurance premiums.

2. Financial Information

Understanding the client's financial status can help you determine their insurance needs and ability to pay premiums.

- Annual Income

- Total Savings and Investments

- Outstanding Debts

- Current Monthly Expenditures

The question about outstanding debts is crucial as it can impact the amount of life insurance coverage required.

3. Dependents Information

This information helps you understand who relies on the client financially, which influences the amount of life insurance needed.

- Number of Dependents

- Age of Youngest Dependent

- Expected Years of Dependency for Youngest Dependent

The age and years of dependency for the youngest dependent help determine the term of the life insurance policy.

4. Current Insurance Coverage

This helps you understand what insurance coverage the client already has, aiding in determining additional requirements.

- Current Life Insurance Coverage Amount

- Current Health Insurance Coverage (Yes, No)

Knowing the current life insurance coverage helps to avoid over-insurance or under-insurance.

5. Future Financial Goals

To ensure the life insurance policy meets the client's future needs, you need to understand their financial goals.

- Retirement Age

- Estimated Annual Income Needed in Retirement

- Future Significant Expenditures (Buying a house, Funding children's education, etc.)

The estimated annual income needed in retirement can guide the calculation of the life insurance cover to provide enough financial support in the client's absence.

Things to consider

- Privacy and Security - Given the sensitive nature of the information you're collecting, consider implementing security measures to maintain client trust and comply with legal requirements. Implement data encryption on your form and clearly state how you plan to use and store the collected data.

- User-Friendly Design - To ensure ease of use, keep the form design simple and intuitive. Break it into clear sections as mentioned in the question list above. Use an easy-to-read typeface and ensure your form is mobile-friendly.

- Minimalistic Approach - Avoid unnecessary questions. The longer the form, the higher the chances of form abandonment. Stick to the essentials to increase the completion rate.

- Clear Instructions - Each question should be straightforward and concise. Use clear language and avoid jargon. If a question requires further explanation, include a short note under the question.

- Use of Conditional Logic - If possible, use conditional logic to show or hide questions based on previous answers. This ensures your form is relevant and concise, improving user experience.

- Validation and Error Messages - Implement real-time validation to alert users of any mistakes or omissions. This helps avoid frustration when submitting the form.

- Confirmation Message - After the form is submitted, provide a confirmation message to acknowledge submission and inform the user of next steps. This provides assurance and clarity, enhancing user experience.

How to create your Life insurance needs assessment form

Now that you know what questions you should include, it's time to build your form!

The only problem is that traditional forms tools are inefficient.

People will forget to fill out your form. They'll get stuck halfway and not be able to finish it. Or they'll send you the wrong stuff. You end up wasting hours chasing people down over email.

That's why you should give Content Snare a try.

Content Snare is packed with advanced features that will have you hours:

- Automatic reminders - Remind people to complete their form with fully customizable reminders.

- Reject incorrect information - If a single question is filled out incorrectly, ask your client to re-do just that one item.

- Autosaving - No progress gets lost. People can fill out forms in multiple sittings.

- Comments and questions - If the person filling the form gets stuck, they can ask a question without having to email you.

Give it a go by signing up for your free 14-day trial.