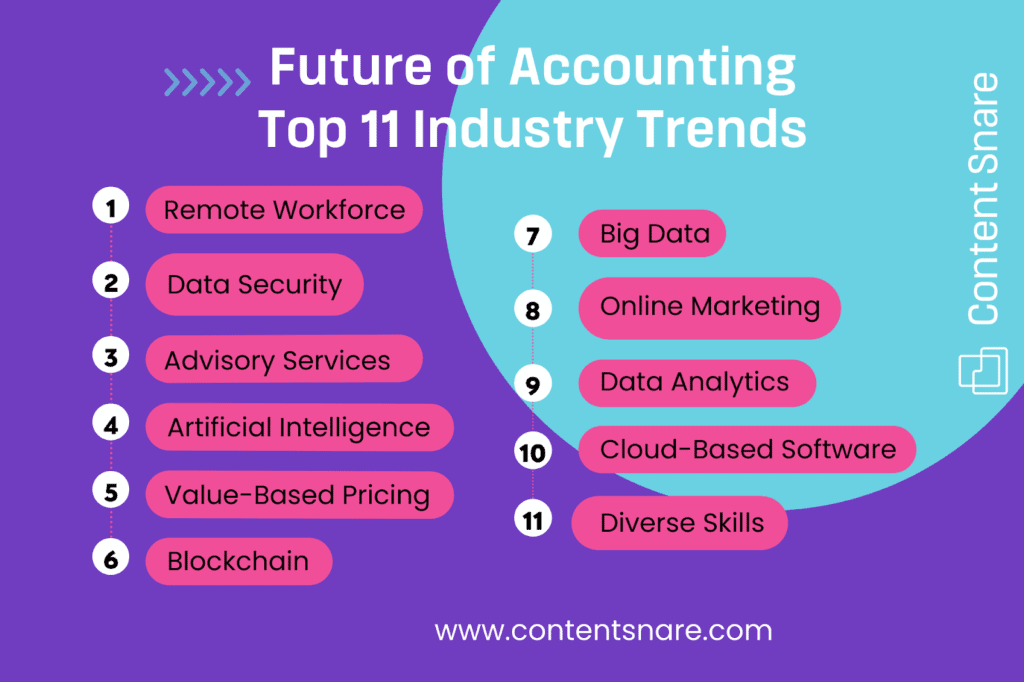

It is hard to know what will happen in the future, and that is never more true than when you are talking about emerging accounting trends.

Accounting practices change over time as new technologies emerge and old ways of doing things become obsolete. Many accounting firm owners feel the impact of automated accounting processes and high-tech systems on their business.

A Sage report reveals that about 90% of accountants feel that accountancy is undergoing a cultural shift that is leaning more toward technology (Sage, 2019). This cultural shift is driven by many factors, including generational change and client demands.

Here are the top 11 accounting trends to watch out for and implement in your firm.

Let’s look at these a little closer.

1. Remote Workforce

The traditional workforce is changing. Employees are no longer bound to a physical office, and businesses are taking advantage of this. The accounting industry is no exception and is one industry that can do it more easily than others.

More and more accountants are working remotely due to the pandemic and implementation of cloud-based software, allowing employees to complete their assigned tasks without being in the same building. And this trend is likely to continue.

There are many benefits to remote work, including increased flexibility and decreased overhead costs.

To have remote work be successful, it is essential to have the right technology solutions, such as virtual communication tools, cloud-based accounting software, and secure online data storage and sharing.

Accounting firms that want to stay competitive should consider implementing a remote work policy. It has become clear that there is no one way to manage your employees. Every team member has individual preferences for being productive at work.

While typically traditional firms work in person, there is a clear need for firms to provide employees with a flexible, customizable work environment to retain talent. And with the support of the right technology and tools, this is very doable.

2. Data Security

As more data is shared electronically between accounting firms and their clients, hackers are also stepping up their games. Accounting firms need to protect themselves from cyber threats and other data security issues, including offering adequate cybersecurity training to their employees.

Cloud-based software provides a cost-effective, scalable solution for secure online data storage, making it easier for accountants to access work when on the go or at home.

Accounting firms should also implement systems with two-factor authentication requirements so only authorized users can access sensitive data. With the level of confidential financial data shared between accountants and clients, even a minor security breach can lead to identity theft.

Focusing on data security will help decrease risk exposure by protecting organizations' most valuable assets - their customers' financial information.

Collect information from clients securely

Stop sending and receiving important information through email and start using Content Snare’s secure platform to protect your data.

3. Advisory Accounting Services & Holistic Advisors

Accounting firms that want to stay competitive will need to expand beyond traditional bookkeeping and tax preparation services while offering advisory services.

Advisory services include providing recommendations on how a business can use new technologies for increased efficiency or solve problems in other areas such as operations software management or human resources.

This allows CPAs to bridge the gap between accountants and other financial advisors. Developments in accounting technology allow accountants to offer more accurate insights and provide their clients with valuable advice.

Despite the rise in accounting automation, we cannot eliminate the need for human influence, opening the doors for holistic advisors rather than transactional accountants. Firms that can adapt to this trend will earn even more revenue than before. This may mean an opportunity to expand your skillset to focus on managing cash flow, financial planning or technology.

4. Automated Processes & Artificial Intelligence

The days of manually inputting data into a spreadsheet are coming to an end. Accounting firms that want to stay competitive need to automate their processes as much as possible to save time and money.

According to research conducted by Sage in 2019, 58% of accounting professionals are expected to automate tasks using artificial intelligence solutions within the next 3 years.

Automation can be achieved through software like robotic process automation (RPA), which uses artificial intelligence (AI) bots to complete repetitive tasks quickly and accurately. It can even play a role in analyzing documents and preparing reports. Not only will this save your firm time and money, but it will also free up employees' time so they can focus on higher impact and higher-value activities.

Automating accounting processes will drastically reduce errors and workload, allowing accountants to take on more advisory responsibilities. This trend will increase the demand for auditors to check the financial inputs and data accuracy of the information provided.

As artificial intelligence continues to evolve, so will the role of accountants within organizations. AI is already being used in several industries to automate tasks done manually. Accounting firms should begin preparing for the day when AI can perform more complex functions currently handled by human beings.

For example, AI could identify fraudulent transactions, compile financial reports, or manage customer relationships. While there is no need to panic just yet, accounting professionals need to learn about AI and its impact on the accounting industry.

While many accounting functions can be automated, there is a lack of understanding of the technologies and resources to implement them. Ever-evolving technology allows a trend toward automation of repetitive accounting tasks.

Some of the processes that are being automated include approval workflows, bank reconciliation, journal entries, inter-company consolidation, revenue recognition, lease accounting and depreciation. But those that take the leap are reaping the benefits.

5. Value-Based Pricing

Accounting firms need to be aware of the impact that value-based pricing will have on their business as they look towards the future. Accounting is a service industry, and clients are looking for accountants who can provide them with what they really need instead of simply selling services at any price point.

There will be fewer accountants billing by the hour or performing work without discussing what it will cost in advance, especially now that we see more automation and less time spent manually inputting data into spreadsheets. Accounting firms should consider implementing clear-cut billing policies such as fixed fees or project rates to avoid confusion when estimating costs upfront.

Value-based pricing provides both business owners and clients certainty on prices and prevents surprises. In addition, it forces accountants to be efficient in their work to allow more profit. Technology and automation are allowing accounting work to be more efficient in itself.

6. Blockchain Technology

The blockchain is a distributed ledger technology that allows for secure, transparent and tamper-proof transactions. Accounting firms should pay close attention to the potential implications of this new technology as it could potentially revolutionize how businesses operate.

Firms in the US are projected to spend approximately $1.1 billion on blockchain technology by the end of 2022 (Statistica, 2020).

Blockchain records and stores assets, liabilities, transactions and provides methods of recording cash flow and reconciling accounts. It is essential for people in the accounting industry to understand blockchain technology and how it will affect the industry moving forward.

Blockchain is already changing the accounting sector by lowering the costs of reconciling and maintaining ledgers. It also provides the needed accuracy in ownership and history of assets. Accountants can better understand their firm’s obligations and available resources.

Some possible applications include automatic invoicing, payments and audit trails. The blockchain could help reduce the need for third-party intermediaries such as banks and auditors, saving organizations time and money.

As with any new technology, there are some risks associated with implementing the blockchain into your business, so be sure to do your research before making any decisions.

7. Big Data

As data becomes increasingly more complex, the need for accountants who can effectively manage and analyze it will also increase.

Accounting firms should consider hiring individuals with strong data analytics skills and experience analyzing data to help them make sense of all the information at their fingertips. This is where big data comes into play.

Big data is a term used to describe the large volume of data organizations collect from various sources. Accounting firms need to find ways to store this data, mine it for insights, and turn it into actionable knowledge to remain competitive.

The use of big data analytics can help identify future trends and correlations that would otherwise be missed. Accounting firms that can harness the power of big data will provide their clients with more valuable insights and recommendations.

By analyzing massive datasets, accountants can analyze risk levels to predict future consequences on an organization’s finances and make plans instantly. Business models are more proactive when analyzing big data.

CPAs, backed by big data, can now focus more on planning, taking control, analyzing processes and anticipating problems before they happen.

8. Online Marketing

With more and more people online, accounting firms need to find ways to market themselves in this digital age.

One way to do this is by creating a solid presence on social media platforms, which are a powerful marketing tool. Accounting firms can use social media to share valuable content with their audience, interact with clients, and build relationships.

It's also essential to have a well-designed website that reflects your brand and showcases your services.

Another effective way to reach potential clients is through email marketing. You can create an email list of contacts interested in what you have to offer and send them regular updates about your firm, upcoming events, or new services.

This is a fundamental way for accountants to grow their network, build relationships, and demonstrate their expertise.

9. Data Analytics and Forecasting

In addition to big data, accountants also need to use advanced analytics and forecasting techniques. The demand for data specialists in the accounting industry will skyrocket soon.

Data analytics help identify operational inefficiencies and manage risks better. More businesses will invest in data analysis to help with data-backed decisions.

Accounting firms can analyze their client's historical performance data to create forecasts for the future. Forecasts allow companies to plan, so they can make more informed decisions when it comes time for critical business choices.

For example, suppose an organization knows that a particular product is selling well during certain months of the year. They will want to optimize production during those times and decide whether or not manufacturing capacity needs adjusting.

Accounting firms should strongly consider investing in data science training programs that provide knowledge on effective strategies used by industry leaders and hands-on experience with various tools commonly used at accounting firms, including SQL, Excel, and Python. Accountants now benefit from having unique skills in data analysis or a background in data science.

10. Cloud-Based Accounting Software

More and more businesses are moving to the cloud, and accounting firms are following suit to meet their needs. Cloud-based accounting systems allow you to access your data from any device with an internet connection. This is an excellent option for firms with multiple locations or employees who work remotely.

Cloud-based solutions also make it easy to share files and collaborate with others. It allows all accountants on the team to have instant access to their accounting data saving valuable time.

It has saved businesses from substantial upfront costs for traditional in-house accounting services and software, as well as increased security.

Cloud-based software also creates workflows, saving businesses valuable time duplicating work and recreating repeatable tasks. Overall, this accounting trend saves time, costs and increases accessibility and security.

11. Accountants with Diverse Skills

To keep up with the changing accounting landscape, firms are looking for CPAs who have diverse skills. Accounting is no longer just about preparing financial statements, and tax returns as more transactional work will become automated.

To be successful, accountants must utilize technology, understand data analytics, and communicate effectively with clients. They also need to be well-versed in business concepts to provide valuable insights to their clients.

As the world becomes more complex, businesses will require more specialized services from their accountant, which means that accountants must continually update their skill set to stay ahead of the curve.

How Can Content Snare Help?

The accounting industry is changing. What will your company do to stay competitive in this digital landscape?

Content Snare makes it easy to collect client information and documents. Use it for client onboarding, month-end bookkeeping or end-of-year tax work.

With all the clients in one place, request templates and automatic reminders, your team can spend more time adding actual value for your clients instead of chasing them for information. Read more about how it works or start your free trial here.