For a business, there’s nothing more important than paying your staff accurately and on time. It’s the very least people expect, and the price of getting it wrong is incredibly high.

Sometimes, the responsibility for managing payroll falls on accountants. But with so much already on their plate, how do they ensure that payroll runs smoothly? The answer is with the right payroll software.

In this article, we’ll cover:

- What payroll software is and does

- The importance of choosing the right payroll solution

- Some of the best payroll software for accountants today

Let’s do it.

Best payroll software for Accountants

What is payroll software?

To answer this question, we first need to define what payroll is.

Payroll involves calculating and processing employee compensation and bonuses, as well as payments made to the government or other organisations, such as income tax, social security, health insurance, and pension contributions.

Payroll is a complicated business — especially at scale. With so many calculations and transactions to handle, the potential for human error is huge. This is where payroll software comes in.

Payroll software enables businesses to guarantee payroll accuracy, speed, and compliance by streamlining and automating key processes, including:

- Paying employees on time

- Deducting payroll taxes and other withholdings

- Generating payslips

- Managing time off

- Generating payroll-related reports

Who is responsible for running payroll?

Well, the short answer is it depends.

In many companies, payroll is part of HR’s remit. Other companies see payroll as the finance department’s responsibility. In smaller businesses with just a handful of employees or contractors, business owners may process payroll themselves. Then there's the option of outsourcing the process to a payroll provider that offers full-service payroll.

The fact that payroll can fall under different departments’ responsibilities is reflected in the tools available. For example, payroll software solutions can be:

- Standalone tools that focus solely on payroll-related processes

- Part of a wider accounting or practice management software offering

- Part of a wider HR or workforce management software offering

9 of the best payroll software for accountants

With tons of great options on the market, choosing payroll software can be a tricky business. To help you out, we’ve selected ten of our favourites. So, in no particular order, here’s our list of the best payroll software for accountants.

1. RUN Powered by ADP

G2 rating: 4.5 (out of 5)

Great for: Small businesses, especially those located in the US.

Pros: Simple to use, powerful features, and excellent customer support at all times.

Cons: Not the cheapest option. Designed more for HR teams than finance.

RUN is a payroll solution developed by ADP, a renowned developer of HR and payroll software. While ADP typically focuses on the enterprise market, RUN is designed for smaller businesses. Its key features include:

- Automatic tax calculations and payments

- Automatic payroll reports on a quarterly or annual basis

- 24/7 customer support from certified payroll specialists

- Automatic updates for federal and state tax laws, covering all 50 US states

- AI-powered error detection ensures that your payroll data is accurate

RUN is as reliable as it is powerful. And with seamless integrations with other ADP solutions — including time and scheduling, benefits, and retirement — you have access to a full suite of HR and payroll tools.

2. QuickBooks Payroll

G2 rating: 3.7

Great for: Small to midsize businesses that already use QuickBooks accounting software.

Pros: One of the most trusted names in the accounting software space.

Cons: Some of the more useful features are only available in the Advanced version.

No list of payroll software for accountants would be complete without QuickBooks. The market leader in accounting software, QuickBooks also offers a payroll solution — QuickBooks Payroll — that’s popular with accountants and financial experts. Here’s what it offers:

- Automated payroll and time tracking

- Customisable payroll reports

- Compliance with country-specific tax, sick pay, and leave

- Auto-generated payslips shared via email or a QuickBooks self-service portal

- Pay your team with same-day direct deposit

One of the biggest benefits of QuickBooks Payroll is its seamless integration with other QuickBooks tools, including its accounting software, which is trusted by countless millions of accountants worldwide.

3. Xero

G2 rating: 4.4

Great for: Small businesses and accountants who already use Xero.

Pros: A complete system for managing your business’s books and payroll.

Cons: You can only pay a maximum of 200 people per month.

Another popular name in the accounting world, Xero offers integrated payroll solutions within its broader accounting software offering. That means you get payroll services alongside project tracking, payments, expenses, tax, and reporting.

Xero’s payroll system offers the following:

- Automated payroll that calculates tax, pensions, and leave

- Employee self-service portal for accessing payslips and requesting leave

- Automated pension re-enrolment

- Country-specific compliance and reporting

- 24/7 support

Xero has three payment plans on a sliding scale, with modular add-ons available to cover different functionality. And while it’s not free payroll software, you can opt for a free 30-day trial to see how it fits your business.

4. Rippling

G2 rating: 4.8

Great for: Businesses looking for a joined-up system that spans more than just payroll.

Pros: Instead of jumping between different systems for managing key business processes, you can do it all in one place.

Cons: Rippling’s all-encompassing approach may simply be too much for accounting firms looking for a straightforward payroll tool.

Rippling is a rather unique entry on our list because its scope is so wide. It not only covers payroll, but also an array of processes relating to finance, HR, and IT. These areas are typically disjointed in most businesses, and Rippling aims to bring them together in a single unified system.

In terms of payroll, here’s what it offers:

- A mobile app where employees can see payslips, request time off, etc.

- Automatic tax submissions and other compliance-related processes

- Payroll analytics with custom dashboards

- Time tracking and time off

Rippling claims that by using their software, you can process payroll in 90 seconds with 100% accuracy guaranteed. That should be enough to make most accountants sit up and take notice!

5. Sage Payroll

G2 rating: 4.2

Great for: Small businesses of up to 100 people.

Pros: Seamless integration with Sage Accounting and other Sage tools.

Cons: A less joined-up experience if you use alternative accounting or HR software.

Sage is another huge name in the business software space. They develop solutions that span HR, CRM, accounting, and payroll. While most of their products are aimed at the enterprise market, Sage Payroll is designed to help small businesses run payroll more efficiently. Here’s what it offers:

- Manage payroll on a weekly, bi-weekly, or monthly basis

- Compliance with location-specific tax and pay legislation

- Analyse payroll data and generate custom reports

- Rapid payroll corrections

- Auto-enrollment for pensions

Sage is a cloud-based solution, so you can access it from any device anywhere. And with 24/7 expert support, you’ll have no problem getting the help you need.

6. Workday

G2 rating: 4.0

Great for: Enterprise customers with international teams.

Pros: Seamless integration with Workday HCM (human capital management).

Cons: Not the cheapest option out there.

Workday is an enterprise software provider whose core product offerings cover financial management, human capital management, and adaptive planning. They also offer several add-on products, including payroll and HR. Let’s take a look at some of its key features:

- A single system for payroll, HR, and time

- The ability to run highly flexible payroll audits at any time

- Payroll reporting and analytics built-in

- Continuous payroll

- A compliance dashboard that allows you to monitor tax updates

Workday allows you to run seamless payroll for the US, UK, Canada, and France. If you have employees elsewhere in the world, you can plug into third-party tools to enable global payments.

7. Paylocity

G2 rating: 4.4

Great for: Small, medium, or large businesses looking for a smart HR and payroll system.

Pros: Their tailored offering allows you to pick and choose the ideal solution for your business.

Cons: Payroll is packaged together with HR functionality, which might not suit all accountants.

Paylocity is a popular HR and payroll software suite that also covers workforce management, talent, benefits, and the employee experience. It offers scalable, tailored options that work for businesses of any size. In terms of payroll, here’s what you get:

- Automated and customisable payroll workflows

- Global payroll support that covers over 100 countries

- Payroll audits with auto alerts

- Digital expense management

- On-demand payments

Paylocity also offers a comprehensive tax service, where you get direct assistance from tax experts. This can take the stress and risk out of handling tax filing and compliance in-house.

8. Gusto

G2 rating: 4.1

Great for: Small to medium-sized businesses looking to scale their operations

Pros: Unlimited payroll runs mean there’s no barrier to growth

Cons: Limited reporting capabilities compared to some competitors

Gusto is a popular all-in-one HR and payroll platform. It offers a broad range of features that also span benefits, resource management, hiring, and more. With over 200k customers in the US and counting, Gusto is one of the most up-and-coming products on our list. Here’s what it offers:

- Automatic payroll and tax filing

- Built-in benefits and time-tracking

- Unlimited payrolls with no hidden charges

- Seamless automation with popular accounting software

- The ability to pay contractors in over 120 countries

Gusto also has a range of features designed to help businesses stay compliant, covering all relevant tax laws and regulations.

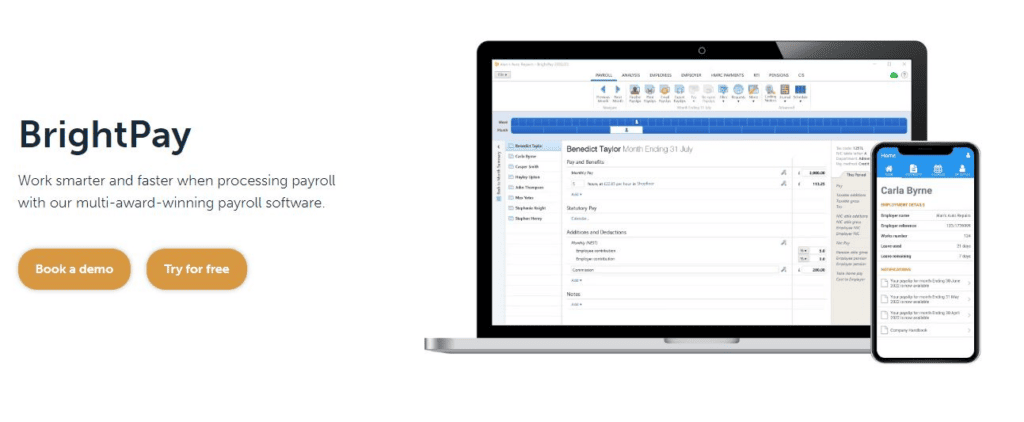

9. BrightPay

G2 rating: 3.6

Great for: Small-business owners located in the UK and Ireland.

Pros: Clear, easy-to-use UI and robust payroll features.

Cons: No good for global companies or those outside the British Isles.

Rounding off our list is Brightpay, a popular payroll software for businesses in the UK and Ireland. BrightPay is part of software provider Bright’s portfolio of solutions that covers accounting, tax, and practice management. Here’s what it offers:

- Payroll scheduled at weekly, fortnightly, 4-weekly, monthly, quarterly, and yearly intervals

- Pay hourly and salaried employees with ease

- Unlimited additions and/or deductions to payslips

- Up-to-date National Insurance, student loans, and tax deductions

- Customisable payslips available via email

BrightPay also offers seamless integrations with Xero, Sage, and QuickBooks, allowing you to connect your payroll and finance data with ease.

Streamline your accounting and payroll process with Content Snare

To run a successful business today, you need the right tools to streamline and automate key processes. Payroll is just one example. Another is information gathering.

With Content Snare, you have a dedicated system for requesting, managing, and storing client information. Whether you’re onboarding new clients or managing their books, Content Snare makes it easier and faster to get the information you need.