In any industry, it’s well-known that customer feedback is absolutely invaluable. Customers are the most important part of any business as, if they’re not satisfied with the services they receive, they won’t hesitate to leave, making a dent in your company’s revenue and reputation.

For health insurance providers, remaining in-the-loop when it comes to customers’ thoughts and feelings on their insurance coverage is even more vital than usual due to the fierce competition and ever-changing prices within the space.

Surveys are always a fantastic way to cut to the chase and figure out what’s working for your customers and what isn’t. By sending your customers a health insurance satisfaction survey questionnaire periodically, you’ll have a much better chance of saving your customers from being lured in by another company.

Get our health insurance satisfaction survey template

Content Snare is here to help you create your health insurance survey. Sign up to access our built-in health insurance survey template. It’s ready when you are.

What questions should I be asking in a health insurance satisfaction survey?

The key to a successful health insurance survey is ensuring that the questions are short and snappy. You’re looking for insightful, straightforward feedback and, with a long list of complicated questions, you’re never going to be able to get that.

With this list of 16 quick and easy questions, you’ll be able to focus on exactly what you need from your customers without compromising their satisfaction and taking up too much of their time.

Basic Information

These 3 simple questions will allow you to split your insurance customers into segments and obtain even more specific feedback.

- Please indicate your age range.

- Please indicate your gender.

- Please indicate your annual income range.

Insurance Information

This short section is focused around further establishing customer information, strictly relating to their insurance policy.

- How long have you been with your current insurance provider?

- How do you receive your insurance?

Evaluation

These statements are designed to be accompanied by checkboxes ranging from ‘strongly disagree’ to ‘strongly agree’. This allows customers to accurately register their satisfaction level of each element of their health insurance plan.

- I have easy access to the information on my plan.

- I can easily find doctors in my area.

- I can easily find doctors I work well with.

- I can find specialists that work with the doctors and my plan.

- I am happy with the plan I have.

- My co-pay is affordable.

- My co-pay is easy for me or a healthcare provider to figure out from my card.

Other Information

Last but not least, these questions wrap things up nicely and provide extra details about the customer and their overall experience.

- Have you switched from another insurance recently?

- Have you filed a claim recently?

- How satisfied were you with the process?

- Would you/have you recommended your insurance to friends/family?

Why send a health insurance satisfaction survey questionnaire?

Excellent question!

Health insurance satisfaction surveys have proven to be incredibly useful to a number of health insurance providers. Here are just a few reasons why you might benefit from the insights you can gather by sending one:

You can avoid losing customers to competitors

Generally, in a bid to win more and more customers, competing insurance companies have a habit of undercutting one another, which can be pretty difficult to keep up with. Unfortunately, you may also come across companies that offer health insurance rates that you simply can’t match.

In order to combat this, you have to be proactive and show your customers that, whilst you may not be the cheapest option, you care about how much value they’re getting from their health plan and don’t just see them as a revenue source. Being proactive when it comes to feedback is a surefire way of showing your customers that their opinions matter and will always be taken into account.

You can improve your services

This is definitely among the most prominent reasons for sending a health insurance satisfaction survey. With big players within the health insurance industry continuing to provide ever-evolving perks and benefits, it’s vital to keep on top of what’s working, what’s missing the mark altogether and what aspects need to be added to make your policy more attractive.

You can anticipate renewal potential

Finally, by collecting feedback on a regular basis, you’ll be able to figure out if your customers are planning to purchase new policies or not.

From there, if a customer is looking as if they might skedaddle, you can get to the bottom of their concerns, take action and show them a little more individualised attention before it’s too late.

Which tool should I use to create my survey?

This part is completely up to you, as there are many solutions available to choose from that’ll allow you to build out your satisfaction survey and get it sent off to your customers. As expected though, these tools range in quality so you might need to do some testing before you determine which tool fits your criteria best.

However, to save you some time, we’ve done all of that for you and picked out two potential options to help you get started as quickly and easily as possible.

Google Forms

As far as basic forms tools go, Google Forms is pretty much the first one that springs to mind for the majority of people. It allows you to add standard question types in order to conduct surveys and collect data.

Unfortunately, as with a lot of similar forms tools, Google Forms has its limitations when it comes to versatility and productivity.

Particularly, using Google forms means forcing your customers to answer every question at once, which can end up being quite frustrating for them. They might want to take a break and come back later which, in this case, they wouldn’t be able to do.

Content Snare

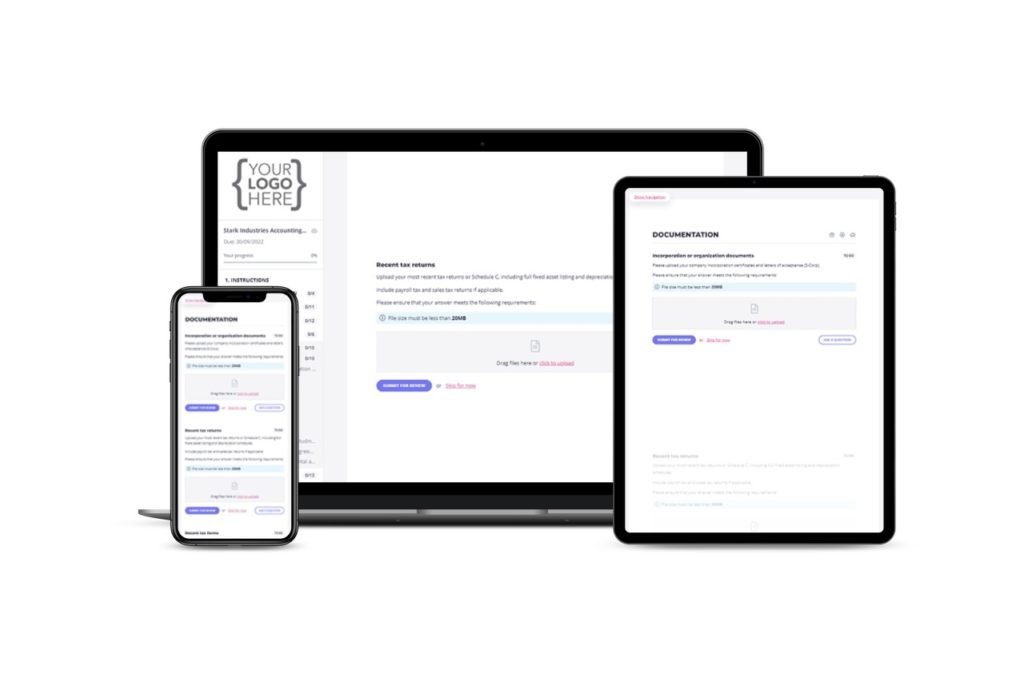

Content Snare provides a restriction-free experience, allowing you to create beautiful and coherent surveys that are tailored to you.

The lack of learning curve for both yourself and your customers means that you can have your first request ready to send off within minutes. From there, using the straightforward UI, your customers can simply begin providing you with all of the data you need at a pace that suits both parties.

Your customers’ answers are saved automatically, meaning that the threat of losing heaps of information just from forgetting to click a button no longer exists. In addition, their progress is cleverly tracked for them so they can see what percentage they’re at as they continue to fill things out.

The platform sends reminder emails to your clients, notifying them of imminent deadlines and any significant events relating to their request. These are also completely customisable; you can stay in control at the same time as taking a backseat. You can’t lose!

We really hope our health insurance satisfaction survey will help you maximise customer satisfaction and ensure you’re always a step ahead of your competitors.

Is there anything you think we forgot to mention that could boost this survey even more? Let us know in the comments below!