As we all know, money makes the world go round, which is why it’s no surprise that more and more people are opting for professional financial planning services in order to start making better decisions about their dough.

Before being able to provide a client with the nuggets of wisdom they came for, it’s important to learn about their personal and financial life and really get a feel for their motivations and ideal financial plan.

Sending a financial planning questionnaire is a sure-fire way to get clients comfortable and to start opening up about important financial topics that’ll form the foundation of your planning strategy.

Get our financial planning questionnaire template

Content Snare is here to help you create your financial planning questionnaire. Sign up to access our built-in financial planning questionnaire template. It’s ready when you are.

What questions should I be asking in a financial planning questionnaire?

There’s no messing around when it comes to finances. This is why your financial planning questionnaire should be as detailed as possible in order to help paint the clearest picture possible of the client’s financial situation and what they’d like their financial future to look like.

Our full questionnaire comprises 80 amazing questions which, for brevity, we’ve chopped in half. For the extended questionnaire, grab a free trial and check out our template section.

Basic Information

The basic information section will allow you to collect any vital details that will aid in confirming the client’s and, if applicable, their spouse’s identity.

- Please provide your full name.

- Please provide your date of birth

- Please indicate your gender.

- What is your place of employment?

- What is your current job title?

- Please provide the address of your place of employment.

- Please provide your spouse/partner's full name.

- Please provide their date of birth.

- Please provide their current address.

Questionnaire

The main body of the questionnaire focuses on the client’s aims, income details, retirement plans, insurance and estate.

- Please indicate your areas of financial concern.

- If there are any others, please let us know here.

- Please detail any different sources of income and summarize your gross annual income.

- At what frequency are you paid?

- Is there a possibility of a career change in the near future?

- How much income do you expect to require in retirement?

- What amount do you contribute each year to your retirement plan?

- What amount does your employer put towards your retirement plan each year?

- Do you have life insurance?

- Do you have homeowner or renter insurance?

- Do you have medical insurance?

- Have you previously been married?

- Do you have a Will?

- Do you have a Durable Power of Attorney?

Assets

This section allows clients to provide an approximate monetary value corresponding to how much capital they’ve invested/currently possess in a number of different assets.

- Checking and Savings

- Money Market funds

- Stocks, Bonds, Mutual Funds

- Investment Real Estate

- IRA: Traditional or Rollover

- IRA: Roth, SEP or SIMPLE

- 529 / Tuition Savings Plans

- UTMA / UGMA Custodial Accounts

- Primary Residence

- Vacation Property

Debts/Liabilities

This final section allows clients to provide an approximate monetary value corresponding to the amount of capital they owe to certain entities and financial bodies.

- Primary Residence Mortgage

- 2nd Mortgage, Equity Loan or Line of Credit (HELOC)

- Education Loans

- Auto Loans

- Credit Card Balances

- 401K or Retirement Plan Loans

- Any other loans or debts

Why send a Financial Planning Questionnaire?

Fantastic question!

Many wealth management and accounting firms use financial planning questionnaires as a standard business practice. This is primarily in order to:

- Streamline the onboarding process

- Keep a more detailed and accurate record of information

- Make a good impression on clients

- Avoid delays within the initial phase

Financial planning questionnaires are a proven way to make things easier and more fluid for yourself and your client. Adding one to your onboarding process will definitely have its perks!

How can Content Snare help me with my financial planning questionnaire?

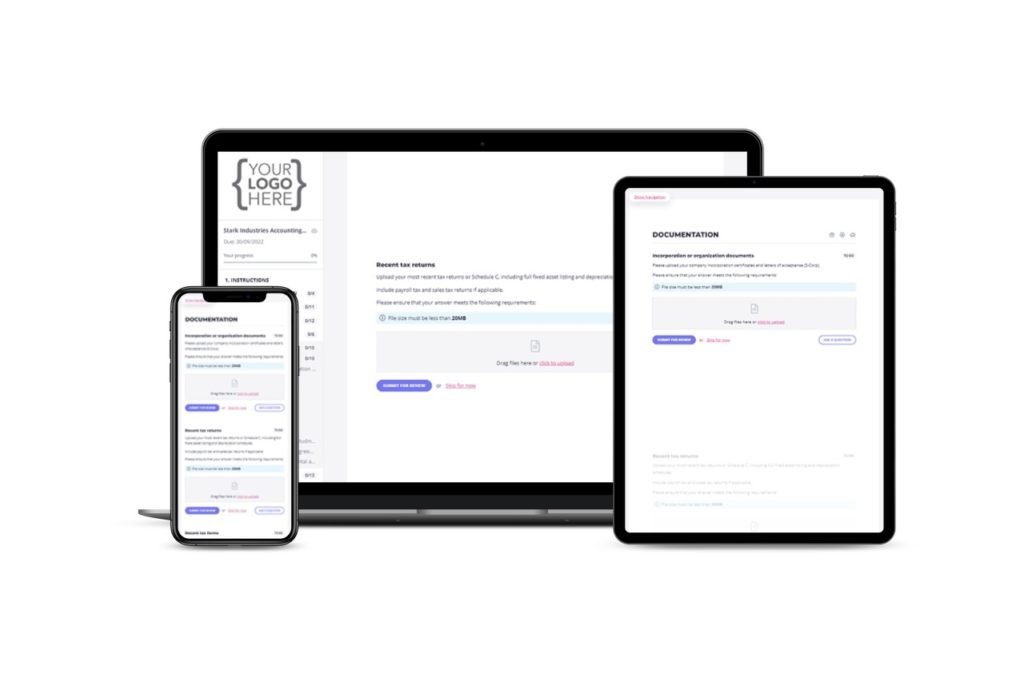

Content Snare is an intuitive, auto-saving forms tool made to help you collect information in the best way possible. The practicality and versatility of the platform combine to give you the best experience when creating your questionnaires and forms.

There are multiple ways in which Content Snare can make everything run much more smoothly and we’ve been able to identify and list a few of those below.

Built-in templates

Doing it on your own isn’t always necessary with an extensive template gallery to choose from to help you get the most out of your time. You can modify templates as much as you like to suit your needs, add and take away questions and personalise the wording and writing style to your taste.

Templates give you a great head start and alleviate a lot of the burden, especially if the questionnaire you’re looking to create is pretty lengthy, like this one.

Straightforward sending

Sending a questionnaire manually enclosed within an email is often awkward and quite tiresome.

With Content Snare, your questionnaire is sent directly to the client in the form of a link within their invitation email. As soon as your request is published, you can sit back and relax as there’s nothing more for you to do! You can also double up on the security of your client’s questionnaire and the information they’ve provided by requiring an access pin code or for the client to create an account and log in.

No matter what happens, your clients will always receive their questionnaires quickly, efficiently and securely.

Automatic reminders

Have you ever had your financial planning sessions delayed because you’re missing information from a client? We’ve also experienced the misery of having to put things on hold for this reason so we know it’s always a bummer.

Following a schedule, Content Snare sends your clients staggered email reminders throughout the process, ensuring they’re always aware of imminent deadlines and everything remains on schedule. These email reminders are also customizable, allowing you to remain on brand at all times.

An effortless experience

Content Snare’s UI is easy to understand and can be used by even the least tech-savvy individuals. You don’t need any IT skills at all to use the website.

For you, the clever builder allows you to choose from different kinds of field types, enforce constraints and even provide instructions to ensure you only get the correct information back.

For your client, it’s easy to tell the difference between the question they’ve already answered and what’s still left to fill out. Only one question at a time appears on the screen, keeping everything organised. The overall appearance of the questionnaire is also a lot less daunting this way, as clients and leads are often put off by questionnaires that look as if they’re going to take an eternity to complete.

An all-in-one space

You’ll forget where you stored a piece of information or questionnaire again as, with Content Snare, everything is kept in one place and find what you're looking for is a breeze.

You can export as much information as you like and simultaneously preserve it on the platform for later use.

We hope that this post has been useful for you and has been able to give you some food for thought on how to create your next financial planning questionnaire.

Any must-have questions we missed? Let us know in the comments below!