When the fiscal year draws to a close, accountants kick into fifth gear. In a profession where heavy workloads and tight deadlines are the norm, this can be a particularly stressful time. But it doesn’t have to be.

In this article, we’ll show you how you can reduce the pressure of end-of-year accounting with a simple checklist.

Read on to learn:

- The benefits that a year-end accounting checklist can bring

- The items you should include on your checklist

- Potential pitfalls in the year-end accounting process

- How technology can help

So, why do I need a year-end accounting checklist?

Accountants are known for being busy at the best of times. But when year-end looms nearer, even the most seasoned accountants have their work cut out to get everything done on time.

Year-end accounting is so challenging because there are so many different processes to complete — from preparing financial statements to gathering tax documentation, and everything in between.

Each task is complex in its own right, and often, tasks need to be completed in a certain order. Expand this process out over multiple clients, and you can see how things can quickly get messy. The potential for mistakes, inaccuracies, and incomplete processes is huge.

A year-end accounting checklist helps you to reduce the chaos by enabling you to:

- Create a reliable, efficient, and standardised process

- Break complex tasks down into manageable bites

- Improve your organisation, accuracy, and consistency

- Adhere to regulatory compliance

- Guarantee the completeness of your work

- Reduce year-end stress

Our ultimate accounting year-end checklist

So what items should you include on your end-of-year accounting checklist? Below, you’ll find an example that we’ve put together. It’s worth noting, however, that your own checklist will depend on various factors, including:

- The branches of accounting you specialise in

- Whether you’re an accountant at a small business, a large enterprise, or an accounting firm

- The types of clients you serve

1. Bank and credit card reconciliation

Bank reconciliation

- Gather up-to-date bank statements, cancelled checks, and deposit slips

- Compare the transactions on bank statements with the company's accounting records

- Reconcile any discrepancies, such as outstanding checks or deposits in transit

- Adjust the company's accounting records to match the bank statements

- Prepare a bank reconciliation statement

- Document the reconciliation process

Credit card reconciliation

- Collect up-to-date credit card statements, receipts, and payment records

- Verify the accuracy of credit card transactions against the company's records

- Reconcile any discrepancies or errors

- Adjust the company's records to match the credit card statements

- Prepare a credit card reconciliation statement

- Document the reconciliation process

2. Inventory, fixed assets, and depreciation

Inventory

- Conduct a physical inventory count to determine actual quantities on hand

- Compare the physical count with the recorded inventory balances

- Identify and investigate any discrepancies or variances

- Adjust the inventory records accordingly

- Review and update inventory valuation methods, if necessary

- Document the inventory reconciliation process

Fixed assets

- Review the fixed asset register to ensure accuracy and completeness

- Verify the existence and condition of fixed assets through physical inspection

- Update the fixed asset register with any additions, disposals, or transfers

- Calculate depreciation expenses for each fixed asset and update depreciation schedules

- Identify and evaluate any impairment indicators for fixed assets

- Document any changes made to the fixed asset register

Payroll

- Review and verify employee payroll records for accuracy and completeness

- Reconcile payroll records with payroll tax filings and other related reports

- Ensure proper classification of employees, including full-time, part-time, and contractors

- Confirm the accuracy of tax withholdings, benefits deductions, and contributions

- Reconcile payroll bank account statements with payroll disbursements

- Document any adjustments or corrections made to the payroll records

Benefits

- Review employee benefit plans and programs for accuracy and compliance

- Verify the accuracy of employee benefit deductions and employer contributions

- Reconcile benefit plan records with payroll and general ledger accounts

- Update employee benefit information, including enrollments and terminations

- Document any changes or adjustments made to employee benefit records

3. Accounts receivable and accounts payable

Accounts receivable

- Review outstanding invoices and ageing reports

- Confirm the accuracy of customer account balances

- Identify any overdue or uncollectible accounts and initiate appropriate actions

- Accrue bad debt expenses for uncollectible accounts, if necessary

- Reconcile the accounts receivable sub-ledger with the general ledger

- Document any adjustments or write-offs made to accounts receivable

Accounts payable

- Review outstanding vendor invoices and ageing reports

- Confirm the accuracy of vendor account balances

- Identify any accrued business expenses or unrecorded liabilities

- Reconcile vendor statements with accounts payable records

- Adjust the accounts payable sub-ledger with the general ledger

- Document any adjustments or accruals made to accounts payable

4. Financial statements

- Prepare and review accurate financial statements, including the balance sheet, income statement, and cash flow statement

- Analyse financial ratios and key performance indicators (KPIs)

- Document any adjustments or reclassifications made to financial statements

5. Tax documentation

- Gather necessary tax documentation, including income statements, expense records, and supporting documents

- Prepare and file the required tax forms, such as corporate income tax returns or individual tax returns

- Ensure compliance with tax regulatory and reporting requirements

- Review and reconcile tax

6. Internal controls

- Evaluate the effectiveness of internal controls and identify any weaknesses

- Implement necessary improvements to strengthen internal controls

- Perform a risk assessment and update risk management strategies

- Review and update fraud prevention and detection measures

- Conduct employee training on internal controls and ethical behaviour

7. Budgeting and forecasting

- Review actual financial results against the budget

- Identify variances and analyse the reasons behind them

- Prepare a budget for the upcoming year based on future cash flow projections

- Update forecasting

Potential pitfalls in the year-end accounting process

Accounting is a notoriously complex process at the best of times. But as the fiscal year comes to an end, the pressure can ramp up — and the risk of errors or issues grows. Here are some common examples of how things can go wrong:

- Incomplete or inaccurate record-keeping and documentation

- Poor time management

- Process bottlenecks

- A lack of communication among team members

- Failure to comply with accounting standards and regulatory requirements

- Insufficient backup and security measures

How technology can help deliver a smooth year-end closing process

The issues we outlined above can be crippling, leading to stressed employees, inaccurate work, and dissatisfied clients. But there’s a simple way to avoid these problems altogether.

With the right tech, you can streamline, enhance, or automate most of the processes we’ve outlined in this article. Let’s take a look at some examples.

Accounting software

Accounting software plays a central role in streamlining and facilitating year-end accounting processes, helping you to ensure a high level of accuracy while saving countless hours wasted on manual data entry, calculations, or processes.

.

Here are just some of the ways accounting software can help:

- Auto-generated financial statements based on accurate accounting data

- Reconcile bank accounts automatically

- Reporting and analytics to support year-end financial analysis

- Automated accruals and deferrals

- Built-in compliance with accounting standards

- Integrations with your other systems, ensuring smooth data transfer

Task management tools

Year-end accounting involves a lot of moving parts, with key tasks often spread across teams. Task management tools allow you to keep track of projects and tasks, providing top-down visibility of progress towards goals.

With a task management tool, you can:

- See all tasks, deadlines, and dependencies in one place

- Collaborate and communicate effectively

- Automate reminders and notifications to ensure you stay on track

Document collection tools

The year-end accounting process often requires you to gather a lot of information — everything from your clients’ tax-related documents to bank statements, invoices, and receipts.

Without a dedicated tool to facilitate this process, things can get messy fast. Key attachments get lost amid endless back-and-forth emails, or buried at the bottom of bursting inboxes. This is where document collection tools can help.

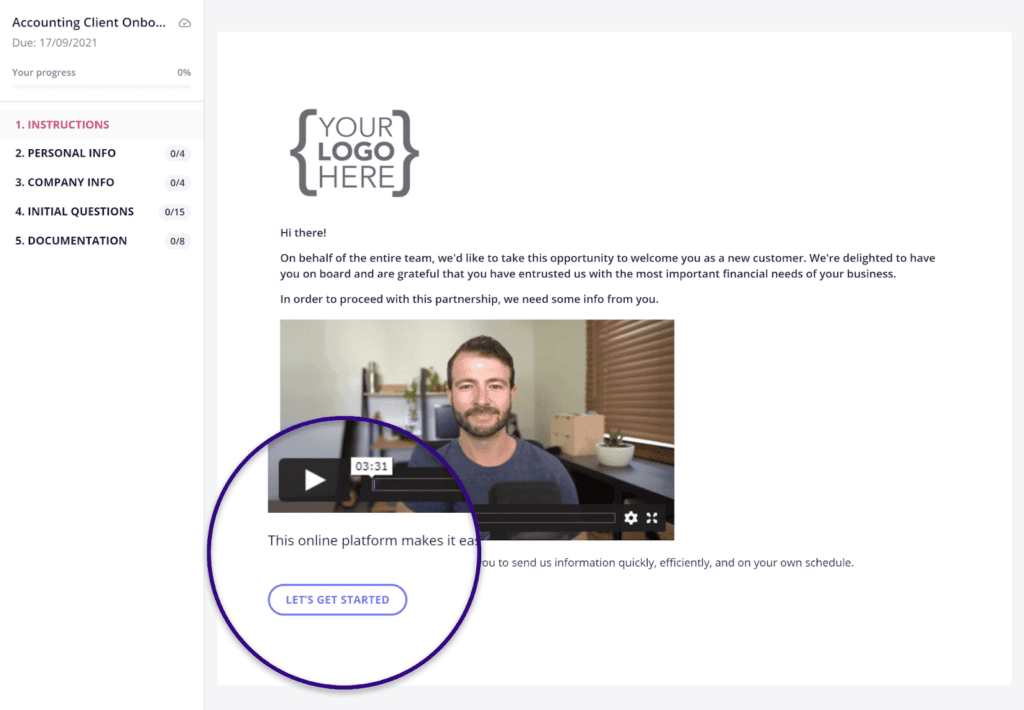

With a tool like Content Snare, for example, you can:

- Create custom forms — or choose one of our ready-made templates

- Request a wide range of file types, content, and documentation

- Send automated follow-ups

- Receive sensitive documents securely

- Communicate with clients about submissions without resorting to email

- Integrate with your existing tech stack

The result is a streamlined document collection process. You get all the information and documents you need on one intuitive platform. For your clients, Content Snare simplifies the process of submitting information, allowing them to tackle the process a step at a time.