Tax season can be a daunting time for even the most experienced accountants. With so many clients to serve and documents to gather, the risk of missing something is huge.

With the right preparation and planning, however, this process can become much smoother and less stressful — and a tax preparer checklist is a great place to start.

In this article, we’ll explain everything you need to know about creating an effective tax preparation checklist, including:

- The benefits of using one

- Key items to include

- The best tools to help streamline this process

But before we dive in, let’s answer an important question.

The benefits of using a tax prep checklist

Using a tax return checklist can bring a whole host of benefits, leading to a smoother tax filing experience.

Perhaps the most obvious benefit is that checklists help to provide structure and consistency to the tax return process, enabling you to tick off tasks and gather tax documents one step at a time. This leads to:

- Better organisation and time management

- Increased efficiency and accuracy

- Reduced risk of incomplete tax returns

- Better outcomes for clients

Our ultimate tax preparer checklist

Now that we know what tax preparer checklists are and why you should be using one, it’s time to look at the type of items your checklist should include. Below, you’ll find a checklist example, complete with the documents you would need to collect for each item (in bullet points).

Please note: This is a generic example of a checklist. In reality, it’s impossible to provide a comprehensive checklist template that will suit every accountant. The specific documents and tax forms you’ll need will depend on factors like your client’s circumstances and the tax regulations and accounting standards used in your country or state.

1. Personal information and contact details

Let’s start with the basics. Capturing personal information is a critical first step in the tax preparation process. The information you gather here will help you communicate with your clients and identify them for tax purposes.

1. Name

2. Social security number (SSN) or taxpayer identification number (TIN)

- Social security card

- Other official documentation showing either your client’s SSN or TIN

3. Date of birth

- Passport, driver’s licence, or birth certificate

4. Marital status

- Marriage certificate

- Divorce certificate (if applicable)

5. Bank account details (for the direct deposit of your client’s tax refund)

2. Sources of income

Next, we’ll gather information about your client’s various sources of income. Accurately reporting income is critical for complying with tax regulations, so be as thorough as possible.

1. Are you employed?

- Salary statement

- Employment contract

2. Are you self-employed?

- Invoices

- Bank statements

- Expense records associated with self-employment

3. Do you own any rental properties?

- Rental agreements

- Rent receipts or bank statements

- Expense records associated with the rental property

4. Do you have any income from investments? (Interest, dividends, capital gains, etc.)

- Brokerage statements

- Dividend income statements

- Any other investment-related statements

5. Do you have any retirement income?

- Pension statements

- Annuity statements

- Social security statements

6. Have you received any unemployment or sickness benefits this tax year?

- Proof of unemployment compensation

- Proof of long-term sickness-related payments

7. Have you had any other sources of income this year? (Alimony, jury duty, gambling winnings, etc.)

- Relevant court documents for alimony

- Records of jury duty

- Records of gambling winnings

- Any other relevant income-related documentation

3. Deductions and credits

By maximising deductions and credits, you can significantly reduce your client’s tax liability. In this section, we’ll explore some commonly claimed deductions and credits

1. Are you a homeowner?

- Mortgage interest statement

- Records of any personal property taxes paid

2. Do you pay state or local income tax?

- Proof of tax payments

3. Do you have any medical expenses?

- Records of medical or dental expenses paid, including health insurance premiums

4. Have you made any charitable contributions this year?

- Receipts or letters of acknowledgement from charitable organisations

- Records of any non-cash charitable donations

5. Do you have any education-related expenses?

- Tuition fee statements

- Student loan interest payment statements

- Receipts for other education-related expenses (books, supplies, etc.)

6. Do you make regular pension contributions?

- Proof of contributions to private pensions (Roth IRA, ISA, etc)

- Proof of contributions to employer-sponsored retirement plans (401k, etc.)

7. Childcare credits

- Information about childcare provider (name, address, tax ID, etc.)

- Proof of childcare expenses

8. Income tax credits

- Proof of income (salary statement, invoices, bank statements, etc)

- Information about any qualifying children (birth certificates, social security numbers, etc.)

9. Education credits

- Records of relevant educational expenses

10. Adoption credits

- Records of adoption-related expenses, including any legal and agency fees

11. Have you made any energy-efficient improvements to your home? (Insulation, solar panels, etc.)

- Relevant receipts and documentation

4. Health insurance

In addition to covering your client’s medical expenses, health insurance can also have implications for their tax obligations. In this section, we’ll collect any relevant health insurance documents.

1. Do you pay for private health insurance?

- Any documents or records relating to private health insurance policies

2. Are you enrolled in an employer-provided health insurance policy?

- Any documents or records relating to employer-provided health insurance policies

5. Business information (if applicable)

Clients who own a business have additional considerations when it comes to tax preparation. In this section, we’ll gather all the information we need about business-related finance and expenses.

1. Do you own a business?

- Profit and loss statement, or an income statement that shows the business’s revenues, expenses, and net income

- Purchase invoices, sales records, and inventory count reports

- Records of the purchase/sale of any business assets

2. Do you use your home or vehicle in the running of your business?

- Any records that demonstrate the use of your home or vehicle in the running of your business, such as mileage logs, home office expense records, or lease agreements

3. Do you have any other business-related expenses? (Travel, meals, entertainment, etc.)

- Any relevant receipts or expense records

4. Do you employ any freelancers or subcontractors?

- Any relevant forms or contracts

How technology can help you gather tax documents

As you can see from the example checklist above, filing a tax return involves gathering a lot of documents and information. When you consider that this process is repeated again and again across tens or hundreds of clients, you can see how important it is to have a well-thought-out system in place.

Thankfully, technology can help. In this section, we’ll look at some of the tools accountants typically use to collect client documents — and discuss how effective they are at the job.

Without a dedicated tool for requesting and gathering key documentation, many accountants rely on email to gather client documents.

On the face of it, email seems like a reliable option. You already have all your client’s contact details there, and attaching files is simple enough. You can write the tax checklist directly in an email. Plus, there’s zero learning curve for accountants or clients — email is one of the most widely adopted tools worldwide, and everyone already knows how to use it.

But when you actually start using email to gather documents at scale, you soon realise that it’s not fit for purpose. After all, email is a legacy communication tool, not a document-gathering tool. Here are some of the main reasons why it doesn’t work:

- Attachments can get lost amid lengthy back-and-forth emails

- Email threads can get buried at the bottom of expanding inboxes

- Email isn’t particularly secure, with only a few email providers offering encryption

- File size limits restrict you from uploading large files

- Documents sent to personal email addresses can’t easily be accessed by team members

Shared documents and spreadsheets

Some accountants use shared documents and spreadsheets to create checklists. Again, it’s easy to see why — most people know how to navigate tools like Excel, Word, Google Docs, or Google Sheets, and the latter two offer synchronous collaboration anywhere, anytime, and from any device. Plus, features like comments can be useful in providing context or answering client queries.

But despite these plus points, shared docs are still a round peg in a square hole when it comes to gathering documents for the following reasons:

- As comments and replies add up, shared docs can soon get messy

- While it is possible to attach some files to shared docs, it’s a messy process

- Spreadsheets can be overwhelming and offer a poor UX

- In most cases, you’ll end up having to use email alongside shared docs

Dedicated document-gathering tools

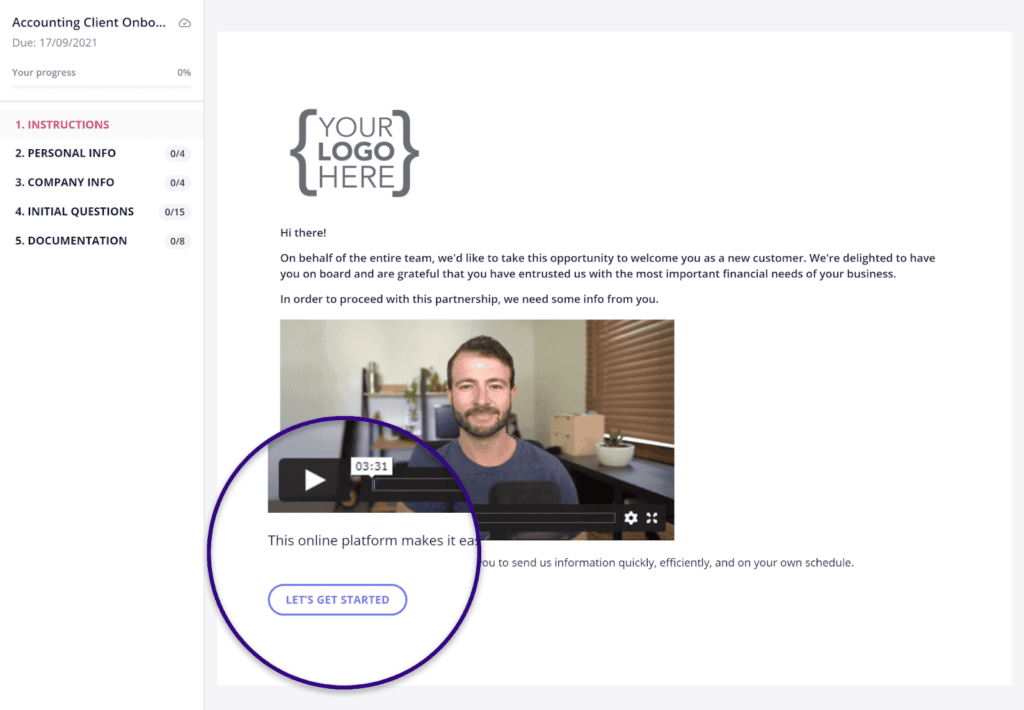

Given that document gathering is quite a specific process, it makes sense to use a tool that’s designed specifically to streamline and enhance it.

Thankfully, there’s no shortage of data collection tools on the market. There are free options, like Google Forms, which is a pretty solid choice for gathering basic data. But free form builders usually lack the functionality and flexibility you need to gather a range of different files at scale.

With a tool like Content Snare, you can manage the entire process of gathering client documents. You can create and share custom checklists, complete with specific file-type requests. These checklists guide your clients through the process of submitting information one step at a time. Alternatively, you can use one of our ready-made templates.

On top of custom forms and templates, Content Snare offers a host of powerful features designed to streamline and enhance the document collection process, including:

- Automated reminders

- One-click approvals

- Add context to requests via text, attachments, or video

- Answer client queries directly in the app

- Analytics dashboards for company-wide insights

- Autosave feature allows clients to complete checklists at their own pace

The result is a complete system for managing the document-gathering process. Not only does this make your tax preparation process easier, but it also provides the slick, digital experience your clients now expect.

Content Snare: The best way to gather client documents

Tired of using outdated tools to gather key client information? It’s time you streamlined your tax preparation process with Content Snare.

What is a tax preparer checklist?

Sometimes called a tax return checklist, a tax preparer checklist is a comprehensive document outlining the essential items you need to tick off — and the documents and information you need to collect — to effectively prepare and file a tax return.

A tax preparer checklist should cover all aspects of tax filing, from a client’s income to deductions and credits — but more on that later.