Gained a new client at your tax firm? Awesome!

But what’s not so awesome is the data-heavy onboarding process. Filing taxes is a burdensome task and, if you’re going to be doing this on behalf of your client, you’re going to need to collect a lot of information from them.

In order to keep the client satisfied and the workflow organized, it’s important to split the onboarding process into different phases. That way, everyone is on the same page and no one feels like they’re drowning in paperwork.

This client intake form guide is one of the first steps towards onboarding your tax preparation client, and will allow you to collect the basic set of details that’ll form the foundation of your process.

Get our free tax preparation client intake form template

Content Snare is here to help you create your next tax preparation client intake form. Sign up to access our built-in tax preparation client intake form template. It’s ready when you are.

20+ questions to ask your in tax preparation client intake form

Let’s face it: preparing taxes is a real slog. This is why making the initial intake and discovery process as concise as possible will be like a breath of fresh air for any client.

We recommend that you keep this set of questions under 30, which is exactly what we’ve done here.

Personal Information

This group of questions will give you a multifaceted view of the client’s initial information.

- Please indicate the date you're filling this form out.

- Please provide your full name.

- Please provide your date of birth.

- Please provide your social security number.

- Please provide an identification photo for yourself.

- Please provide your current address.

- Please provide your home phone number.

- Please provide an alternative personal contact number.

- Please provide your work phone number.

- Please provide your fax details.

- Please provide your primary email address.

- What is your occupation?

- Please indicate your filing status.

- Please indicate your desired refund type.

Spouse Information

Naturally, the same applies for the spouse of the individual filling out the questionnaire. Of course, this section can be omitted if not applicable.

- Please provide your spouse's full name.

- Please provide your spouse's date of birth.

- Please provide your social security number.

- Please provide an identification photo for yourself.

- Please provide your spouse's current address.

- Please provide your spouse's home phone number.

- Please provide an alternative personal contact number for your spouse.

- Please provide your spouse's work phone number.

- Please provide your spouse's fax details.

- Please provide your spouse's primary email address.

- What is your spouse's occupation?

Additional information

This final piece of the puzzle allows the individual to let you know a little more about anyone or anything else involved that’ll need to be taken into consideration for tax filing.

- Please provide details for each dependent.

- Please provide details for each of your income streams.

Want this in an editable template? It’s included with Content Snare!

Content Snare is here to ease the stresses of tax preparation client intake forms. Sign up to access our tax preparation client intake form template. It’s ready when you are.

Why is creating a tax preparation client intake form important?

We’re thrilled that you now have everything you need to start things off on the right foot with your new tax clients!

However, before we leave you to go and start getting to know them, if you’re not yet 100% persuaded of the benefits associated with sending out a tax preparation client intake form, here are some more details that’ll win you over completely.

You’ll be able to establish and maintain accurate information

With an abundance of documents and information to collect, sometimes the basics can be overlooked, leaving you having to rummage through emails and files just to find a simple phone number.

With a tax preparation client intake form, all of the crucial details about a client will be there and ready to access in one place, preventing any guessing.

Related: How this accounting practice broke free of a never-ending loop of inefficiencies

Your clients will have a fantastic experience from start to finish

A client’s first experience with you and your firm is incredibly important from their perspective, as it gives them a taste of what’s to come. And, if that first taste is a no-no, regardless of what happens next, they’re not likely to rate your service highly overall.

Providing your clients with a clear and smooth process from the get-go is the key to boosting satisfaction and retention rates.

Your firm will look professional

Let’s be honest, what firm would say no to coming across as even more professional?

A clean tax preparation client intake form should do the trick nicely, as clients will notice the finer details and admire your smooth and clearly defined onboarding process. The little things always make a world of a difference!

Which tool should I use to create my tax preparation client intake form?

When scouring the internet in search of a tool to use for your tax preparation client intake form, you may well come across a fair few tools that claim to do the job in the way you’d like.

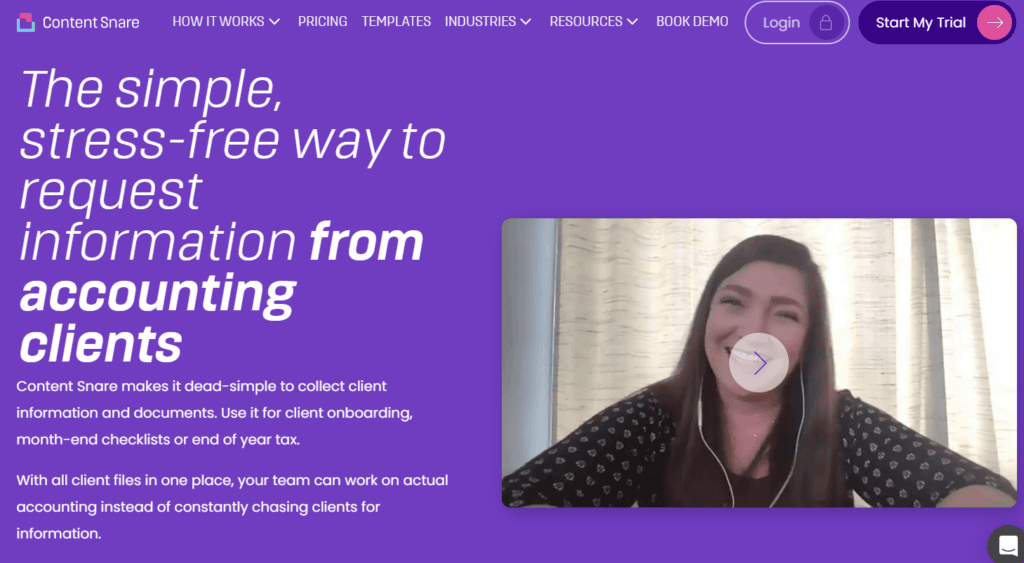

However, in reality, a lot of those tools are extremely limited feature-wise which, as a result, will also place limitations on the quality of your form.

This is why exploring Content Snare is the right way forward, as it makes the process easier and allows you to gather the content you need restriction-free.

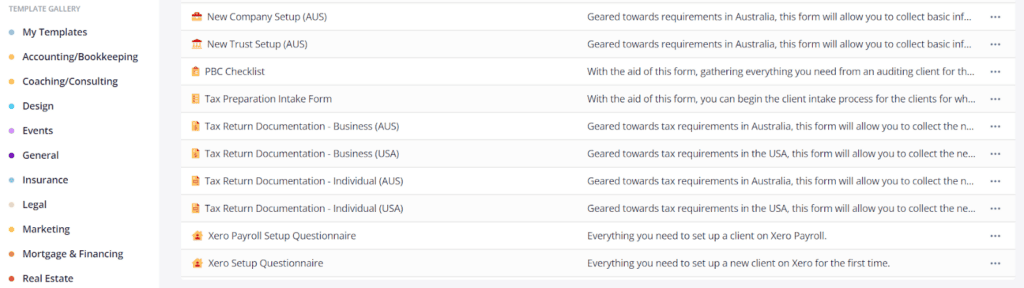

Content Snare makes information gathering a joy for both yourself and your clients. You can create knockout requests from scratch to send to your clients or, to make your life easier, you can simply select any template you want from our built-in templates gallery in order to skip that step altogether.

Image source: Content Snare template gallery

The user interface was designed to be as straightforward as possible in order to allow you to jump in and begin collecting responses without having to spend hours watching tutorials first.

Speaking of responses, those are automatically saved by the system, withdrawing the need for your client to click any buttons to save their progress. This eliminates the chances of any information being lost or needing to be redone.

Related: How Content Snare helped Northwest Accountancy gather client info more efficiently

As Content Snare also has an automatic email reminder feature on top of everything else, you’ll never have to worry about late content and potential delays again. Those days of working your way through endless email threads just to communicate with clients and collect their information are well and truly over!