Accounting can be a tricky business. It’s not just about tracking transactions, generating profit and loss statements, and understanding balance sheets. You also need to communicate with clients, gather information, and manage tasks. It’s enough to make your head spin.

Thankfully, there are tons of tools out there designed to simplify and streamline the way your accounting firm operates. In this article, you’ll learn what workflow management software is, the benefits it brings to accounting firms, and the best workflow management software on the market, including:

- Content Snare — Best tool for collecting client information

- Jetpack Workflow — Best all-round workflow tool for accounting firms

- Kissflow — Best no-code tool for process automation

- Karbon — Best all-round practice management software

- Canopy — A cracking practice management tool for small-to-mid-sized firms

- Financial Cents — Best practice management tool with a CRM

- Xero — Best accounting software for tracking and paying bills

- FreshBooks — Best accounting software for freelancers and small businesses

- QuickBooks Online — The market-leading accounting software

Let’s dive in.

What is accounting workflow management software?

Accounting has changed a lot in recent decades. Back in the day, accounting was a purely back-end function, and accountants spent their days crunching numbers. Today, accounting is much more strategic. And to stay competitive in a fast-moving market, accountants must leverage the latest technology.

This is where accounting workflow management software comes in. It’s designed to help accounting firms automate and streamline everyday processes, including:

- Tracking and recording financial data

- Payment processing

- Creating financial statements

- Task management

- Document management

- Gathering client data

- Communication and collaboration

What are the benefits of workflow software for accountants?

The best technology saves you time and improves productivity, allowing you to do more with less. Workflow management software is no different. Here are just some of the ways it can benefit accountants and firms:

- Reduce manual processes and human error

- Increase efficiency and accuracy

- Assign, track, and execute tasks better

- Communicate and collaborate more effectively

- Gather key information and documents

It’s worth noting that “workflow management” spans a fairly broad range of solutions, and no two tools are the same. For this reason, we’ve split our list into three different categories:

- Accounting and bookkeeping tools

- Accounting practice management software

- Accounting workflow management software

So without further ado, let’s have a look.

Best workflow management software

Workflow management software is designed to make accounting workflows smoother and more efficient. While there is some overlap with practice management software, the tools in this section focus solely on streamlining internal processes rather than day-to-day accounting operations. Here are three of the best.

1. Content Snare

Kicking off this list in our very own Content Snare, a workflow management software that streamlines and automates the process of gathering client information.

Your accounting firm probably spends a lot of time chasing clients for information, documents, and data. In many cases, you can’t move forward with your work until you get the information you need. This is where Content Snare can help.

With Content Snare, you can:

- Create and share custom forms

- Use one of our growing number of ready-made templates

- Request a range of client information — and approve or reject with a single click

- Set automatic reminders to chase missing info

- Answer client queries directly in the app

- View progress across all your clients via our dashboard

Pros: Put simply, Content Snare saves you countless hours spent chasing clients or lost in messy email threads. If you’re looking for a smarter way to onboard new clients or gather information, Content Snare is the perfect tool.

Cons: Encouraging your clients to move from outdated, generic tools like email and into a new system like Content Snare can be a challenge. That’s despite the obvious benefits it brings to everyone.

Streamline your accounting operations with Content Snare

Gathering client information doesn’t have to be a hassle. With Content Snare, you have the tools and features you need to make it a breeze.

2. Jetpack Workflow

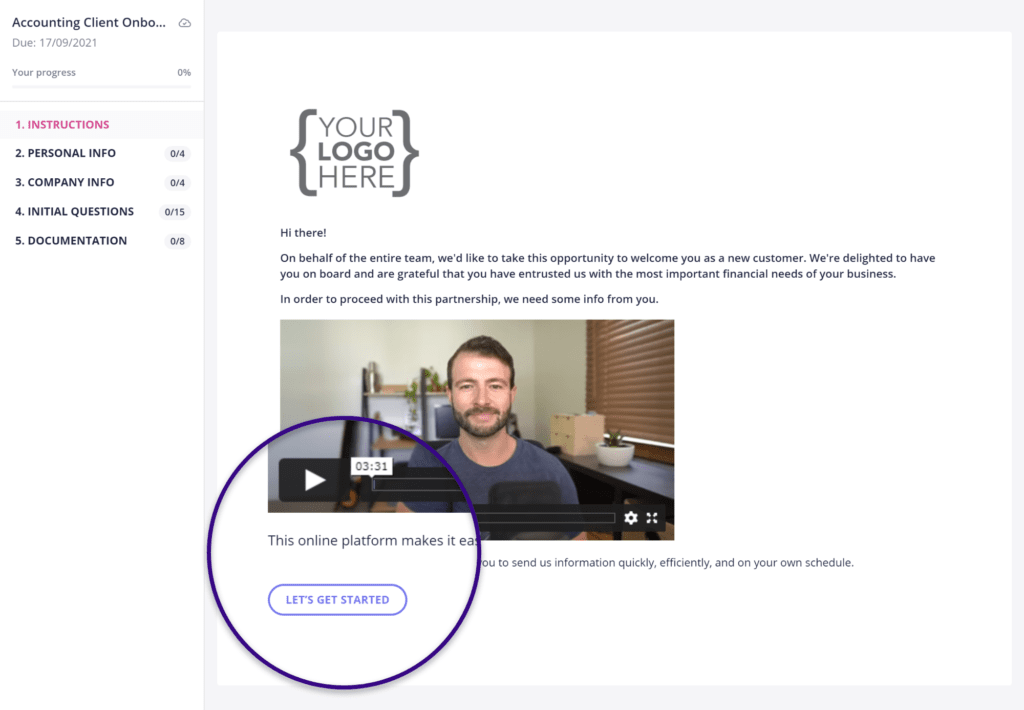

Jetpack Workflow is a popular workflow management software that helps accountants automate, track, and standardise key processes. It enables accounting firms to work better and faster, ensuring deadlines are always met. With Jetpack Workflow, you can:

- Create custom templates and checklists that standardise your work

- Easily access a library of over 70 ready-made templates

- Automate repeat work

- Create tasks and track progress towards goals

- Collaborate with your team seamlessly

Pros: Jetpack Workflow claims to save on average 10 hours per user per week, so it’s easy to see how this tool could benefit your accounting firm. It’s also available in almost 20 countries, making it ideal for international teams.

Cons: Some users have complained about the lack of a mobile app for working on the go. Others have stated that they eventually outgrew the tool and needed to switch to a more comprehensive offering.

3. Kissflow

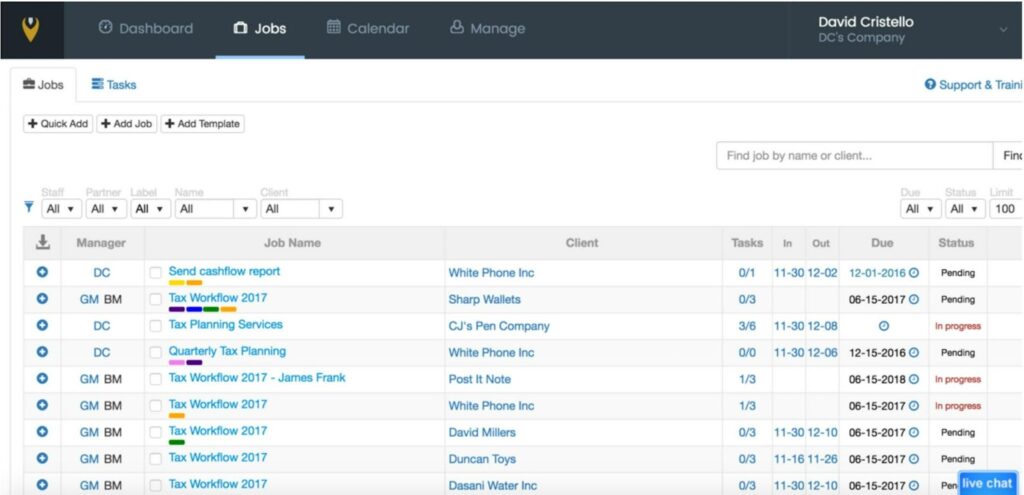

Although not designed specifically for accountants, Kissflow is another popular workflow management software. It allows users to create apps, processes, and boards with little or no code needed. Here are some of its key features:

- 400+ ready-made form templates

- Low-code app builder

- Build automated workflows with drag-and-drop simplicity

- Reporting and analytics

Pros: Kissflow’s simple app-builder is a game-changer, adding a new level of flexibility and customisation for users.

Cons: Because Kissflow isn’t designed specifically for accountants, you may find that its features don’t fit the nuances of accounting processes. And while its app-building capabilities are a plus for some, others may find them overwhelming.

Best practice management software for accounting firms

Practice management software helps accounting firms manage their day-to-day operations more effectively. It covers areas such as client management, communication and collaboration, and document management. Here are three of the best tools on the market.

4. Karbon

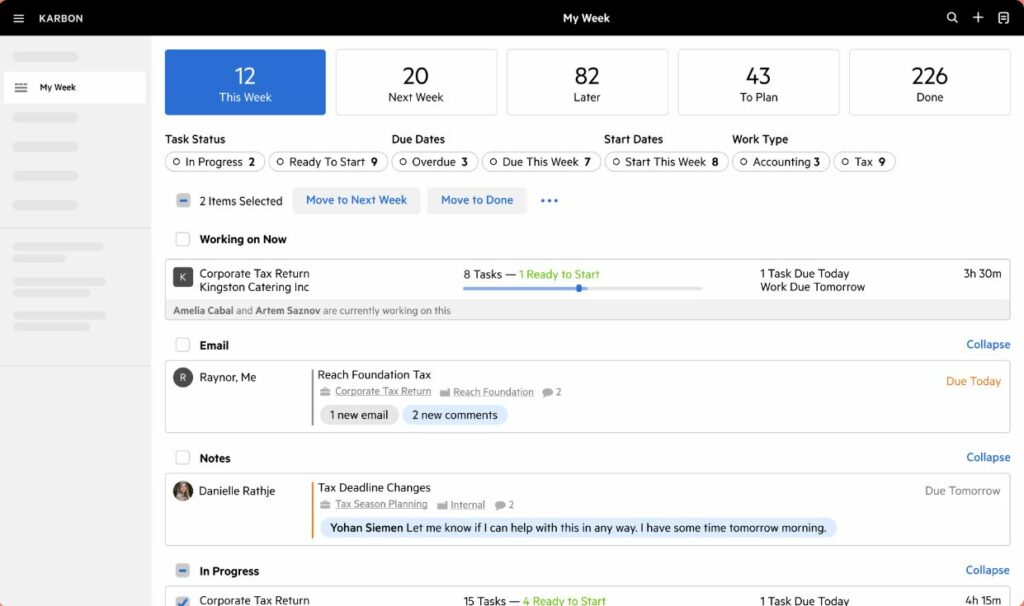

Karbon is a popular practice management software for accounting firms. It’s designed to improve communication and collaboration, streamline and automate workflows, and help accounting firms manage projects more effectively. Here are some of its core features:

- A central hub where you can manage projects, clients, and tasks

- Seamless collaboration across your team

- Document management

- Powerful business analytics, with key performance metrics

- Automated workflows

Pros: Karbon provides a single source of truth for all your workflows and data. This enables accounting firms to operate more efficiently across the board. Karbon has outstanding reviews from users online.

Cons: Kabon’s pricing model works on a per-user basis, so if you run a large accounting firm, it could get pretty expensive.

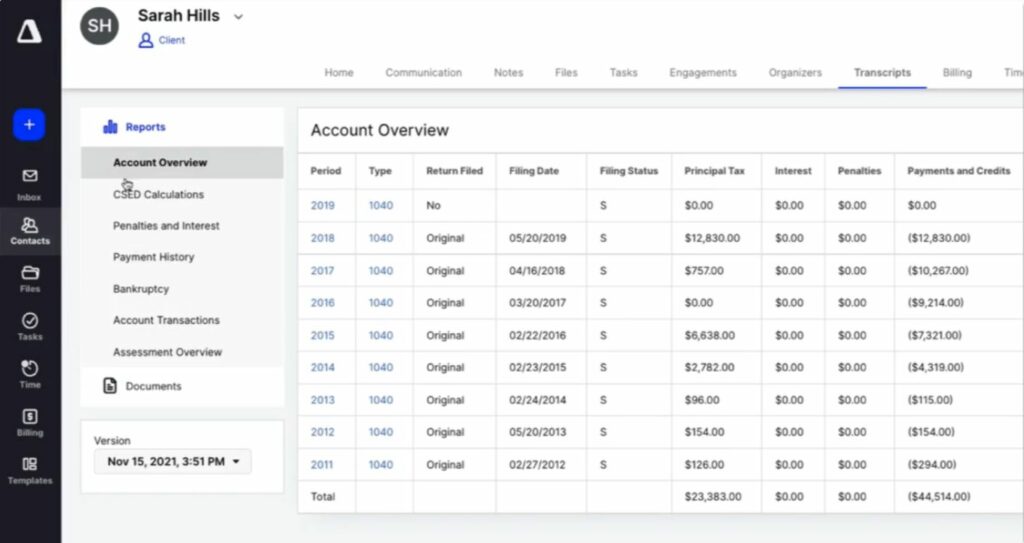

5. Canopy

Canopy is an accounting practice management system that promises to “unclunk your accounting firm”. It enables teams to streamline these key processes:

- Client management

- Document management

- Workflow management and automation

- Time and billing

- Payments

Pros: Canopy is user-friendly and ideally suited to smaller accounting firms. If you’re looking for an all-round solution to help simplify the day-to-day running of your business, Canopy is a great option. This statement is backed up by excellent online user ratings.

Cons: Some users have commented that Canopy still seems to be in build mode, adding new features at frequent intervals. While this could be seen as a plus, it may make the UX more confusing.

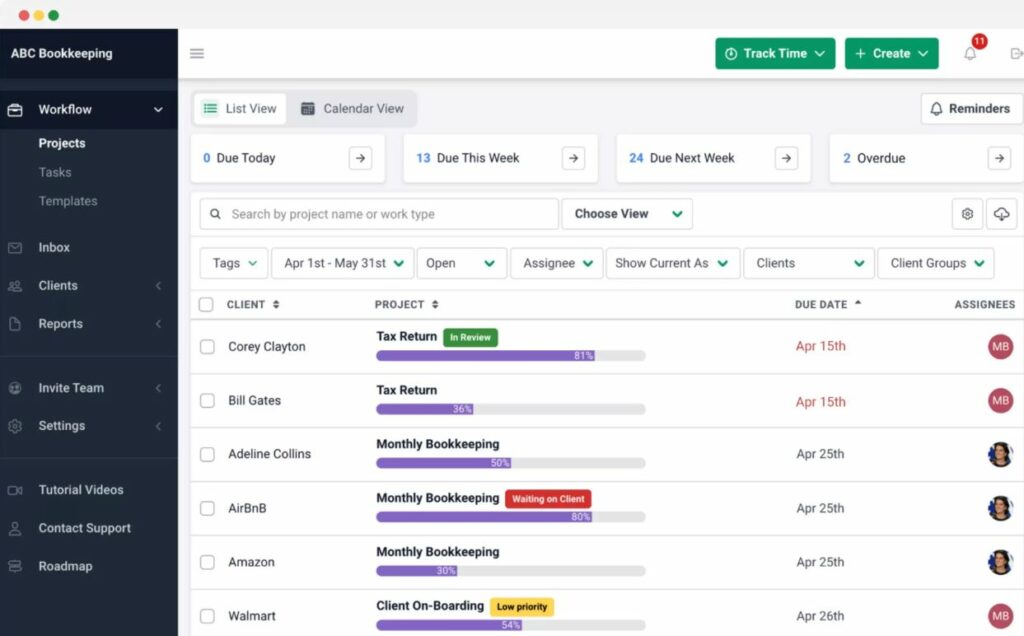

6. Financial Cents

Financial Cents is workflow management software designed to streamline day-to-day accounting processes and boost collaboration. At the same time, it provides a central hub for all your accounting communications, documents, and client data. Here are its key features:

- Workflow management to keep track of tasks, projects, and deadlines

- Time tracking and invoicing

- Client requests and automatic reminders

- Email integration that turns emails into tasks

- Capacity management to ensure work is delegated responsibly

- CRM tools for keeping all your client data in one place

Pros: Customers regularly call out Financial Cents' simple UX and fast setup. Meanwhile, its CRM functionality makes it a true all-in-one solution for managing an accounting firm.

Cons: While most customers appear happy with Financial Cents, some have mentioned a few nice-to-haves that are missing. These include e-signature capabilities, secure file-storage, and the ability to create email templates.

Best accounting and bookkeeping tools

In this last category, we’ll look at tools that streamline fundamental accounting tasks. So things like tracking financial data, creating financial reports, and issuing sales invoices. Here are three of the best options that most accountants should be familiar with.

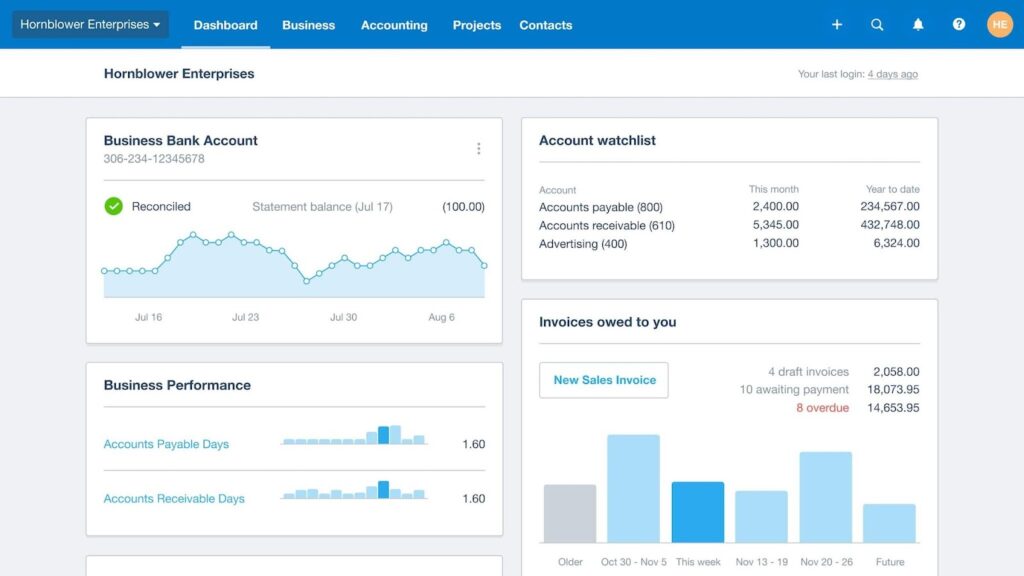

7. Xero

A highly popular accounting tool, Xero is described as a “small business platform”. In addition to accounting and bookkeeping, it covers payroll, reporting, project management, and expenses. Key features include:

- Automated bank reconciliation ensures your books stay up-to-date

- Track expenses, attach receipts, and categorise them for tax purposes

- Business dashboards show all your most important data in one place

- Online billing with automatic reminders

- Automatic data entry reduces manual processes

Pros: Xero is known for being user-friendly and intuitive, even for first-time users with no accounting experience. And with integrations with PayPal, Shopify, and Square, it’s a great choice for managing eCommerce and online businesses.

Cons: While Xero’s customisable reports look great, they can be time-consuming to create. Some customers have complained about broken integrations as well.

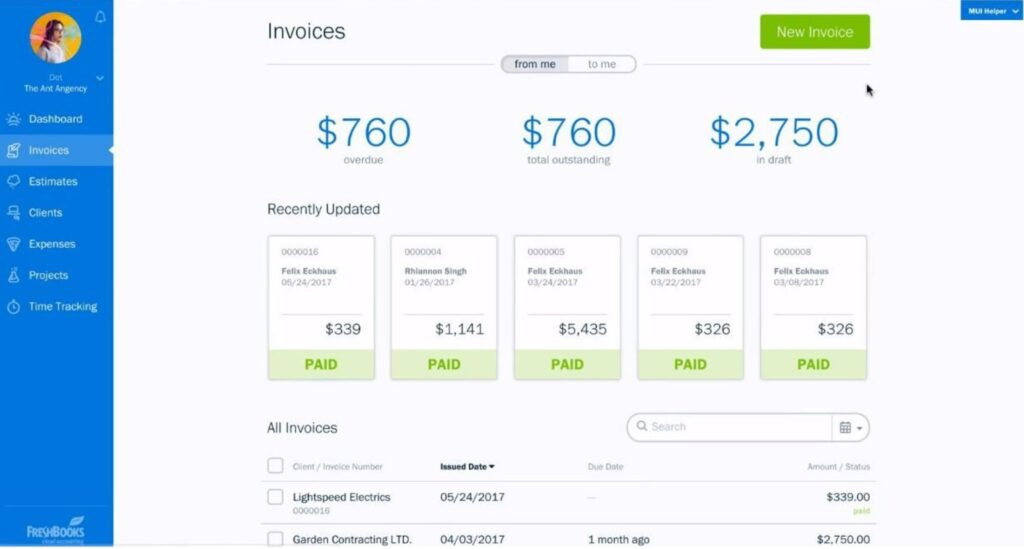

8. FreshBooks

FreshBooks is a cloud-based accounting software. It’s designed to help small businesses and freelancers manage their financial data and ensure compliance. Key features include:

- Invoicing, including automatic payment reminders

- Accurate financial reports and customisable charts

- Built-in time-tracking

- Project management and collaboration features

- Expense tracking

- Integrations with PayPal, Stripe, and other software

Pros: Its intuitive, user-friendly interface makes it a great choice for anyone looking to keep things simple. And with automated invoicing and expense tracking, you’ll save loads of time too.

Cons: There’s no inventory tracking functionality in FreshBooks, which might put off some eCommerce businesses.

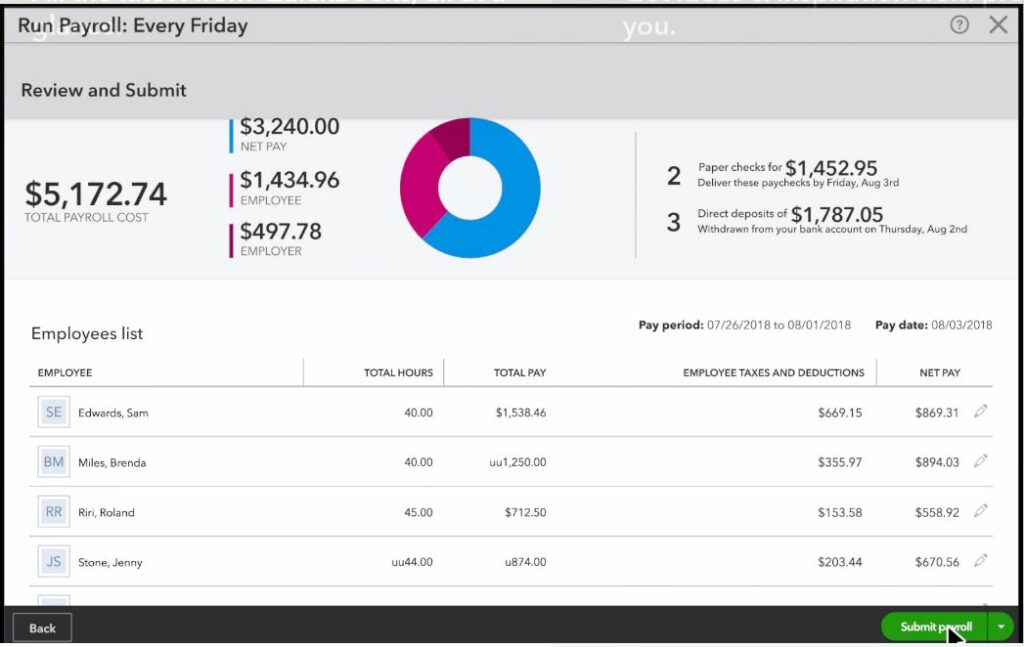

9. QuickBooks Online

QuickBooks Online is the market-leading accounting software, with over 27% of the market share. And for good reason. It's a complete accounting system, with advanced features that make accounting and bookkeeping easier. With QuickBooks, you can:

- Track income and expenses across multiple accounts

- Manage your inventory and keep on top of stock levels

- Send invoices and receive payments

- Evaluate which projects are profitable with job costing

- Automate payroll and tax calculations

- Communicate with customers via a client portal

Pros: A range of plans and features to suit businesses at all stages of their growth. Seamless integration with Microsoft Word, Excel, and Google docs allows you to transfer data to and from popular tools with ease.

Cons: Some users complain about the level of customer service, while others state that first-time users may find it difficult to get to grips with. QuickBooks has also suffered security breaches in the past, which may concern some business owners.