Accounting is the backbone of any organization's financial operations. It holds the keys to valuable assets and confidential data. Hackers know this very well, making accounting practices a common target for cybercrime.

According to a recent report, accounting firms saw a 300% increase in cyberattacks since the outbreak of the coronavirus pandemic. That’s why you have to deploy robust security measures to protect your company and your clients.

In this post, we’ll show you how to do that.

Tips to improve accounting security

- Secure accounting software

- Strong password policies

- Improve password management

- Two-factor authentication (2FA)

- Secure file sharing with Content Snare

- Employee training and testing

- Regular data backups

- Firewalls and antivirus software

- Secure network

- Strict access controls

- VPN is a must in public WiFi areas

- Hire a cybersecurity expert

- Regulatory compliance

- Physical security

Why is data security so important for accounting firms?

Accounting systems have to prevent data breach incidents for three highly specific reasons.

Protect your clients

Clients rely on accounting practices to handle their sensitive financial information with the utmost care and confidentiality. In fact, studies have shown that clients consider responsible behavior and reliability to be more important trust signals than the actual quality of your work.

That’s why you need to invest in accounting cybersecurity — it’s the only way to protect your clients' data and safeguard their privacy.

Protect your company

Data security is not only crucial for protecting clients but also for safeguarding the accounting firm itself. After all, malicious actors won’t stop trying to exploit vulnerabilities in your accounting system because they can monetize sensitive data.

Accounting data include everything from personally identifiable information to financial records and intellectual property. If you don’t want to lose it, you better implement comprehensive information security measures.

Protect your reputation

A single data breach can shatter your professional reputation in an instant. Most people think they are safe, but check this out — cybercriminals will steal over 33 billion records by the end of 2023, an increase of 175% from 2018.

Rebuilding trust after a data breach is a challenging task (if not outright impossible). The long-term consequences extend beyond client relationships, impacting partnerships, business opportunities, and overall growth.

Cyberattacks are the new normal, so it’s much better to be safe than sorry.

Practical tips to improve accounting security

Ok, accounting cybersecurity is important, but how do you strengthen it? We’ve prepared a list of 13 tips that help accounting firms prevent data breaches and protect financial data. Here they are:

1. Secure accounting software

A security platform is the most important tip. This kind of software won’t only help you manage your work but also protect your cloud accounting data.

For example, a platform like Practice Protect controls access to which staff can login to which portal.It also employs advanced encryption, multi-factor authentication, and regular security updates to mitigate the risk of financial data breaches.

2. Strong password policies

Did you know that 30% of Internet users experienced a data breach due to a weak password? That’s because people still use passwords like ‘123456’ or ‘qwerty’, which is absurd in 2023.

Your job is to implement strong password policies to avoid accounting cybersecurity attacks. It’s a simple task — encourage your employees to create complex passwords and update them periodically. Strong passwords include a combination of letters, numbers, and special characters.

3. Improve password management

If you’re tired of new accounts and passwords — and let’s face it, we all are — it’s time to improve your password management system. The simplest way to do it is by using a dedicated password management tool like Practice Protect (see more in step 2) or 1password.

These platforms keep entire teams safe by storing and managing all of your passwords simultaneously. They make logins easy by taking the guesswork out of the process.

4. Two-factor authentication (2FA)

Add an extra layer of security with an additional verification factor that stretches beyond passwords. For instance, users can receive a unique code to their smartphones when signing in. 2FA for all user accounts, including both internal and client portals, significantly reduces the risk of unauthorized access.

Keep in mind, however, that 2FA via an app is much more secure than SMS because the latter are vulnerable to SIM swapping.

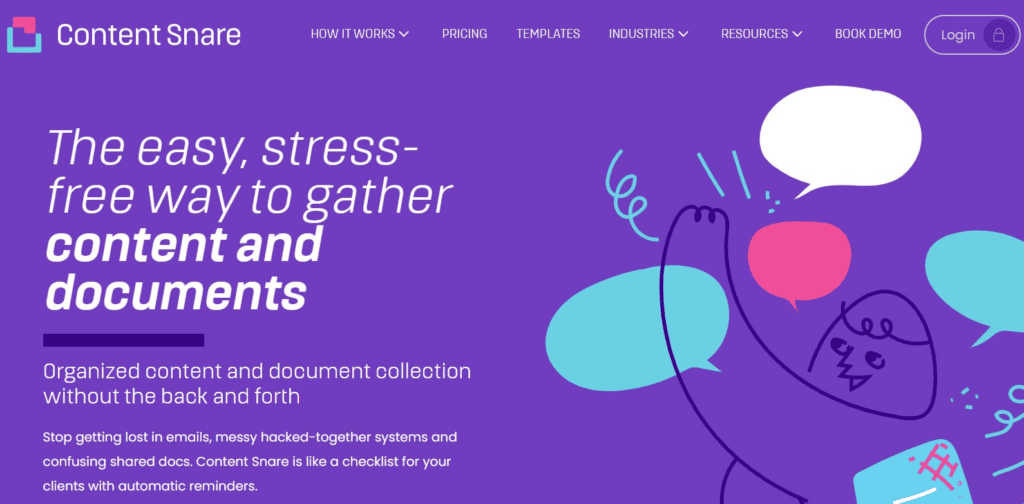

5. Secure file sharing with Content Snare

A typical accounting firm exchanges a lot of files with their clients. Most of them do it via email, which is not the safest way to send documents (to say the least).

Enter Content Snare, a secure document upload portal for your accounting clients. Our platform incorporates encryption protocols to protect data during transit and at rest. It allows for controlled access permissions, ensuring that only authorized individuals can view and download the shared files.

Content Snare also uses firewalls, advanced password management, throttling, and disaster recovery to keep your accounting firm safe and sound.

Protect sensitive information with Content Snare

Gather information faster than you thought possible without the fear of data breaches.

6. Employee training and testing

The human factor is often the weakest link in accounting cybersecurity. You should conduct regular training sessions to educate employees about potential cyber threats and data protection best practices.

This is yet another area where Practice Protect can help you out. With this platform, you can train employees on how to identify phishing attempts and avoid clicking on suspicious links or downloading malicious attachments. In addition, it’s highly recommended to periodically test their knowledge through simulated phishing exercises.

7. Regular data backups

Another tip is to regularly back up financial data to secure offsite locations or cloud-based platforms. That way, you can restore critical information in the event of a data breach or system failure.

8. Firewalls and antivirus software

Tip number seven is to install firewalls and reliable antivirus software across all devices. Firewalls act as a barrier between your internal network and external threats, while antivirus software detects and removes malicious software that can compromise your system's security.

9. Secure network

You can also protect your accounting firm's network by implementing secure Wi-Fi protocols, such as WPA2 or WPA3. It’s a good idea to segment your network and separate sensitive financial systems from guest or public access networks.

In addition, your IT staff should monitor network activity for any signs of unauthorized access or suspicious behavior.

10. Strict access controls

Limit access to financial data to only authorized individuals who need it for their job responsibilities. For example, role-based access controls give each employee an appropriate level of access privileges.

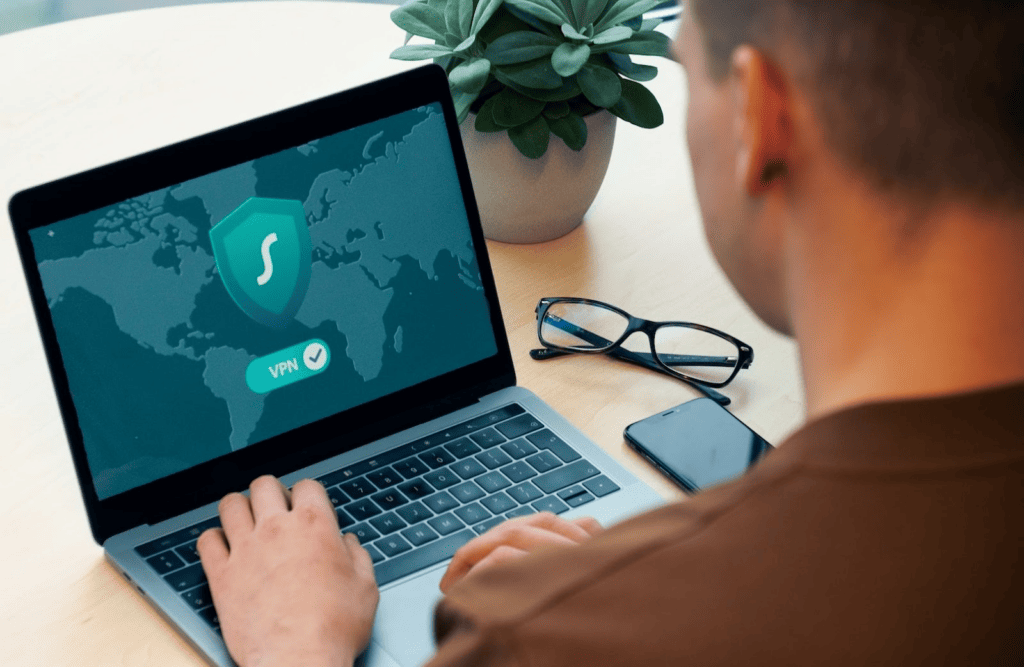

11. VPN is a must in public WiFi areas

Most people take public networks for granted, but they come with some real cybersecurity risks. But there’s an easy way to avoid threats that come with public WiFi networks — use a virtual private network (VPN).

A VPN encrypts your Internet connection to protect data from potential eavesdropping or interception on public Wi-Fi networks.

12. Hire a cybersecurity expert

Smaller firms probably don’t have enough resources for this, but bigger companies should consider hiring a cybersecurity expert. Experts can assess your firm's vulnerabilities, recommend appropriate security measures, and assist in implementing the latest security practices.

13. Regulatory compliance

Another important task is to comply with relevant data protection and privacy regulations. These include regulations like the General Data Protection Regulation (GDPR) or the Payment Card Industry Data Security Standard (PCI DSS). These rules change often, so stay informed in order to adjust your security practices accordingly.

14. Physical security

While much of accounting security focuses on digital measures, physical security is equally important. Secure your office premises by implementing access control systems, surveillance cameras, and alarm systems.

You can also store physical documents containing sensitive information in locked cabinets or rooms accessible only to authorized personnel.

Beware of the legal landscape

Accounting security isn’t just about protecting sensitive financial data and preventing cyber threats. Accounting firms also need to navigate the complex and ever-changing legal landscape that governs their operations. Failing to comply with regulatory requirements can have severe consequences:

- Reputational damage

- Financial penalties

- Legal action

Keep in mind, however, that regulatory requirements vary.

Different countries or even regions may have unique laws and accounting standards that dictate how firms should conduct their business and handle financial information. For example, the Generally Accepted Accounting Principles (GAAP) impose specific obligations in the US, but many other countries rely on the International Financial Reporting Standards (IFRS).

| Portland-based firm pays a fine for not disclosing a data breachTwo In 2021, an accounting practice Gustafson & Co. from Portland, Oregon, had to pay $50 thousand for not disclosing a data breach that had affected almost two thousand clients. According to local laws, Oregon-based organizations that suffer breaches affecting over 250 consumers have to notify local authorities about such incidents. |

Given the complexity and diversity of regulatory requirements, we encourage accounting firms to seek legal advice and ensure compliance with the applicable laws and regulations in their jurisdictions.

Protect your accounting firm with cybersecurity measures

The increasing number of cyberattacks targeting accounting practices underscores the need for advanced security measures. Modern defense systems have to be agile and dynamic, as it’s the only way to protect your company and your clients in real-time.

Accounting cybersecurity requires a fair share of resources, but you should see it as an investment with long-term benefits for your accounting practice.