For new homeowners, finding the perfect home insurance policy marks the end of a fantastic journey and brings everything together. As such, they actively strive to find a policy that’s both fulfilling of their needs and competitive. That’s where you come in.

In order to match your new client to their perfect policy, several aspects of their home need to be analysed and taken into account, as these aspects will have a direct impact on their costs and coverage.

This is best done through sending them a home insurance questionnaire. This type of questionnaire allows you to collect all of the initial information needed to provide a preliminary quote for your client and kick off your working relationship.

Get our homeowners insurance questionnaire template

Content Snare is here to help you create your homeowners insurance questionnaire. Sign up to access our built-in homeowners insurance questionnaire template. It’s ready when you are.

What questions should I be asking in a home insurance questionnaire?

With a home insurance questionnaire, getting the balance right when it comes to the length is a truly vital piece of the puzzle. Too short and you’ll leave with a stack of unanswered questions. Too long and you risk losing the client to an overly lengthy discovery process.

Where’s the sweet spot? We think it’s between 30-40 questions, which is exactly what we’ve opted for here.

Basic Information

You can’t get started until you know the basics! Kick off with these questions to get an initial overview of the client.

- Please provide your full name.

- Please provide your email address.

- Please provide the full address of the property concerned.

- Please provide your primary contact number.

Ownership and Financial Specifications

This section is focused around establishing the ownership of the property, as well as the financial resources associated with said ownership.

- Is the property for sale?

- Are you satisfied with the service you receive from your current home insurance carrier?

- Is the property owned by a trust?

- If you have a mortgage, please provide the name of the lender(s).

- Do you escrow your home insurance payments?

House specifications

Now it’s time to dig deeper into the more specific aspects of the home…

- Do you have a pool?

- Do you have a trampoline, treehouse, zip line or climbing wall on your property?

- Do you have an automatic whole house water shutoff device?

- Do you have a permanently installed whole house generator?

- Do you have a fire alarm monitored by a central monitoring service?

- Do you have a burglar alarm monitored by a central monitoring service?

- Do you have a finished basement?

- If so, what percentage of the basement is finished?

- Do you get water in your basement?

- Do you have a sump pump?

- Please indicate the year built, style, and estimated square footage of your home.

- Have you renovated or made any additions to your property in the past 5 years?

- If yes, please let us know what type of changes these were and the year of each change.

- How old is the oldest section of your roof?

Heating and plumbing specifications

Water and heat are the fuel to any home’s fire, often quite literally. These two vital elements can have profound impact on a house insurance policy, which is why it’s important to get into the nitty gritty early doors.

- What type of fuel heats your home?

- What is the age of your furnace or boiler?

- Do you have a wood or pellet stove?

- Do you have circuit breakers?

- If any, please describe the updates you made to your plumbing in the past ten years.

Additional questions

Extras are incredibly important to consider and cannot be left out of the questionnaire. Use this section to garner all of the necessary details about the smaller things, guaranteeing the utmost accuracy when it comes to drafting up the policy and quote.

- Does anyone smoke that lives in the household?

- Do any adults residing in the household work less than 20 hours a week?

- Do you have valuable articles such as jewelry, fine arts, guns, or silver that you would like estimates to add to the policy?

- Do you work out of your home?

- Do you own any watercraft or recreational vehicles?

- Please provide details of any pets you own.

- Do you own any additional property or land or rent any portion of your home to others?

- Do you have anything else to add?

Why send a home insurance questionnaire when I can ask my clients for this information on the phone?

You’re all set! Now that you have your home insurance questionnaire form sorted, we can assure you that your next experience with a client is going to be smoother than butter.

However, before we leave you to go and learn about your new clients’ needs, if you’re not yet convinced by collecting the information using the questionnaire method, here are a few more in-depth reasons as to why questionnaires are the way to go for this process.

It doesn’t set a time limit on the conversation

Spare time is pretty rare these days, meaning both yourself and your client are likely to be rushed off of your feet. This often results in scheduling insufficient time periods for discovery phases like this one, which leads to data inaccuracy and lack of detail when it comes to the responses that are given.

By supplying a questionnaire, clients can answer any questions gradually and carefully in their own time, which is often at night or during the weekend. That way, neither party is rushing and all information given is much more accurate and complete.

It ensures nothing’s missing

Human error and memory are both important factors that make collecting information through phone calls a pretty inefficient process. It’s more than likely that a mistake will be made here and there when noting information down which, along with the possibility of forgetting certain details before pen touches paper, can result in missing and incorrect information.

Having a digital, written record of every answer you need provided directly by the client eliminates all possibility of miscommunication and errors on your part and leaves the ball in the client’s court.

It makes your firm look a lot more professional

If your information collection process is sloppy in the slightest through the eyes of the client, this will leave a bad taste in their mouth and could potentially make them question your professionalism.

A sleek, smooth system for retrieving their responses from the get-go eliminates the chances of this happening completely and makes your firm look better than ever.

Which tool should I use to create my homeowners insurance questionnaire?

When it comes to creating your home insurance questionnaire, there are many options available that’ll pretty much do the job. However, a lot of them have a number of disappointing limitations that are likely to make the process incredibly time-consuming and difficult for everyone.

This is why online tools like Content Snare exist, making the process easier and allowing you to collect all of the information you need in a hassle-free manner.

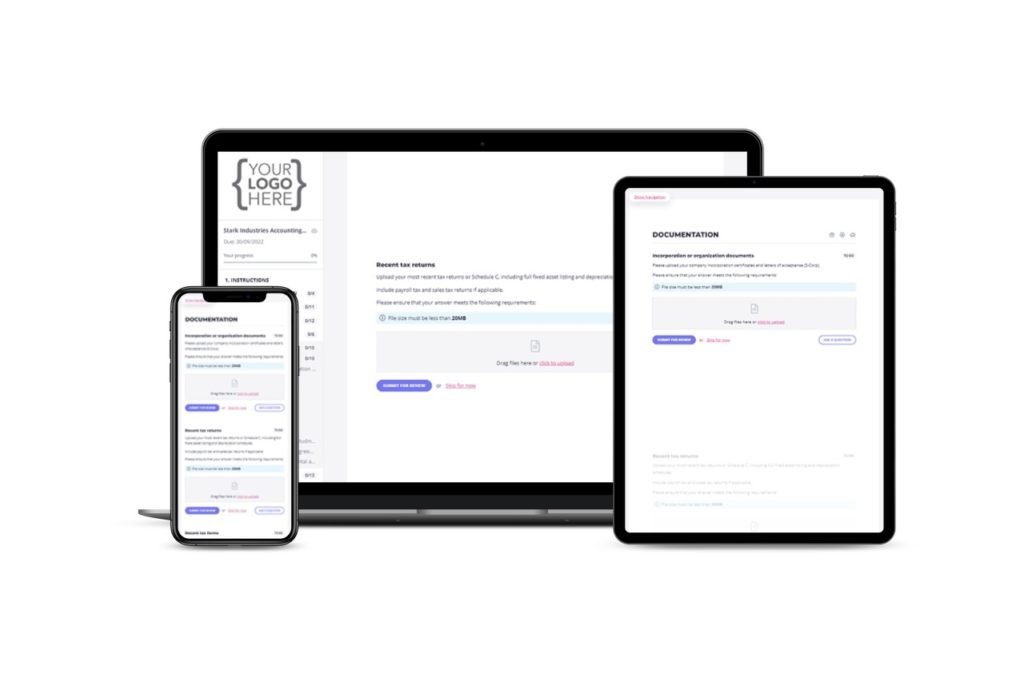

Content Snare is quick and easy to use for you and, better yet, for your clients. In fact, your clients may even end up loving it more than you. You can create killer requests from scratch to send to your clients or, to make things even simpler, you can take your pick from the range of built-in templates that are there and waiting for you within our library.

With little to no learning curve, sending your first request can take just minutes and, from there, your job is done! Your client can now begin filling in their responses and enjoying Content Snare’s intuitive client user interface. Anything your client types in is automatically saved, meaning that they can return later in their own time, which takes away the pressure from everybody.

With its automatic email reminder feature, Content Snare also ensures that your content gets delivered in the right place at the right time, which is how it should be. Those days of working your way through endless email threads just to communicate with clients and collect their information are well and truly over!

We truly hope this post has been able to shed a bit of light on the best bits to include in your next home insurance questionnaire.

Is there anything you think we forgot to mention that could make this questionnaire even better? Let us know in the comments below!