When it comes to pricing accounting services, accountants often need help deciding what to charge and how. We are scared that pricing incorrectly will make more work for us and frustrate our clients.

You have a few options when it comes to pricing: hourly, fixed price, or value pricing. At least, these are the most common ones.

This blog post will discuss factors to consider when pricing your accounting services and each pricing model and share some tips to remember when deciding which is the best option for your business.

First, why is pricing accounting services so difficult?

After all, pricing is a vital part of any business - yet many accountants struggle with it. Part of the reason that accounting services are often complex and difficult to price accurately because it's hard to know how much time a project will take or what the client’s accounting needs are. As a result, many accountants either undercharge or overcharge for their services.

The second reason pricing is so difficult is that many variables are involved for each client. For example, some clients only need a few hours of work per month, while others may need dozens of hours. And, of course, each client's needs are different, so it's hard to compare and price accurately.

Factors to consider when pricing your accounting services

Discuss your prospective client's accounting needs

The first step is to discuss your prospective client's needs with them. What exactly do they need help with? How often do they need help? What is their budget? This information will help you choose the right pricing structure and the right price.

Consider your target audience

Are you targeting small businesses or large corporations? Local businesses or international businesses? Your target audience will impact your pricing.

For example, small businesses are often more price-sensitive than large corporations.

Think about your unique selling proposition

What makes your bookkeeping and accounting services unique? What sets you apart from the competition? You can charge a premium price if you have a unique selling proposition that clients view as valuable.

Define your scope of work

Before you price your services, you need to define the scope of work. What exactly will you be doing for the client? This is important because it will help you determine how many hours you'll need to complete the project and how much to charge.

Your engagement letter should clearly outline the scope of the engagement, such as what's included as a part of your services and when your work will be delivered.

It is also important to address what will happen if additional services are needed, such as first providing an estimate of additional costs with the client and signing a new agreement.

Consider your costs

How much do your accounting services cost to deliver? This includes your overhead costs (e.g. office rent, utilities, insurance) and the cost of your time (e.g. your hourly rate). Make sure your prices are high enough to cover your costs.

Choose the right pricing model

Once you've considered these factors, you're ready to choose a pricing strategy. The most common pricing strategies are hourly, fixed rate, and value pricing. Let's take a closer look at each one.

Hourly Pricing

Hourly pricing is the simplest and most common pricing structure for accounting services. You charge your clients based on the hours you work. This rate can vary depending on the type of work, your experience level, and the client's location.

The main advantage of hourly pricing is that it's easy to understand and calculate for billing clients.

The main disadvantage is that it can be difficult to estimate how long a project will take and can lead to billing surprises for your client. Secondly, hourly pricing can incentivize you and your team to work more hours than necessary because the more you work, the more money you make. This doesn't encourage you or your team to become more efficient.

These disadvantages are why the industry is slowly moving towards fixed and value pricing, despite still being the primary pricing structure for many firms. A survey by AICPA found that the future doesn't look promising for the billable hours model as there is a consistent decline and preference for other pricing models.

With this pricing model, you and your team will need to keep track of the hours each person spends on each product which is simple enough with a good time and billing software for accounting professionals.

Fixed Price Pricing

Fixed price pricing is another common pricing model for your accounting service.

With fixed price pricing, you quote the client a set price for the entire project upfront, and this price is usually the same for all prospective clients with little to no customization. This price is based on estimating the time and resources required to complete the project, but no matter how much time you spend on the work, your client will always pay the fixed price agreed upon upfront.

One advantage of fixed-price pricing is that it's predictable and easy to understand. The client knows exactly how much they'll be paying, and there are no surprises. You can even build in the cost of their accounting software subscription.

Another advantage of fixed-price pricing is that it gives you more control over your valuable time. You can set clear boundaries upfront with fixed-price pricing and avoid scope creep.

There are also some disadvantages to fixed-price pricing. First, it can be difficult to estimate the true cost of a project. If you underestimate the time and resources required, you'll lose money. On the other hand, if you overestimate the cost, the client may not see the value and look for a cheaper option.

This pricing option is best used for simple and repetitive services such as simple tax preparation and monthly bookkeeping services and is commonly offered using three service levels, such as bronze, silver and gold. Each service level must outline what is included with as much detail as possible.

Value Pricing

Value pricing is a pricing model that considers the perceived value of your accounting service to the client rather than the time required to complete the project. With this model, you'll typically charge a flat fee for the entire project, regardless of how long it takes. This model is becoming increasingly popular, as it allows you to charge what you're worth - not just what your time is billed out at.

You need to find out which services to provide your client based on what they consider important and valuable, which you will discover by asking lots of questions, and the exact price they are willing to pay for that value.

Any price must reflect the value for the client. If a client feels they received $5,000 worth of value from your services, don't charge them $500 just because it only took 10 hours to complete the project. Instead, charge them based on the value they received. Simply because you took X amount of time to do something does not mean the client should pay for that.

Or if you help clients save $10,000 on their taxes, you could charge them a percentage of that savings (say, 10%) rather than charging hourly rates.

Accountants often use this pricing model with a lot of experience and confidence in their abilities. It's also a good option if you're offering a unique service that isn't easily replicated.

The downside of value pricing is that it can be risky - you may spend more time on the project than you anticipated and not get paid for it. Additionally, value pricing can sometimes be difficult to justify to clients, especially if they're used to paying by the hour. Value pricing is difficult to implement because each client is unique and must be priced individually. Value is subjective because everyone values things differently, so it can't be measured.

This pricing method also makes it difficult to get your team involved in prospecting and pricing meetings as it's much harder for them to learn and implement.

Many accountants charge using standard packages as a starting point and tailor the packages to their client's needs with add-on services. Or offer a hybrid approach, such as fixed fee pricing for routine services such as simple tax preparation and basic bookkeeping services and then offer your complex or advisory services, such as cash flow forecastings or complex financial statements, as value-priced.

Tips to remember when pricing your accounting services

Know your worth

Don't undercharge for your services just to get the job. It's not sustainable in the long run. Instead, know your worth and charge what you're worth.

Consider all the factors

When pricing your services, don't just consider your time. Think about the value you deliver, the resources required, and the cost of doing business.

Be flexible

Don't be afraid to be flexible with your pricing. If a client is on a tight budget temporarily, consider offering a discount. Or, if a project is particularly complex, you may need to charge more.

Know your client

When pricing your services, it's important to consider your client and consider defining factors like their business size. If they're a small business, they may have a limited budget, but if they're a large corporation, they may be able to afford to pay more.

Get feedback

After you've priced your services, get feedback from your clients. If they're happy with the price and feel like they are getting value for the price, great! If not, you may need to adjust your pricing.

Consider price anchoring

When presenting your price, it can be helpful to "anchor" it by starting high and then coming down to your actual price.

For example, if you're proposing a project costing $5,000, you might start by saying, "Our fee for this project is $10,000." The client will likely balk at this price, but then you can say, "However, we're willing to do the project for $5,000." The client will probably be relieved - and may even see your $5,000 fee as a bargain.

Price anchoring allows you to show your client your value and feel like they are getting a good deal.

You can also utilize price anchoring by placing your offering next to one or more additional options, such as presenting three package options: bronze, silver and gold.

Have an engagement letter in place

Engagement letters protect both parties by clearly outlining the terms of the engagement.

It is important for all professional services, especially value-based pricing, which opens the door to misunderstandings and scope creep.

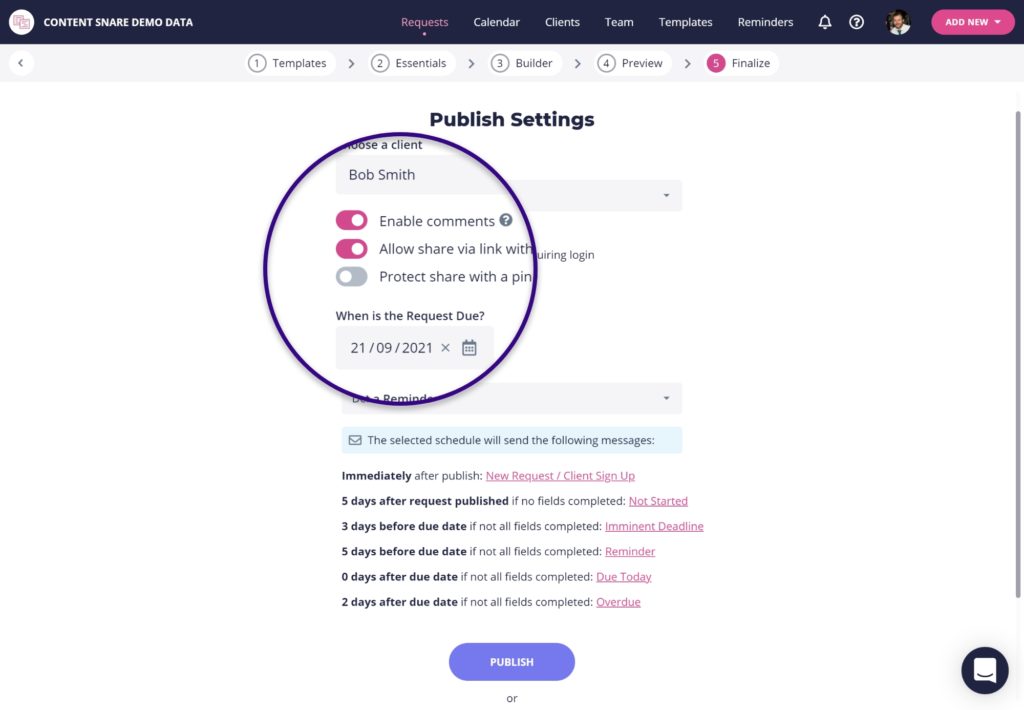

Implement automation through technology

Implementing technology to your service offering allows you to increase the quality of your service for your client, which can increase the value for your client, allowing you to charge more based on your efficiency, responsiveness and accuracy.

It also makes your work more efficient. When you get rid of hourly billing and are no longer paid directly for your time, you can implement automation to eliminate manual work and increase your efficiency, increasing your profitability.

Simplify client document collection with Content Snare

Organized document collection without the back and forth emails. Content Snare is like a checklist for your clients with automatic reminders.

Choose the pricing strategy that works for your firm and matches your values

There's no one-size-fits-all solution when it comes to pricing your services. The best pricing strategy for your accounting firm will depend on various factors, including your specialty, your target market, and the services you offer.

How you price your accounting services will tie into your firm's success, hopefully increasing your profitability while sustaining long-term relationships with your clients and bringing in new clients.

Remember to consider all the factors, be flexible, and know your worth. And most importantly, choose a pricing model that makes sense for your business. With these tips in mind, you'll be able to price your services confidently.