Deciding what to charge for your services is one of the primary challenges that bookkeeping professionals face. Pricing is an art rather than a science, and it's essential to look at many factors to determine the perfect price so you don't overcharge or undercharge.

In this blog post, we will discuss factors you should consider when deciding how much to charge for your services, the most common pricing structures and share some tips on pricing and receiving payment from your clients.

Factors to consider when determining your bookkeeping rate

Scope of work

When it comes to charging for bookkeeping services, there are a few factors that you will need to consider. The first is the scope of work involved.

Are you only responsible for recording transactions, reconciling accounts and preparing monthly financial reports? Or will you be responsible for tax preparation services and payroll services? How about offering additional services such as handling the accounts receivable or accounts payable for the business owner? The amount of work involved will significantly affect how much you can charge for your services.

Whether you offer bookkeeping price packages or custom pricing, it is important to determine how many bank accounts and credit card accounts need to be reconciled. Each pricing package should clearly outline how many bank account reconciliations are included and an approximate number of bank and credit card transactions.

Your pricing will also depend if your client's books are current or if you need to do a lot of catch-up reporting because the more time passes, the harder it is for the business owner to remember what happened with their finances making your job harder.

Frequency of services

Another factor to consider is the frequency of your services.

Will you provide services once or on a monthly, quarterly, or annual basis? The more frequently you provide your services, the higher your rate can be. This is because businesses will benefit from having someone regularly tracking their finances and looking at their cash flow. You may offer client meetings and financial statements more frequently, which is more time and effort for you.

Location

Another important factor to consider is your location.

If you live in a small town or rural area, you will likely need to charge less for your bookkeeping services than someone in a major city, as living costs are typically lower in smaller towns and rural areas. However, location plays less of a role now than it used to because everything is virtual, and you can serve small business clients worldwide.

Niche

If you "niche-down" by offering bookkeeping to a specialized industry such as real estate or healthcare, that may affect your pricing. If you can prove your worth and expertise in working with that specific industry and the nuances that come along with it, it will allow you to increase your prices.

Size of client

Another factor to consider is the size of your client's business. A small business client will have different bookkeeping needs than a large corporation. You will need to consider the number of employees, the number of bank accounts, the type of business, and the annual revenue when pricing your services.

Offering bookkeeping service packages at different tiers, such as gold, silver and bronze, is a great way to offer different pricing to clients of different sizes and needs.

Your experience and qualifications

You will also need to factor in your experience and qualifications.

If you have been working as a bookkeeper for many years, you will be able to charge more than someone just starting out. The same is true if you have specialized training or certifications.

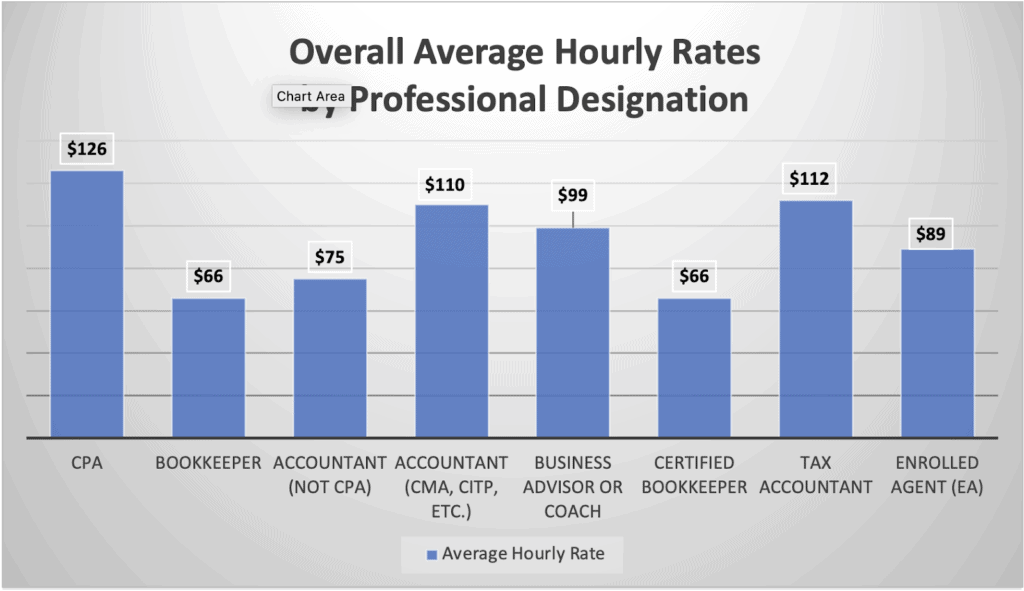

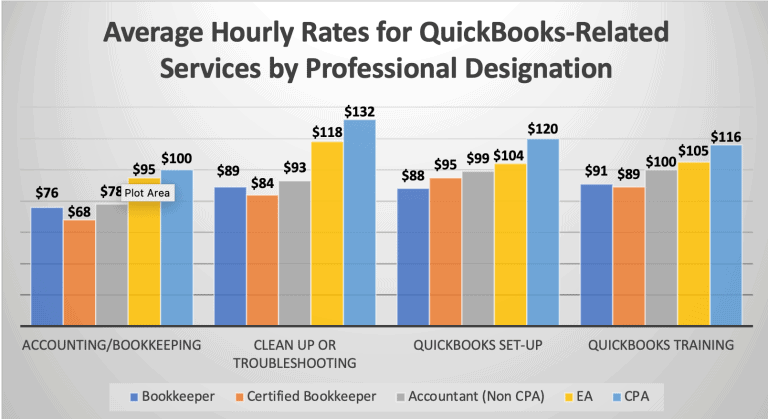

There are several certifications you can get as a bookkeeper, but they are not necessarily required. Intuit's 2021 rate survey found that average hourly rates did not differ between bookkeepers and certified bookkeepers, suggesting that a bookkeeping certification has no significant impact on pricing.

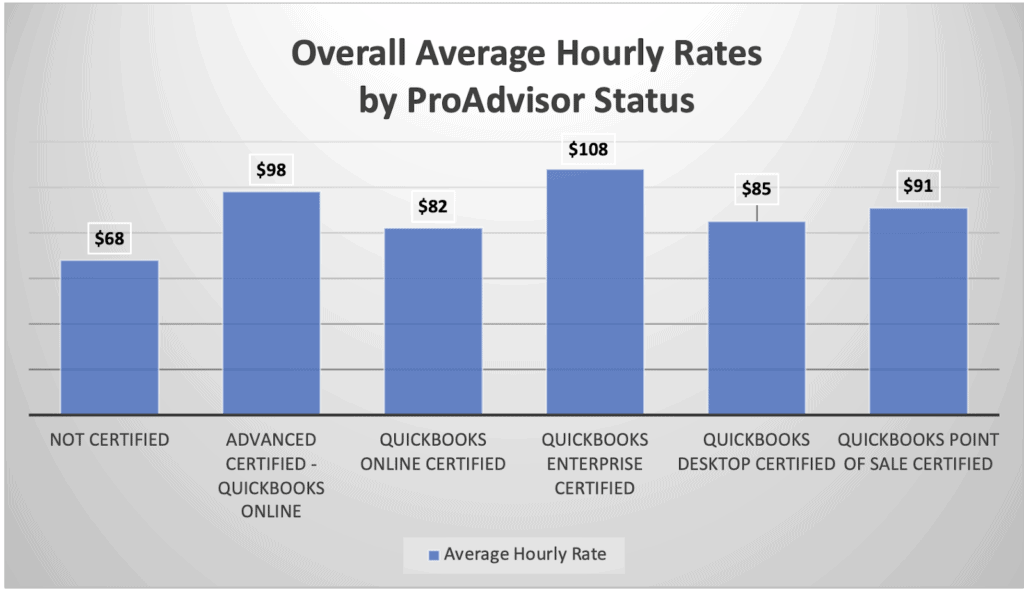

While most clients do not expect bookkeepers to have their bookkeeping certificate or CPA designation, they may value their bookkeepers having accounting software designations, such as Xero or Quickbooks ProAdvisor program. That same survey found that, on average, practitioners who obtained Quickbooks ProAdvisor certifications significantly increased their overall hourly rates.

Competition

When it comes to pricing your services, you need to make sure that you are competitive.

You can research the rates charged by other bookkeepers in your area. Look at your services and compare them to what other bookkeepers are charging.

You must also look at what makes you different or your competitive advantage because you may be able to charge more if you can show your prospective clients that you provide more value than your competitors.

Value of services

The last factor to consider is the value of your services.

If you can help your clients save time and money or improve their cash flow, you can charge more for your bookkeeping services. It is important to show your clients the value of your services based on what they value so that they are willing to pay a higher rate.

A small business client may see the value in bookkeeping services that help them save time and money. They may be willing to pay a higher rate for bookkeepers who can do more work for them in less time.

A large corporation may place a higher value on bookkeeping services that help them stay compliant with government regulations and audits. They may be willing to pay a higher rate for bookkeepers with specialized training or certification in auditing and accounting.

New business owners are often reluctant to outsource their bookkeeping because of the added cost. But bookkeeping done well is an important part of running a successful business, and it can save you from costly record-keeping and tax-filing mistakes in the long run.

By taking the time to research and consider all of these factors, you can determine how much to charge and adjust as needed.

Bookkeeping services pricing structure

Now that we've gone over some of the factors you need to consider when pricing your bookkeeping services let's take a look at a few different pricing structures you can use.

Hourly rate pricing

One standard pricing structure is to charge an hourly rate, which is what accounting firms traditionally used and many still use today.

This billing allows you to price your accounting services based on the time it will take you to complete the work. Each employee will have a charge-out rate based on their experience as a markup on their hourly rate. To give your client an accurate estimate, it is important to be honest about how much time you expect the work will take.

Hourly billing can be a good option for bookkeepers because it is simple to implement. You can also easily adjust your rates as your experience and skills increase.

The problem with hourly billing is that it can lead to unpredictable fees for your client, and there is no incentive for you, as the bookkeeper, to complete your work more efficiently. It is best for this pricing structure to implement software for accountants that track time to ensure your time tracking is efficient and accurate.

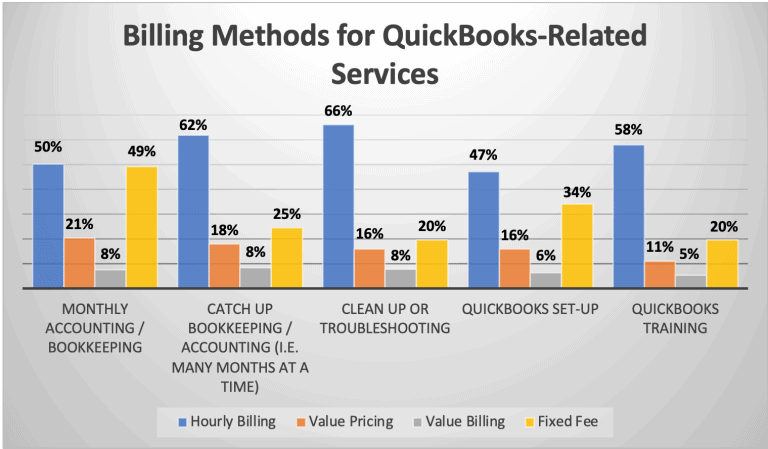

When billing for QuickBooks-related services, hourly billing is still most commonly used for monthly accounting/bookkeeping, catch-up accounting/bookkeeping, clean-up or troubleshooting, QuickBooks setup, and QuickBooks training.

As observed in prior years, the survey results suggest that accounting professionals prefer to bill hourly for services with a higher degree of uncertainty about the time and effort needed to complete the work.

Flat rate pricing

Another option is to charge a flat rate. This means you will set one price for all your bookkeeping services. This option is ideal if you have a good understanding of the scope of work involved and you are confident that you can complete the job in a timely manner.

The pricing structure you choose will depend on the work you will be doing, what you and your employees prefer and your clients' needs.

Fixed fee pricing is an attractive option for both bookkeepers and clients. For bookkeepers, it provides a guaranteed expected income, and for clients, it ensures that they will not be surprised by a large bill at the end of the month.

The main downside to fixed fee pricing is that it can be difficult to estimate the time needed to complete the work. You may lose money on the project if you underestimate the time needed. Additionally, if the job takes longer than expected, you may also lose money on the project. Problems also arise if scope of work is not clearly defined.

Flat rate pricing is easy to standardize with a few pricing packages, which may look like a small, medium or large package based on the size of the business and your client's needs.

Value-based pricing

The third option is to price your services based on their value to your clients. Value-based pricing is based on the maximum amount a given client is willing to pay for a service, typically set before the work begins.This means you will charge a higher price for services that provide more value to your clients.

Value-based pricing is a good option for bookkeepers who are confident in their abilities and can provide a high level of value to their clients. It allows you to charge more for more valuable services to your clients, which can result in higher profits.

The main downside is that it can be difficult to estimate what clients value and, therefore, what to charge for your services as it is very customized. You will need to understand your client's needs and what they are willing to pay for your services. You may also need to negotiate prices with clients, which can be time-consuming.

Value-based pricing lends itself to custom pricing because every client is different and therefore values your services differently.

You don't have to choose just one pricing structure. You can use a combination of different pricing structures to come up with a rate that works for you and your client. For example, you could charge an hourly rate for some services and a flat rate for others. Just be sure to be transparent in your engagement letter so both you and your client are clear on the pricing structure and terms.

Bookkeeping payment terms

Once you decide what to charge, you'll also need to consider additional terms for collecting payment from your clients.

Decide on a payment schedule

Regarding bookkeeping services, you will need to decide on a payment schedule. This can be either weekly, bi-weekly, monthly, or project-based. When deciding on a payment schedule, you should consider the scope of work and your client's needs.

If you are working on a project basis, you will need to invoice your clients for the work you have completed. You should include all the relevant details on the invoice, such as the hours worked, the tasks completed, and the total cost.

If you are working monthly, you can set up a recurring payment plan allowing your clients to make automatic monthly payments that come right out of their bank account.

No matter what payment schedule you choose, you should always send your invoices in a timely manner. This will ensure you are paid for your work as soon as possible.

Implement a one-time setup fee

In addition to the monthly bookkeeping charge, you should also charge a one-time setup fee to set up the client's books. This is especially important if you choose fixed monthly fee pricing, as the setup can be time-consuming and outside the scope of monthly bookkeeping.

This fee will cover things like setting up or transitioning the accounting software, setting the chart of accounts and inputting opening balances.

Have your clients pay in advance

To avoid clients not paying their bills after work has been completed, it is important to move toward expecting some form of payment before the job is done, such as a deposit or retainer.

This works well with a flat fee or fixed price agreement, as a retainer is due upon agreement signing and comes out automatically at the beginning of every month. If you use hourly pricing, request a retainer that can be applied to the final bill.

Implement a late fee

If you don’t have your clients pay in advance, you can also charge a late fee if a client doesn't pay an invoice on time. This is typically a percentage of the invoice, such as 2% or 5%. You should document this in your client intake form or accounts receivable policies and also include your late payment terms on the invoice so the client knows the fee.

You can also choose to withhold services until the invoice is paid. For example, if you are doing monthly bookkeeping, you can withhold the next month's services until the current invoice is paid.

Charge your worth when it comes to bookkeeping services

Deciding what to charge for bookkeeping services can be a complex task. You need to consider the type of work you will be doing, the needs of your clients, and the competitive landscape when setting your rates. You should also decide on a pricing structure and payment schedule that will work well for you and your clients.

By taking the time to consider all of these factors, you will be able to determine how much to charge for your bookkeeping services. The key to accurately pricing is understanding and showcasing your value to your clients and prospective clients and then price your worth appropriately.