Life insurance is a serious business. For the insured, it provides peace of mind that loved ones will be looked after if they’re no longer around. For the insurer, there’s the challenge of understanding risk and offering a competitive-yet-realistic policy — all while keeping an eye out for insurance fraud.

To create life insurance policies that work for both parties, insurers need to know as much as possible about their clients. And that means gathering information via life insurance questionnaires. In this article, we’ll explain:

- The questions you should be asking

- How you can gather the information you need quickly and easily

What questions should I be asking in a life insurance questionnaire?

The goal of a life insurance questionnaire is to gather all the important information you need to know who a person is and evaluate their risk. You need to be thorough. But if you overwhelm potential customers with too many questions, they may give up on their life insurance application altogether.

Personal information

First, you'll need a solid understanding of who the customer is. While this information may seem purely administrative, a customer’s age and gender can have a huge impact on their premium and terms.

- Their name

- Date of birth

- Country of birth

- Gender

- Address

- Contact details

You’ll also need to know what they do for a living, and what their financial situation looks like, with questions such as:

- What is your occupation?

- What is your employer’s name, contact, number, and address?

- What is your annual income?

- What is your annual household income?

- What are your total liabilities?

- What is your total net worth?

Existing insurance

While some customers may be applying for life insurance coverage for the first time, others may be switching in hope of a better deal or higher rate. Questions like the ones below will help you understand if your customers already have a life insurance policy in place.

- Do you have any existing insurance policies you have in place?

- Have you applied for any additional life insurance coverage with another provider?

- If so, please list the company and the amount.

- Will the life insurance policy you are applying for here replace any of those listed above?

- If yes, which ones?

Health, history, and risk

In this section, we dig into detailed information about the customer’s medical history and current condition, as well as their family medical history. This gives us a more complete picture of their risk profile and the factors behind it. Medical records or a medical exam can help to verify the answers to these questions.

- What is the name, address, and phone number of your personal physician?

- When did you last see them?

- What was the reason for your visit, and what diagnosis did you receive?

- What is your height and weight?

- Have you experienced a change in weight of 10 lbs or more in the last year?

- Do you, or have you ever, used tobacco or nicotine products in any form?

- Please list all the medications you are currently taking, including doses.

- Have you visited any other medical practitioners or specialists in the last five years?

- Please provide information about your father, mother, and siblings, including their age and health status (if living), or their age at death and cause of death (if deceased).

- Have you participated in or planned to participate in any dangerous activities during the last three years?

- Do you exercise regularly?

- Are there any medical conditions, past or present, that we should know about?

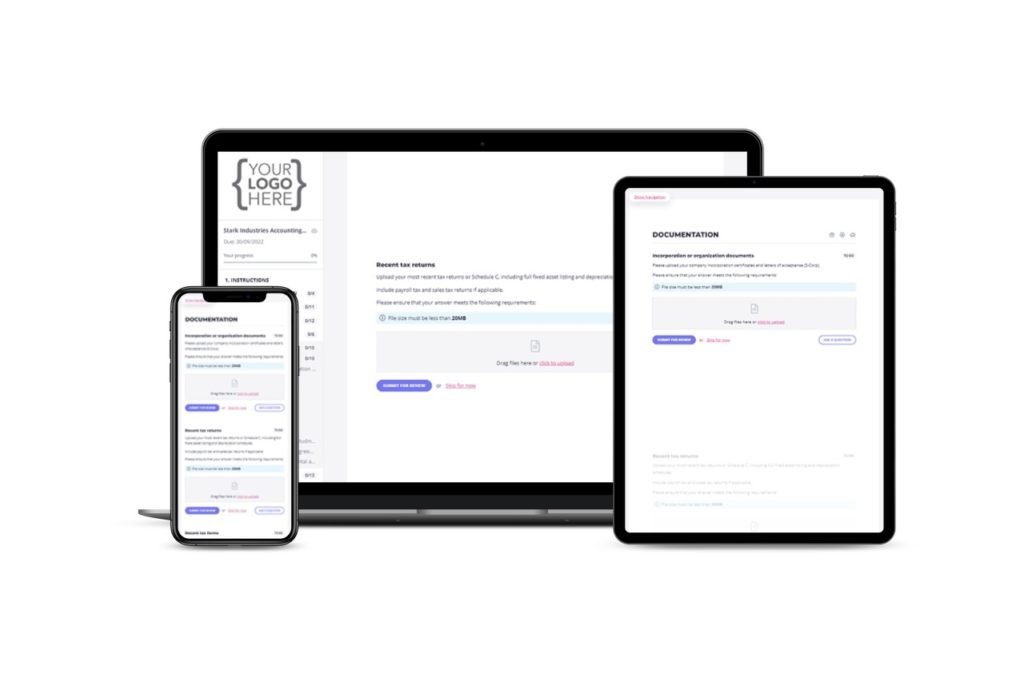

Content Snare streamlines the process of collecting information

Life insurance companies need to collect a lot of information from clients before they can move forward. Without a dedicated system for collecting information and documents, this process can become messy and complicated. But it doesn’t have to be this way.

Content Snare makes document collection simple. It allows you to request, store, and approve client documents and information on one simple, easy-to-ease platform. Think of it as a single source of truth for all the content you need, or a digital checklist that allows you to:

- Save time with built-in templates — including a life insurance questionnaire

- Avoid the mess of back-and-forth emails

- Set automatic reminders and follow-ups

- Approve or reject customer information with a single click

- Offer a slick and intuitive customer experience

So no more messy spreadsheets, email chains, or shared documents. No more forgetting who sent what, or where to find it. With Content Snare, you and your customers have everything you need in one place.