As a firm, you’re probably aware of the latest Australian Tax Office (ATO) initiative to expand on the client-to-agent linking programme. In a bid to cut down on fraud and to improve security, every business with an ABN number (apart from sole traders) must now complete the ATO’s five-step online process for nominating an adviser.

It’s a move that’s angered many accountants and tax advisers, with the programme being seen as yet more red tape and admin for firms and their clients to wade through.

But the good news is that Content Snare has your back. Our new client-to-agent linking template allows you to navigate the whole process right from inside Content Snare.

What is client-to-agent linking all about?

Client-to-agent linking is part of the ATO’s ongoing mission to strengthen the security of online services, with the aim of protecting users against fraud and identity-related theft.

Client linking had already been rolled out to larger entities, such as public and multinational businesses, businesses in the Top 500 privately-owned wealthy groups and government entities. But from 13 November 2023, all entities with an ABN number (excluding sole traders) will need to nominate an accountant or tax adviser to act on their behalf as a tax agent.

The responsibility for completing this process lies with the client, adding a task to the onboarding process over which you (the accounting firm) have little control. The concern is that this expansion of client-agent linking will add a big chunk of admin to your existing workload.

For example:

- Clients will need reminding to complete the client-agent linking process

- Additional admin will be created for your practice team

- The engagement process will be slowed down while you wait for disorganized clients to get around to completing the key linking steps.

What are the five steps that client’s must complete?

So, what exactly does the client have to do to complete the client-to-agent linking process?

As with most ATO processes in the digital age, this is an online process that’s carried out directly through the ATO site. It does, however, entail a certain amount of organization and pre-planning from the client, who will need to know their myGovID, their ABN number and the agent details for your firm, so they can nominate you as their advisor

Here are the five key steps that your client must complete to get client linking up and running:

- Step 1: Set up their Digital ID (myGovID) – the client will need to download the myGovID app, available from the App Store or Google, and follow these instructions on how to set up their myGovID.

- Step 2: Link their myGovID to their ABN – your client will need to link their myGovID to their Australian Business Number (ABN) using the Relationship Authorisation Manager (RAM) on the government site.

- Step 3: Log in to Online services for business – Use your myGovID to log in to Online services for business.

- Step 4: Nominate you as their authorized agent – this will be done in the Online services for business section. To complete this step your client will need your registered agent number in order to identify you as their advisor.

- Step 5: Inform you that they’ve nominated you as their agent – as their agent, you won't receive an automated system notification. This final step is left to the client to complete, which could lead to firm’s not being aware of the nomination.

As the agent, you have 28 days to action the nomination before it expires. This time period can be extended for another 28 days if you run out of time.

How does our client linking template cut the red tape?

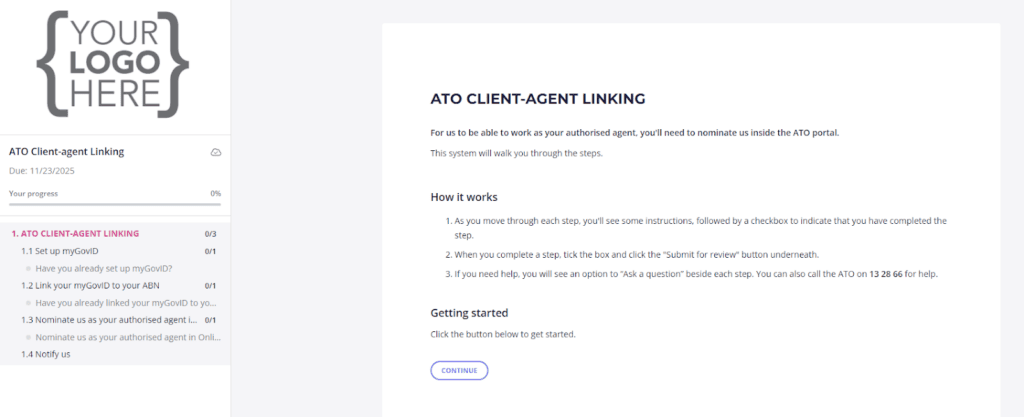

This is a relatively complex process for the client to finalize. But, don’t worry, our new ATO Client-agent Linking template is live now in Content Snare to make things easier.

Just hit a new request, launch the template from your dashboard and it’s all ready to be tailored with your firm name and external branding. You can even add the template to an existing client onboarding template, adding the client-agent linking process straight into your onboarding process and cutting down on the admin tasks.

It’s a fast and effective way to send out the client-to-agent linking request to new clients, with the request neatly included in your standard onboarding process.

Once received by the client, the request will walk them through all five steps in the client-to-agent linking process. It will even help them find their myGovID and get everything linked to the ABN number, so there are no hiccups in the set-up procedure.

You can watch James Rose, Content Snare founder, taking you through the template set-up in the video below:

Content Snare: cutting back the ATO red tape

Here at Content Snare we believe in making your client onboarding process as streamlined and simple as possible. We get rid of the wasted ‘pick up, put down’ time by making it easy to onboard your clients and request the key documents and information you need from the client.

Using our ATO client-agent template is just one way to cut back the red tape, speed up the onboarding process and remove all the obstacles that can derail a smooth workflow.

Take a trial of Content Snare and start seeing the difference that a centralized, cloud-based approach to onboarding can have on your productivity and your client relationships