Imagine having a clear checklist of the tasks you need to complete every month for your clients. Each task can be delegated or automated, saving time and money for your firm.

As your business grows, there are a lot of tasks for a lot of clients that continue to grow, and it can be overwhelming, but having a monthly closing process can help.

In this post, we'll look at why you need a checklist and provide a list of functions bookkeepers complete to close their clients' books monthly and how to streamline each step.

Streamline your client document collection process

Say goodbye to the days of unorganized uploads and unanswered emails with your clients. Content Snare houses everything you need for collecting documents from your clients (and reminding them too!) under one roof.

The importance of having a month end checklist

- A checklist will keep you organized. There is nothing better than checking off tasks on your list as they get completed keeping you organized each month.

- A checklist will make sure nothing gets forgotten. Month-end close is so routine and second-nature that essential items may get overlooked. Still, a list ensures nothing falls through the cracks and gets forgotten and may avoid common accounting mistakes.

- A checklist will allow you to delegate to other team members or automate with technology as your business grows. At some point, as your business grows, you may want to pass some responsibility off to another team member. A checklist makes it easy to onboard and gives them an organized list of their monthly duties.

Having this simple process and workflow in place that can evolve and be customized will save you time in the long run, minimize errors and save your firm money.

How can month-end closing be improved?

A checklist allows you to break down each task and see how each can be improved, simplified, automated or delegated. Perhaps a monthly task can be done way more efficiently using software or utilizing features of your existing software. Find out how long each task is taking you or your team each month, and find solutions to reduce that.

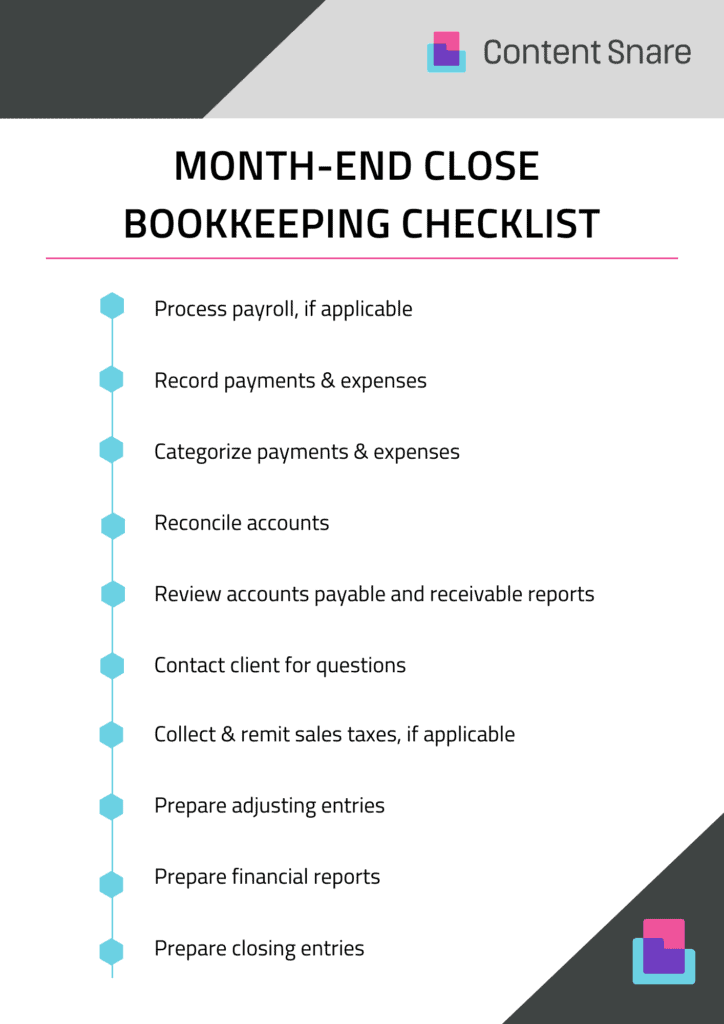

Month End Checklist

- Process Payroll, if applicable

If your clients have employees, you may be completing payroll bi-weekly or monthly. This may also be outsourced and need to be imported into the financials. Either way, this will need to be completed and payroll deductions submitted.

- Record Payments and Expenses

Record financial transactions and balance the books. The first step is to ensure that all income and expenses are recorded in your accounting system to categorize and reconcile. Enter all the accounting data such as bills received, receipts, import/post payroll, and generate invoices.

Tip: Automate This! - Utilize an accounting software that connects directly to the clients' bank

- Categorize Payments and Expenses

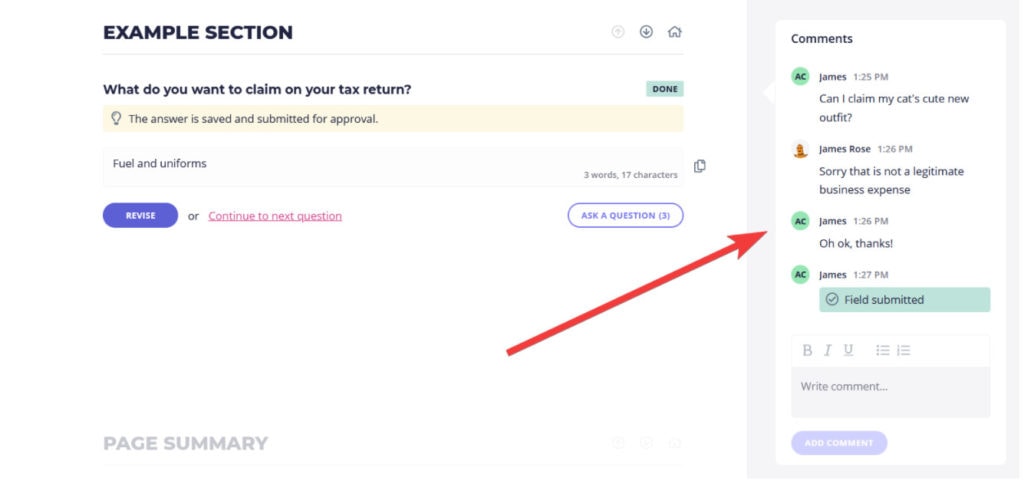

All incoming and outgoing payments need to be in their correct category. The more familiar you are with your client, the easier this is. Rules can be created to automate the categorization of common payments and income. No matter how familiar you are with the client, there will always be exceptions and items to confirm. Keep an organized list of questions to review with the client or missing documents to receive. Try using Content Snare to send queries to your clients. It eliminates back and forth emails by collecting all documentation and asking for progress status questions.

Tip: Automate This! - Set-up rules for recurring transactions and common categorizing of transactions

- Reconcile Accounts

The next crucial monthly step is to collect the statements from the clients, including a bank statement, credit card statements, loan statements or other financial records. If this step is not already automated, you will need to collect these from your client or directly from the financial institutions if you have access. This can be very time-consuming each month and is necessary for completing the month-end reconciliation. Reconciling accounts is critical to ensure that no transactions are missed, and everything is recorded correctly. Particularly bank account reconciliation, such as for chequing and savings accounts to ensure all transactions are recorded.

This is also why your client separates their business from their personal dealings. It allows easy reconciliation for just the business bank accounts. Cross-referencing the books against the bank statement and other source documents to confirm accuracy or reviewing the client’s work.

Tip: Automate This! - Content Snare will allow you to gather documents from your clients in an organized manner so you can skip the back and forth emails.

- Review Accounts Payable and Accounts Receivable Reports

Review the accounts payable aging report to see which bills need to be paid or scheduled to pay. After your analysis, you may want to show the client these reports to verify that every payment has been applied correctly and what is still outstanding. This is an important step to spot past-due balances. You will then create and send invoices to follow up on the accounts payable balance to get it paid.

The same goes for accounts receivable by ensuring all customer payments received were applied to the correct accounts receivable item. Make sure invoices from suppliers are accurate and delivered promptly. make sure you get paid on time, and pay your bills on time

- Contact Client for Questions

Content Snare is a great way to handle these questions without having constant email back-and-forth and ignored requests. It can be set up to when each question was answered or request completed. Report on issues and variances when they pop up.

- Collect and Remit Sales Tax, if applicable

This will vary by business and by location but something to keep in mind to be completed regularly.

- Prepare Adjusting Entries

Now is the time to prepare any necessary journal entries such as accruals, deferrals, prepaid expenses, and depreciation. It is essential to create schedules for these items to ensure the amount of each entry is accurate, such as a listing for fixed assets. All additions and disposals will need to be identified and tracked in your record depreciation expense. Keep track of routine journal entries and calculations done in the previous month to speed up this process each month.

- Prepare Financial Statements

Before presenting to the client, you will want to prepare the financial statements, including the following:

- the profit and loss statement (or income statement)

- the balance sheet and

- the cash flow statement.

This allows you to compare the budget or prior period financial statements to watch for any errors or unusual balances. Review the income statement accounts (revenue and expenses) for anything that looks off based on the preceding period and significant account balances that look out of place. You will also want to include the accounts receivable and accounts payable summary reports for their review.

As a bookkeeper, you are likely not preparing the tax returns. Having accurate financial statements and source documentation will save your clients money when they pass over to their CPA at tax-filing time.

- Review with Client

Schedule time to review the monthly financial statements with your clients. And don't assume they know everything in the financial statements as they are a small business owner, not an accountant. Work with them to add value to their business’s financial information by explaining everything to them over time, allowing them to make profitable business decisions moving forward.

- Closing Entries

Closing the books at the end of the period is essential to transfer the "temporary" income and expenses accounts to retained earnings. This may be done monthly or annually, so this may or may not be part of your monthly tasks.

Would your firm benefit from a checklist?

A checklist allows you to delegate, streamline, automate your month-end closing process. Could this task be done more efficiently with technology - like Content Snare - or delegated?

Contact Content Snare if you'd like to learn more about setting up an account to gather information and documents from your clients without the back and forth emails and unorganized shared document systems. Gone are the days of messing around with email trails and attachments is a massive waste of time. Keep accounting data organized and clients happy.