Accounting practices need more than just technical expertise to stand out.

The industry is getting increasingly competitive, and it takes a serious accounting lead generation strategy to ensure a steady stream of quality prospects. In this post, we’ll explore proven tactics that can improve your visibility and help you connect with potential clients in a meaningful way.

Let’s take a look!

Essential methods to generate accounting leads

We picked seven lead generation tactics that almost all accounting firms can execute (or at least outsource without substantial investments). If done properly, these methods will greatly improve your lead generation efforts in the long run.

1. Build a professional website

Would you consider hiring a firm without a professional website?

We’re sure the answer is ‘No’.

The same goes for your potential clients — they will likely spend some time researching your services online before making a move, and that’s why you need to create a good website to prove professional authority. Industry reports confirm this point: Half of users say their impression of a business depends on the company’s website design.

The best part is that your website doesn’t have to be complex.

All it takes is to create a few pages to clearly present your services and showcase credibility.

Premier One, an Australian accounting firm, gives us a nice example of how simple yet effective an accounting site can be:

Their website features a homepage followed by a few more pages: Services, About, Blogs, and Contact. It’s easy to navigate the site, explore Premier One, and get in touch with this company.

Much like the example above, your accounting website should also:

- Be user-friendly and easy to navigate

- Present your accounting services

- Explain who you are and what makes you a trustworthy accountant

- Feature quality content that proves you know what you’re doing

- Invite visitors to get in touch

Pro tip: Tailor website content to your audience

Bear in mind that accounting clients may have different demands. For instance, individual clients typically require personal tax preparation or financial planning services, while SMEs often need more complex services such as business tax planning or payroll management.

Take another look at Premier One’s homepage — it addresses small businesses rather than individual clients or enterprise-level companies. You should also tailor website content based on what your prospective leads are looking for.

2. Optimize your site for local searches

Local search engine optimization (SEO) is vital for accounting businesses because:

- 80% of users conduct local intent searches

- Almost 80% of users who search for something nearby visit a business within a day

So, how do you optimize your site for “near me” searches?

Firstly, publish location-specific content that talks to potential clients in your city or region. For instance, you can write blog posts and service pages that mention your city or neighborhood.

This tells Google and other search engines that you are relevant to local queries.

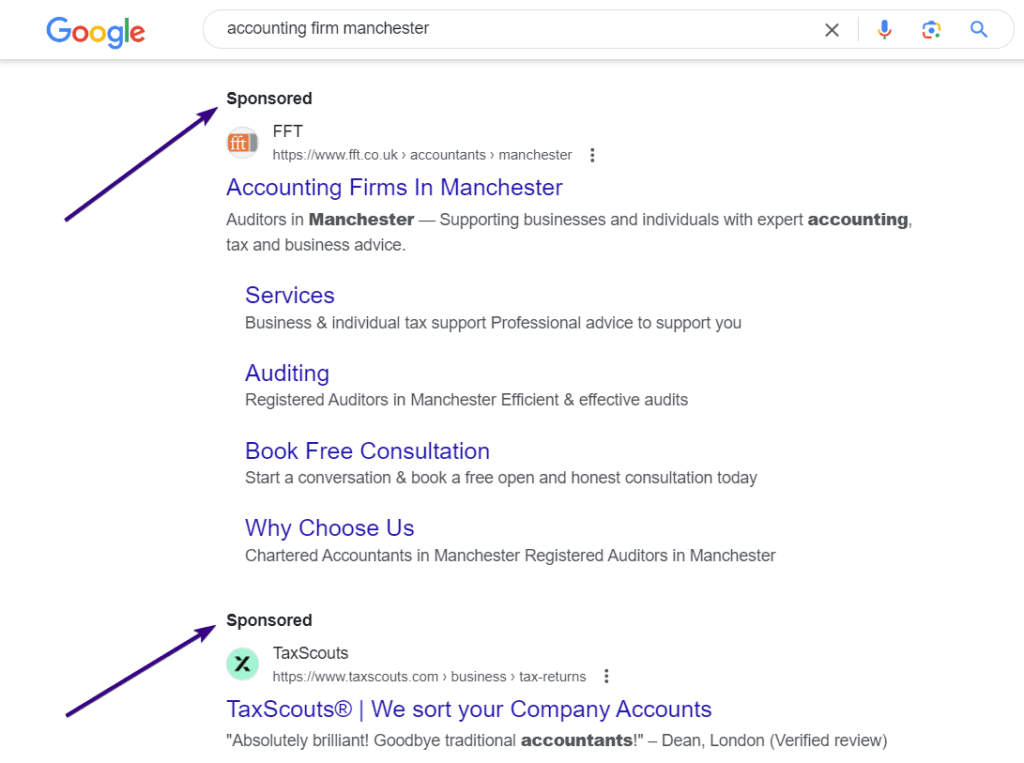

Secondly, you need to create a Google Business Profile. It’s a free tool that helps Google searchers find nearby businesses. Here’s an example of what users see when they search for “accounting firm Manchester”:

All it takes is 10 minutes to register and complete your Google Business Profile by filling out business information such as:

- Address

- Phone number

- Website

- Business hours

- Images

In addition, we strongly suggest using relevant keywords in your business description to increase your chances of appearing in local search results. For instance, it can be something like “Your City accounting firm” or “tax services in Your City”.

3. Show your knowledge (and personality) on social media

Most people want to work with someone they can relate to. This makes social networks an amazing lead generation tool because they allow you to demonstrate knowledge in a more personalized manner.

You could use social media like LinkedIn or X to give followers a glimpse of the person behind the numbers. Even a brief touch of humor or honesty can humanize your business and make it more approachable to prospective clients.

For instance, you can post about a typical day in your office, share photos from team-building events, or talk about why you chose to become an accountant.

Related: 15 accounting influencers you should follow

What’s best, social networks are a two-way street. They help you engage with followers by responding to comments and joining conversations about accounting and finance.

| Note: Consistency matters Social media marketing demands consistency, so we encourage you to post regularly. Whether it’s daily or weekly, regular posts keep you top-of-mind with your audience and signal reliability — a critical trait for accounting professionals trying to attract qualified leads. |

4. Email marketing still works

Despite the rise of social media and other digital marketing channels, email remains one of the most effective tools for generating and nurturing leads. After all, nearly 100% of email users still check their messages every day, some as much as 20 times a day.

How can you take advantage of it?

Start by growing a list of contacts who have shown interest in your services. This can include current clients, past clients, and prospects who have signed up for your newsletter or downloaded a resource from your website.

| Note: Make sure to collect email addresses ethically, with clear opt-in consent and opt-out options. |

For instance, offer a free resource like a “Small Business Tax Planning Guide” in exchange for an email sign-up. This does two things for your accounting practice:

- It helps grow your emailing list

- It attracts leads who are already interested in accounting services

Remember to keep your emails truly useful and not just promotional. For example, send newsletters that include insightful articles, tax tips, industry news, or case studies showcasing how you’ve helped other clients succeed.

Finally, each email must have a clear call to action:

It’s an easy-to-see link or button that guides the subscriber towards the next step: booking a meeting, downloading a resource, watching a demo, or simply reading more on your blog.

5. Support organic content with ads

Organic content is irreplaceable when it comes to building trust and engaging your audience, but you should occasionally augment it with paid advertising.

The point is to amplify your reach and accelerate lead generation. Targeted ads on platforms like Google or LinkedIn put your content in front of a broader but more specific audience that might not find you through organic search alone.

For instance, use Google Ads to target keywords such as “accounting firm Your City” or “tax services near me.”

The outcome of your advertising campaign depends on multiple factors, but the overall results are positive:

- The average ROI on Google Ads is 800% — companies earn $8 for every $1 spent.

- Accounting clients spend an average of $683 after finding a company through online search.

6. Find partner firms for cross-promotion campaigns

Another interesting idea is to partner with complementary businesses to generate leads through cross-promotion. For instance, accountants can collaborate with:

- Legal firms

- Financial advisors

- Business consultants

It’s important to discover firms that share a similar target audience but offer non-competing services. Once done, you can work together to create joint content or special offers that both sides can promote to each other’s client base.

For instance, you and your partner company can create an eBook called “Small Business Compliance Guide,” or organize a webinar series "Financial Strategies for Business Growth."

This doesn’t just broaden your reach — it also adds value to your clients by introducing them to trusted professionals in related fields.

7. Don’t avoid relevant industry events

Networking events are referral generators for accounting practices. All those conferences, seminars, round tables, and trade shows give you an opportunity to connect with potential clients, partners, and peers in your field.

Face-to-face interactions leave a more lasting impression, making your firm more memorable than a cold email or digital ad. Here’s one of many networking-related comments we discovered while researching accounting forums:

From our experience, it’s useful to research the attendee list and identify key individuals or companies you’d like to connect with before the actual event. That way, you can prepare a few talking points or questions that demonstrate your expertise and interest in their business.

The bottom line is that in-person communication with other professionals often leads to mutual referrals — you are going to recommend their services to your clients, and they will end up doing the same for you.

Mix these methods for maximum efficiency

The only thing left to add is that no single lead generation tactic works in isolation. It’s best to blend these methods into a comprehensive strategy that targets potential leads through multiple channels. After that, you should regularly assess and tweak the strategy based on performance data to make sure you’re consistently attracting new leads.