If there’s one challenge that keeps accountants on their toes, it’s the never-ending pursuit of client payments. This not only drains valuable resources but also hampers cash flow and affects the overall financial health of the accounting practice — not to mention strained client relationships.

But we live in the era of digital transformation, which means you can use technology to solve (or at least reduce) the problem.

The best billing software for accountants can handle both fixed-fee and variable costs. More importantly, they can help you streamline payment management and mitigate the hassle of chasing clients.

But before we check the best options, let’s see why an accounting firm should use billing software at all.

The benefits of using billing software

Traditional billing methods require a lot of manual work. They aren’t only time-consuming but also prone to errors and inconsistencies. After all, tracking multiple payments across various clients is daunting, especially if you rely on spreadsheets or paper-based systems.

That’s why modern accounting firms use invoicing software to track billable hours, monitor expenses, and manage projects more efficiently. Here are just a few benefits of using billing software in accounting:

1. Automation

Dedicated software for accountants automates the entire invoicing process, from generating professional invoices to sending them electronically. It eliminates manual data entry and reduces the time spent on administrative tasks.

2. Efficient payment tracking

Billing software provides real-time visibility into payments received and outstanding. You can track payments, send automated reminders, and reconcile accounts effortlessly. This streamlines the payment process and improves cash flow management.

3. Streamlined invoicing

Billing tools generate recurring invoices and apply taxes and discounts. They also integrate with accounting systems, ensuring accuracy and consistency in invoicing. At the same time, most tools serve as time-tracking software — you get two tools in one, which makes it easier to properly price your accounting services.

4. Tracking fixed-fee and variable costs

Billing software helps accountants manage fixed-fee costs through automated invoicing based on predefined rates or estimates. On the other hand, it tracks expenses associated with client engagements, so you can input and categorize variable costs as well.

5. Advanced reporting and analytics

Billing software for accountants offers robust reporting capabilities that can improve your workflow. It provides accounting firms with comprehensive insights into billing trends, payment history, billable hours, and outstanding balances.

7 billing software solutions for accounting firms

Similar to client portals and accounting CRMs, the competition in the billing software market is fierce. We did the homework on your behalf to identify some of the finest time and billing software for accountants. Here are our favorite options:

1. Ignition App

- Price: Starter ($69), Professional ($149), Scale ($369)

- Free trial: Yes

- G2 rating: 4.6

Ignition App is a powerful client billing software that streamlines the invoicing process for accountants. You don’t need to go beyond the Starter plan to realize the advantages of this tool.

Ignition App offers ready-made proposal templates that cover the basics like services, payments, and e-signatures. You can brand your proposals and even embed videos to personalize the message or explain certain details.

You can make invoices automatically and use flexible client billing options — recurring, one-time, quarterly, and so on. You can also use manual billing in Ignition App, which is particularly useful for variable costs.

The platform offers a comprehensive business insights dashboard with features like financial reports, expense tracking, invoice categories, time tracking, and many more.

2. AccountSight

- Price: Basic ($108), Small group ($96), Enterprise ($72)

- Free trial: Yes

- G2 rating: 4.8

AccountSight is professional service automation software for all types of small businesses, including accounting firms. This platform offers basic features for online invoicing, payment receipts, resource management, and time tracking.

We particularly like AccountSight’s online project estimates. With this feature, you can customize the existing templates to create accurate cost predictions for upcoming projects. If the client accepts your project estimate, you can automatically convert it into an invoice for future use.

It’s also important to say that AccountSight integrates with QuickBooks, so you can automate billing and invoices. It’s also possible to change predefined billing rates in order to make one-off discounts or price adjustments.

3. Zoho Invoice

- Price: Free

- Free trial: It’s a free tool

- G2 rating: 4.7

Zoho Invoice is a free billing solution for accounting practices (and all other businesses). This tool will help you get paid on time thanks to the pretty wide range of free invoicing and accounting features.

For instance, you can use Zoho Invoice to bill multiple clients simultaneously or make recurring invoices. The system adjusts to numerous currencies and languages, but you can also adapt to local tax laws. It automates payment reminders, while clients have the option to accept or decline quotes.

Although it’s part of a wider Zoho ecosystem, Zoho Invoice seamlessly integrates with many other business apps. What’s best, you can also use it as a free time-tracking software.

4. Xero

- Price: Starter ($25), Standard ($40), Premium ($54)

- Free trial: Yes

- G2 rating: 4.3

You probably know Xero as one of the most popular accounting software solutions currently available. This platform has a plethora of powerful accounting features, with invoicing being only one of them.

Xero enables you to do many things — enter bills, track expenses, send quotes and invoices, reconcile bank transactions, and so on. We particularly like the Premium package because it gives users detailed cash flow and business overviews.

This accounting software is also user-friendlier than many similar tools. All things considered, it’s a fine platform for those who want to quickly charge clients for their accounting and bookkeeping services.

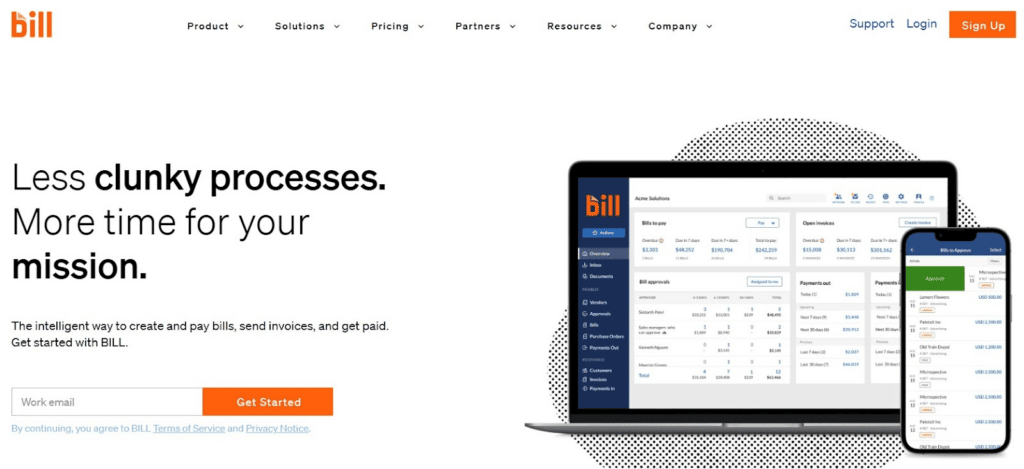

5. Bill

- Price: $49 per month

- Free trial: Yes

- G2 rating: 4.3

Bill (formerly known as Bill.com) was named G2’s number one accounting and finance software in 2023, which tells a lot about this platform. Bill can do almost anything for you — track billable hours, time, expenses, and even entire projects.

It eliminates annoying back-and-forth emails from your billing process. We love Bill’s smart scan function that can read invoices on its own and pre-populate entry fields for you. Besides that, the system integrates with many popular accounting software solutions like Xero, QuickBooks, and Microsoft Dynamics.

6. Invoicely

- Price: Free (limited), Basic ($9.99), Professional ($19.99), Enterprise ($29.99)

- Free trial: It offers a free version

- G2 rating: 4.4

Invoicely is a free tool with customizable invoice templates. Of course, it also offers paid plans that are much more powerful, especially if you work with many clients and send a lot of invoices each month. It’s both time and billing software, so you can use it to track an entire team or project activities.

We recommend Invoicely for those who want a reliable billing platform but don’t need too many advanced features. Invoicely is simple and easy to use, which is often enough for smaller accounting practices and businesses.

7. Paymo

- Price: Free (limited), Starter ($4.95), Small Office ($9.95), Business ($20.79)

- Free trial: It offers a free version

- G2 rating: 4.6

Paymo is an excellent project management tool with robust features for accountants. It makes billing a breeze thanks to the intuitive interface and simple invoicing functions. Accountants can easily track time spent on different tasks with Paymo, which allows for accurate billing based on actual hours worked.

Although it’s mainly focused on project management, Paymo gives you all the key features for billing and expense tracking. Besides that, the system displays impressive live reports with countless details about your clients and projects.

Streamline your workflow with billing software

Accounting firms that use billing software streamline their workflows and position their businesses for long-term growth. You can do the same thing — billing software for accountants lets you generate invoices, track payments and expenses, and reconcile accounts with just a few clicks.

This newfound efficiency will free up your time and improve accuracy, ensuring you get paid on time and in full. The only job you have left is to choose time and billing software that perfectly matches the needs of your accounting firm.