Industries across the board are revolutionizing the ways that they do things by implementing AI software. It’s no surprise that the accounting industry is following this trend given its need to process large volumes of data and ensure complete accuracy.

If you work for an accounting firm and are wondering what benefits you can experience through the introduction of AI tools or just want to start exploring AI in accounting, you’re in the right place.

In this introductory post, we’ll explore some examples of AI tools you can use in accounting along with some guidance on how to run an AI pilot program in your accounting business.

Let’s jump in!

What types of AI are used in the accounting industry?

The accounting industry uses a range of AI tools for specific purposes. Here are a few of the most common types of AI in accounting, each of which works a bit differently.

Natural language processing (NLP)

NLP is a type of AI that makes it possible for computers to understand, interpret, and generate human language. In accounting, NLP would be used to pull data from documents that have text in them, like invoices, receipts, and financial statements.

Robotic process automation (RPA)

RPA involves using bots to automate repetitive tasks that typically follow rules. Accounting firms use RPA for data entry, matching invoices, and other mundane financial processes that take a lot of time. RPA helps them be more accurate and efficient.

Machine learning (ML)

ML is when AI uses algorithms to identify patterns and trends. Accounting and finance departments apply machine learning algorithms to financial data sets to pick out potentially fraudulent patterns, predict analytics, and forecast numbers.

What are some examples of AI tools accounting firms can use?

Here are just a few examples of accounting processes that can be optimized along with a list of AI accounting software to explore.

Invoice and document creation

AI tools can automate the extraction of data from invoices and receipts, saving tremendous time on manual data entry. They can pick out data like transaction amounts, invoice numbers, invoice dates, and client info and feed this information directly into an accounting system.

Chat GPT offers a number of plugins to facilitate this. To access them, you need to be a ChatGPT+ subscriber. One example is Invoice Pilot. By installing the plugin, you can generate invoices more quickly using simple language and prompts like:

“Create an invoice for customer John Doe, for web design services totaling $500.”

The tool will follow the prompt to create a basic formatted invoice for you and then give you options for customizing it (add a logo, choose a currency, etc) before sending it to your client.

The plugin will then send the invoice directly to your email or create a PDF for you that you can attach to an email yourself. Easy peasy!

CSV Creator and DOCX Maker are two other similar plugins that can create basic formatted documents for you based on the information you plug into ChatGPT.

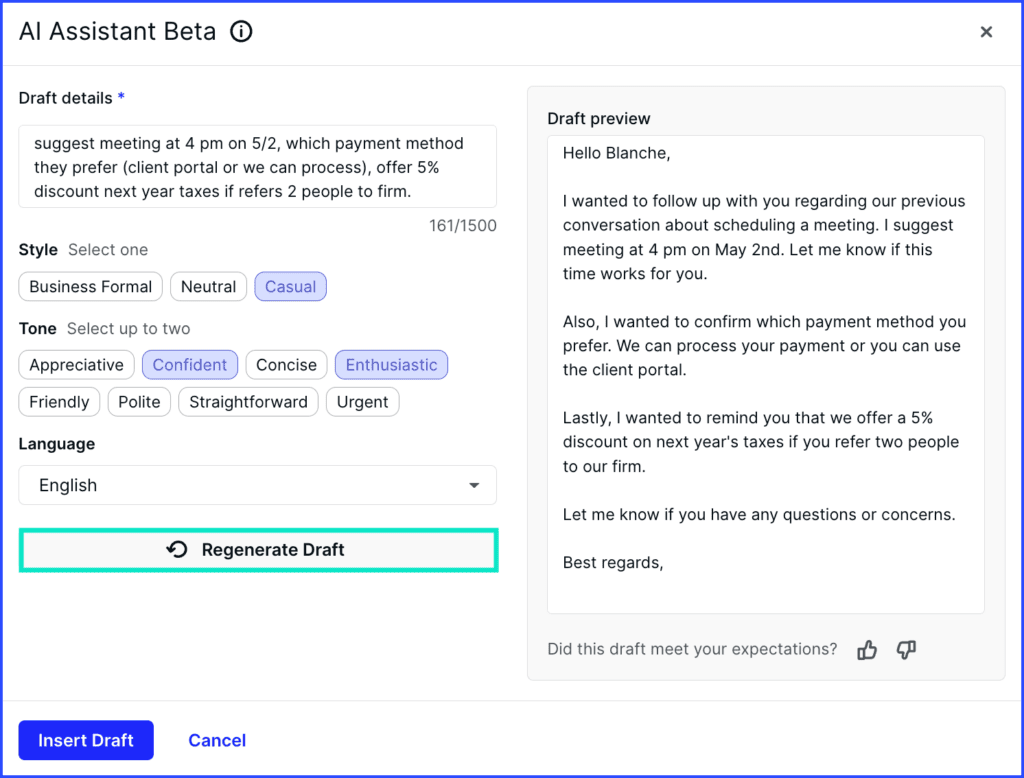

Generating client emails

AI tools can help you save on all those added hours you spend typing out emails to clients.

Canopy AI assistant and Karbon AI are examples of tools that help you save time by generating emails for you based on some basic input from you. Not only will it draft an email for you, but it gives you countless options to rephrase it if you don’t like the draft, and tweak the tone to make it friendlier, more formal, or more concise as needed.

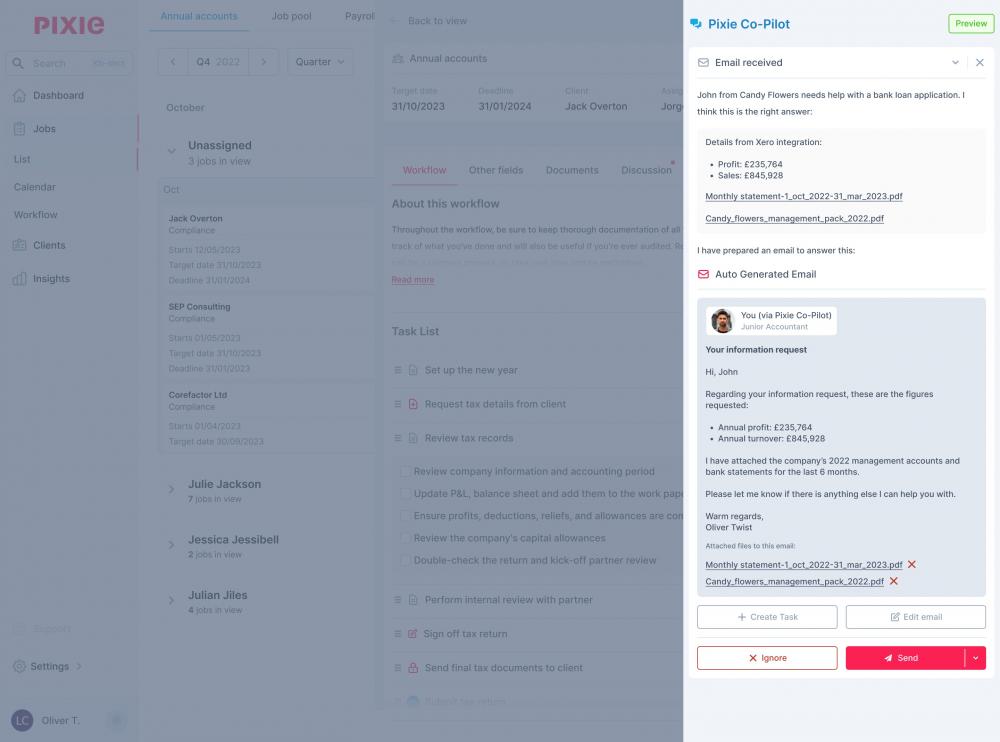

Pixie co-pilot is an AI that takes email generation a step further as an AI agent tool. AI agents have the ability to get to a source like Xero and locate relevant data that you may need to provide in an email response, like balance amount or related documents.

This can be a game change when it comes to saving time on client correspondence. This tool isn’t officially out yet but is certainly one you’ll want to keep an eye out for.

Recording Meetings

AI tools can come in handy for recording lengthy meetings and helping you locate important information that was discussed in the meeting later on.

Several tools like Fathom and Fireflies.AI are available to sit in on Zoom meetings and transcribe away.

A great feature of Fireflies.AI is that it allows you to chat with the AI tool about the meeting itself. After the meeting has been transcribed and made searchable, you can converse with the tool to ask it things like:

“Did the client mention X in the meeting?

“Were rental properties discussed?”

“Did I remember to go over last year’s tax return with them?’’

With smart search functions, it also lets you search for themes, topics, dates, questions, and sentiments.

This can be a real time saver!

Locating information in large data sets / documents

In the event that you need to analyze a new bill, regulation, or any other large document, another handy ChatGPT plugin to make use of is AskYourPDF.

Once you enable the plugin, all you have to do is put a URL of a document into your ChatGPT conversation, use the Chrome extension, or upload a document and ask for the specifics you’re looking for.

Client communication

AI-powered chatbots like ChatGPT and ChatCPA can help accounting firms answer common questions asked by clients more quickly. These tools help enhance the customer service experience by providing 24/7 availability and faster responses. AI-powered chatbots can also help send out regular client messaging and reminders, saving on manual time needed to write emails.

In a LinkedIn post written by Andrew Suttman, a SmartlinkAI employee, he shares how AI chatbots transformed customer service for a renowned accountancy firm by helping it reduce response times, improve client satisfaction, and unleash operational efficiency.

Tax Preparation

AI-driven tax preparation software like AI Tax and ZeroTax AI use NLP and ML to extract, analyze, and input information from various tax-related documents like paystubs to prepare annual taxes in a fraction of the time. Some software can cross-reference tax codes and regulations to ensure tax compliance with the latest laws.

What are the benefits of using AI in accounting?

Saving time

AI-powered tools help accountants save plenty of time on routine tasks. Rather than having to manually extract information from invoices and receipts and then input the information into accounting software, AI can do this in a fraction of the time.

Avoiding and reducing human error

Manual accounting tasks like data entry can be extremely prone to human errors like typos in spreadsheets or numerical mistakes in journal entries. AI tools help to reduce these errors by ensuring complete accuracy.

Increasing productivity

As a result of saving time on manual tasks, accountants can focus their time on higher-value and higher-impact tasks. It helps them get more done in a workday and achieve a better work-life balance.

Gaining valuable insights

Machine learning tools can analyze data in-depth and provide valuable insights they might not have the time or capability to gather otherwise. These insights can guide them in making more informed decisions on how to advise a client or what steps to take next in growing the business.

Cost savings

AI-powered systems help reduce the labor hours needed for repetitive tasks as well as hours needed by auditors. Needing fewer workers for these tasks, and having more data stored in the cloud with these tools ultimately leads to needing less office space, meaning firms can save tremendously on rent and utilities.

Another way that accounting AI systems help accounting firms save money is by saving on the cost of employee turnover by removing the mundane tasks that often lead to disengagement.

Competitive advantage

Staying up to date with technology and integrating it into existing workflows is one way to gain a competitive edge against competing accounting firms that might be experiencing slower processing times by doing things the old way. Being early adopters of AI accounting tools can also help accounting firms stand out and attract clients who want to work with tech-savvy partners.

Improved client experience

Not only do clients benefit from having faster turnaround times, more accurate statements and tax returns, and reduced fees thanks to the help of AI accounting tools. But when these aspects are taken care of, it opens up the firm to do more with managing client relationships.

One example of a firm that has enhanced its client experience thanks to the help of AI is Goldstein Enright Accountancy. In an interview, Robert Goldstein, CPA and Managing Parter of Goldstein Enright speaks about the ways the firm is now able to go above and beyond to support its clients thanks to delegating other tasks to AI:

“We want to help the client succeed. So we get more involved in their management decisions, interpreting a financial statement, tax planning, relationships with banks, helping a client sell their business, helping them buy a business. We get involved with more meaty consulting. And it's how it gets more fulfilling, to tell you the truth.”

How to run an AI pilot program

1. Identify your goals

You don’t want to buy software that you hear is working for other firms, only to find out later on that it’s not what your firm needs to solve its specific challenges. Before making any impulse buys, determine what you’re looking to solve by adding AI technology. Do you want to:

- Save time on manual tasks?

- Reduce how often you experience human errors?

- Get insights you need to make complex decisions?

- Deliver an improved client experience?

Knowing your goals will help you narrow down what type of AI software you need to shop for so you don’t invest in things that you don’t need.

2. Audit current performance and determine KPIs

Measure how you’re performing without the accounting AI first. For example, if your goal is to save time on manual tasks, complete an audit to quantify how long you are currently spending on those tasks. That way, you’ll be able to come back to it later and see how much time your accounting AI tool helped you save.

3. Explore software options

Now that it’s time to explore what’s on the market, you might want to ask other accountants what they use or go through review sites like G2 to compare user reviews. pricing, options, and features. As you explore your options, remember to check whether or not the software can integrate with your existing systems, otherwise it might not go as smoothly as you planned.

Here are a couple of our blog posts on popular accounting software to help you get started too:

- Accounting automation software: Industry experts reveal their favorites

- A guide to the best software for accountants

4. Invest in training

Once you’ve chosen your software, it’s time to get your team on board because the software won’t just run itself! Set up a couple of onboarding meetings to introduce your team to the software, explain how to use it, and share how you foresee it improving day-to-day processes for the better. This will help maximize your team's success with the new tool.

5. Collect feedback throughout the pilot project

Set up a feedback meeting or use a feedback tool a couple of weeks or a month into using the new AI technology to get timely feedback on how the team is adjusting to the tool. Team feedback will help you determine whether it’s helping them solve problems, creating new issues that are slowing them down, or just isn’t the right tool for the tasks at hand.

6. Compare results

After your trial period for using the tool has come to an end, it’s time to evaluate whether or not it provided any benefit. Consider the feedback you collected from your team's experience and re-measure the KPIs you measured before the pilot project began. You’ll now be able to compare data side by side to see if the tool did indeed help you save time, improve the customer experience, or reach the goal you set.

Will AI replace accounting professionals?

Whatever the industry, when it comes to AI, there’s always the question of whether or not AI-based tools are on their way to replace human expertise. So will artificial intelligence replace accountants eventually?

The short answer is no for now.

Even though companies may hire less staff for the routine and manual tasks that software can take care of instead, such tools are not suited for:

- Complex decision-making, like considering the emotional and psychological aspects of financial decisions

- Critical thinking, like considering a company’s unique financial situation or a client’s personal needs and goals

- Considering business ethics, like complying with rules and regulations, or doing the right thing in challenging situations

- Finding creative solutions to financial challenges

- Performing certain accounting tasks that involve working with unstructured data sets

For all these reasons, human expertise is still essential to the accounting field. As we look forward, we can expect the near future to see AI and human accountants working together hand in hand to optimize financial processes and management.

Final advice for introducing AI technology in accounting

Helping to save tremendous time on accounting processes, guarantee accuracy, and deliver valuable insights, accountants are already seeing significant benefits by embracing AI technology.

With many accounting AI options on the market and more emerging by the minute, it’s crucial to choose AI software wisely according to the needs and goals of the business.

Don’t forget that although AI sometimes requires minimal human intervention, staff needs to be trained on how to work with the software to reap its benefits. By being open to the introduction of AI without forgetting the value of human expertise, accounting firms can enter their next evolution and start gaining the competitive advantage they need for business growth.

Related posts: