With a third of a billion businesses registered worldwide, how do we ensure that accounting is performed consistently, transparently, and in line with the latest regulations? The answer is through accounting standards.

In this article, we’ll explain everything you need to know about accounting standards, including:

- What they are

- Why we need them

- The different standards that are used worldwide

Ready? Let’s dive in.

What do we mean by accounting standards?

Accounting standards are sets of guidelines and rules that aim to systematise and standardise accounting practices. Essentially, they ensure that businesses within and across international borders are all playing by the same rulebook.

Regulatory bodies are usually responsible for designing and establishing accounting standards. In the USA, the Financial Accounting Standards Board (FASB) sets the agenda, while the International Accounting Standards Board (IASB) sets standards globally.

Why are accounting standards important?

Accounting is a complex and critical business function. Without a set of standards to conform to, each business would go about managing its books differently. It would be impossible to understand the processes involved. This would erode trust in the business world and accounting in general.

Accounting standards offer a prescribed way of doing things. By adhering to accounting standards, you can guarantee that your accounting practices are accurate, transparent, and trustworthy. This is beneficial for everyone, from accountants and auditors to business owners and investors.

How many accounting standards are there?

Well, the short answer is: it’s hard to say. Calculating the exact number of accounting standards worldwide is tricky for the following reasons:

- While many countries adhere to internationally recognised standards, others use their own accounting standards, either alongside international ones or instead of them

- Accounting standards are constantly evolving in line with changing business and accounting practices, as well as technological advancements

So, for the sake of simplicity, we’ll focus on two of the most important and widely used accounting standards.

The International Financial Reporting Standards (IFRS)

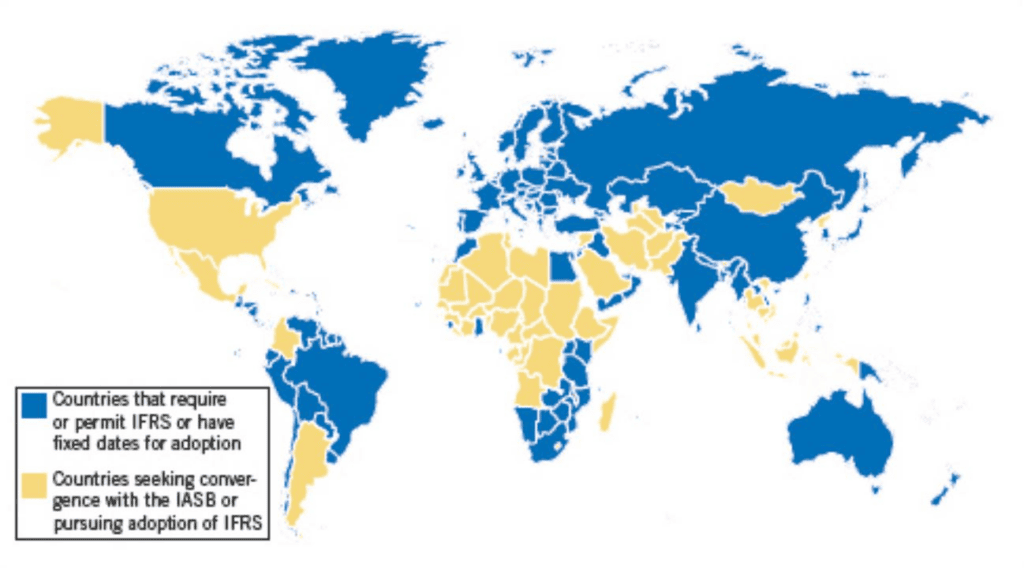

IFRS was established in 2003 by the IASB. Today, it is used in more than 144 countries globally, including Australia, Canada, India, Japan, and the entire European Union. This makes it by far the most widely used set of accounting standards worldwide.

In some countries, like those in the EU, IFRS is mandatory for all companies. In other countries, IFRS is mandatory only for certain types of companies. and currently comprises the following 17 accounting standards:

- IFRS 1 — First-time Adoption of International Financial Reporting Standards

- IFRS 2 — Share-based Payment

- IFRS 3 — Business Combinations

- IFRS 4 — Insurance Contracts

- IFRS 5 — Non-current Assets Held for Sale and Discontinued Operations

- IFRS 6 — Exploration for and Evaluation of Mineral Resources

- IFRS 7 — Financial Instruments: Disclosures

- IFRS 8 — Operating Segments

- IFRS 9 — Financial Instruments

- IFRS 10 — Consolidated Financial Statements

- IFRS 11 — Joint Arrangements

- IFRS 12 — Disclosure of Interests in Other Entities

- IFRS 13 — Fair Value Measurement

- IFRS 14 — Regulatory Deferral Accounts

- IFRS 15 — Revenue from Contracts with Customers

- IFRS 16 — Leases

- IFRS 17 — Insurance Contracts

The Generally Accepted Accounting Principles (GAAP)

GAAP is a set of accounting standards used in the US. Set by the Financial Accounting Standards Board (FASB) and enforced by the Securities and Exchange Commission (SEC), the first iteration of GAAP was implemented in 1936. Since then, GAAP has evolved to become a comprehensive set of accounting standards.

Today, GAAP is used by the vast majority of public and private companies in the US. That said, some US companies use IFRS instead of GAAP, especially international companies that operate in countries where IFRS is preferred or required.

Because GAAP is constantly evolving, it’s difficult to define how many accounting standards it contains. But there are 10 key principles that underpin GAAP:

- Regularity: The accountant adheres to GAAP rules as an agreed-upon standard

- Consistency: The accountant applies GAAP rules consistently at all times

- Sincerity: The accountant strives to deliver work that is accurate and impartial

- Permanence of Methods: The accountant applies consistent accounting procedures and methods, in line with GAAP

- Non-Compensation: Both positives and negatives, profits and losses, should be reported with full transparency

- Prudence: The accountant takes a fact-based approach to financial analysis, not a speculative or emotional one

- Continuity: While valuing assets, it is assumed that the business will continue to operate

- Periodicity: The accountant should make accurate financial entries across the appropriate time periods

- Materiality: The accountant must disclose all financial data and not withhold anything

- Good Faith: In other words, honesty is the best policy when it comes to adhering to GAAP

GAAP vs IFRS — what are the key differences?

You might be wondering at this stage how these two major accounting standards compare. Both standards share the same ultimate goal: to codify accounting rules and practices, with a focus on transparency, consistency, and compliance.

That said, there are some major differences between the two. Let’s take a look at some key examples.

1. Scope

GAAP is a local standard used in the US, while IFRS is an international standard used across the world, including 15 of the G20 countries.

2. Rules-based vs principles-based

GAAP accounting standards are rules-based. They offer much greater detail than IFRS, leaving little room for interpretation. IFRS takes a more theoretical, principles-based approach, leaving more space for flexibility and professional judgement.

3. Inventory costing

Another key difference between GAAP and IFRS is the way they treat inventory. Both standards allow for the first-in, first-out accounting method (FIFO) and the weighted average-cost method. But when it comes to the last-in, first-out method (LIFO), GAAP allows for it whereas IFRS does not.

4. Research and development costs

The development of intangible assets, such as through research and development (R&D), is treated differently between GAAP and IFRS. Under GAAP, R&D costs are considered expenses, except for costs relating to software development. Under IFRS, R&D costs can be capitalised.

5. Cash flow statements

Companies are required to prepare their cash flow statements differently under GAAP and IFRS, with information relating to interest and dividends being entered in different sections of the cash flow statement.

Other country-specific accounting standards

Like the US, many other countries have their own accounting standards issued and governed by national accounting bodies. These accounting standards are often based on IFRS, with modifications that reflect local requirements or regulations.

In the UK, for example, most companies adhere to the UK GAAP, which was established by the Financial Reporting Council (FRC) and is based on IFRS. Large publicly listed companies are required to use the EU version of the IFRS (EU-IFRS), with all other companies using UK GAAP.

There’s a similar situation in Australia, where most companies adhere to the Australian Accounting Standards (AAS), while companies listed on the Australian stock exchange are required to apply IFRS standards. AAS, like UK GAAP, is a modified version of IFRS.

There are many other country-specific accounting standards, which are often used alongside IFRS. Notable examples include:

- Chinese Accounting Standards (CAS)

- Japanese Generally Accepted Accounting Principles (JGAAP)

- Indian Accounting Standards (Ind AS)

- Korean International Financial Reporting Standards (K-IFRS)

- New Zealand Generally Accepted Accounting Standards (NZ GAAP)

What’s the future of accounting standards?

With IFRS now adopted across the globe, it is close to realising its goal of a single unified set of accounting standards. But there is one major omission when it comes to IFRS adoption: the US.

Unsurprisingly, there has been plenty of talk over the years of GAAP potentially converging with IFRS. But, so far, the US has remained resistant to giving up its local accounting standards.

Will this change in the future? Who knows. But one thing is certain: accounting standards will continue to evolve and adapt to the ever-changing business, regulatory, and technological environment.