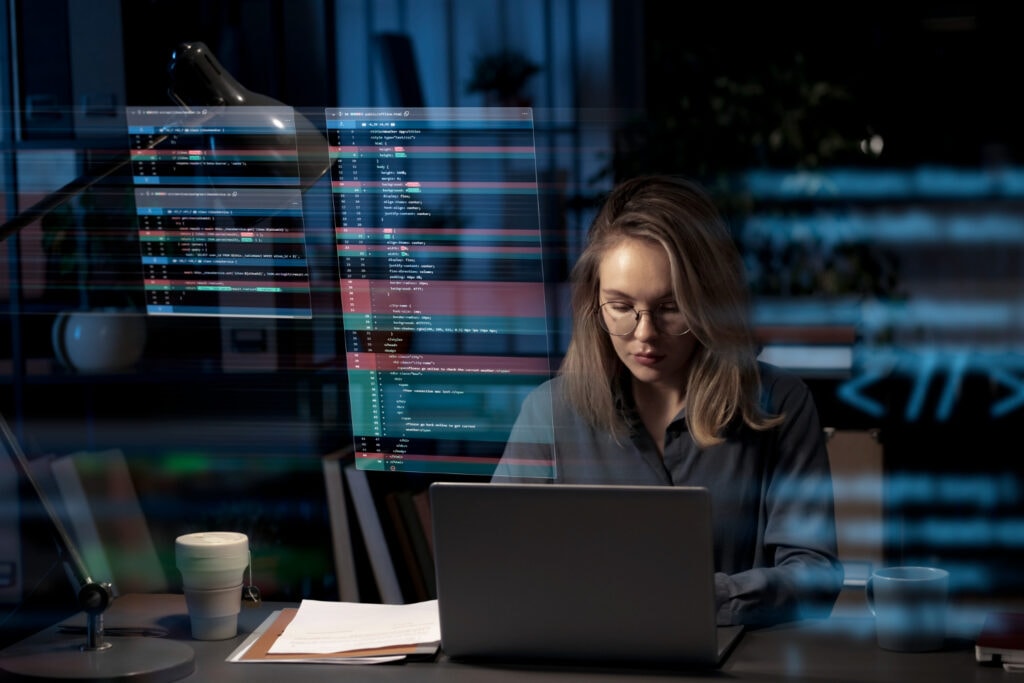

Security threats are a real danger for all businesses running at least some of their operations online. However, accounting practices are particularly vulnerable because they manage both their financial data as well as their clients’.

Reports show that one in three accounting firms experiences a cyber attack, which makes this sector the fifth most targeted in terms of hacking threats. To make things worse, security breaches often extend into companies’ offline operations too.

The big question is: how can you deal with it?

In this post, we’ll explain what makes data security in accounting so critical and show you practical tips on how to protect sensitive information.

Note: Just want to go straight to our security tips? Skip the rest of the post and go directly to the best practices for accounting data security.

Key takeaways:

- Accounting data security is an ongoing process relying on a whole set of tools and procedures to protect client-related information.

- Some of the must-have security practices and platforms include multi-factor authentication, data encryption, antivirus software, firewalls, and periodical employee training.

- Reliable accounting systems will help your firm with automation, secure client communication, endpoint security, and access controls.

Understanding data security in accounting

The goal of data security in accounting is to create a set of measures that protect financial information from unauthorized access, disclosure, modification, or deletion. Accounting firms do this to preserve the confidentiality and integrity of financial data throughout its lifecycle.

Some types of sensitive financial data are particularly prone to malicious attacks:

- Personally identifiable information (PII) such as names, addresses, social security numbers, and other details. Unauthorized access to this data may lead to identity theft and financial fraud.

- Financial transactions such as payments, receipts, or investment details.

- Confidential client-related information such as business strategies, financial plans, and proprietary data. Breaches in client confidentiality not only harm the client but can also lead to legal repercussions.

Consequences of data breaches in accounting

Firstly, hackers usually steal financial data to perform unauthorized transactions. This results in direct financial losses for you and your clients, while recovery costs (investigations and regulatory compliance) can further exacerbate the financial impact.

The second consequence is even greater because successful attacks compromise your professional reputation. Clients tend to mistrust organizations that fail to protect their sensitive information, which leads to a decline in business and partnerships.

Last but not least, you must pay attention to regulatory compliance. If you don’t abide by what's expected for compliance, your accounting practice will probably face legal actions, fines, and penalties that further intensify the impact of a data breach.

| Deloitte suffered a data breach incident in 2016/17Hacking attacks target accounting firms of all sizes — even the biggest accounting practices in the world experience such incidents. For instance, Deloitte suffered a data breach that compromised the confidential emails and plans of some of its blue-chip clients. |

Common threats

Data security threats in accounting are versatile — they continuously change as technology advances. However, phishing and social engineering tactics remain the most common cyber threats that exploit human vulnerabilities.

In addition, hackers will always target unsecured networks and devices.

On the other hand, we must emphasize insider threats originating from employees or trusted individuals within an organization. This category includes intentional or unintentional actions that jeopardize data security, which highlights the importance of physical access controls.

Related: How secure is email? Hint: not secure enough

Best practices for accounting data security

Although it’s getting harder to fend off ever-changing threats, accounting practices can impose several security measures.

1. User authentication

Authentication serves as the first line of defense against unauthorized access. Employing strong, multi-factor authentication methods helps ensure that only authorized personnel can access critical financial data. This may involve a combination of passwords, biometrics, smart cards, or other secure authentication mechanisms.

2. Data encryption

Encrypting financial data both in transit and at rest is fundamental. Encryption transforms data into unreadable formats — even if someone is able to access your information without authorization, they won’t be able to decipher it.

Related: How to send documents securely

3. Regular software updates

Outdated software is often vulnerable to exploitation by cybercriminals. According to the report, 80% of organizations that experienced a data breach could have prevented it by updating software on time.

4. Secure network and firewall configurations

Another tip is to establish secure network configurations and solid firewalls. This helps create a protective barrier against unauthorized access. Simply put, proper network segmentation keeps the entire system at bay even if one part of the network is compromised.

5. Organize employee training

Human error is a significant factor in data breaches — perhaps a bit too significant. Some reports claim that 95% of data breaches come as a result of human error. That’s why you should organize regular training sessions on cybersecurity awareness.

That way, employees will know how to recognize and thwart phishing attempts, social engineering tactics, and other deceptive practices.

6. Monitor and audit access to financial data

Real-time monitoring and auditing tools are the only way to track and review access to financial data. This not only helps detect suspicious activities promptly but also facilitates compliance with regulatory requirements.

7. Conduct periodical data backups

Regular data backups are a crucial defense mechanism against data loss due to cyberattacks or system failures. In the event of a breach, your organization can quickly restore financial data to minimize downtime.

Data security tools accountants should consider

Accounting data protection is by no means a manual process. It requires a whole set of tools to safeguard your accounting practice and protect it from different types of threats. Here are some suggestions:

Client communication tools

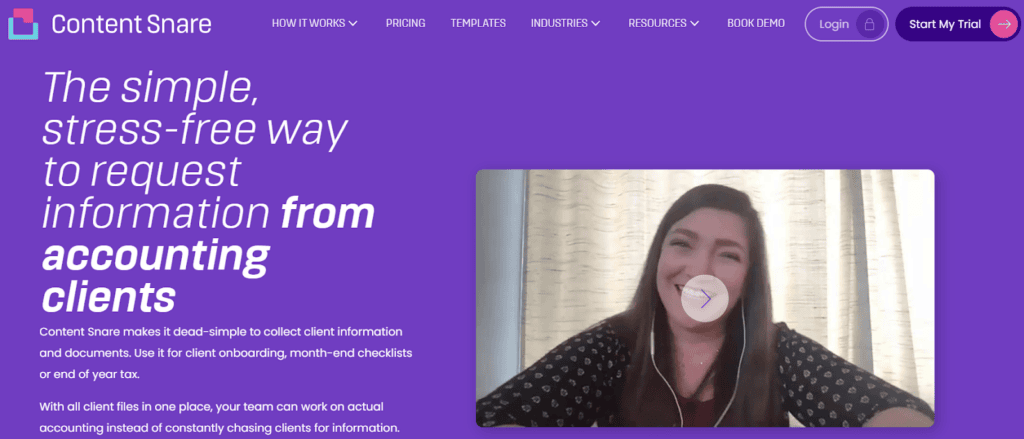

You’ll need a reliable communication system to collect client-related information and documents securely. Content Snare is one of the best information-gathering tools because:

- It helps you gather data and files from clients as quickly as possible

- It creates a secure environment powered by encryption, user authentication, firewalls, and network isolation

Our platform also offers a whole set of features that streamline data collection. For instance, automated reminders encourage clients to fill out your forms, so there’s no need to send emails manually. If your clients require additional help, you can provide it within forms using comments.

But do you want to know the best part? You can test Content Snare for two weeks free of charge — no credit card required.

Protect your accounting data with Content Snare

Improve the way you collect files and information from clients while keeping everything perfectly secure.

Accounting automation software

Investing in accounting automation software is the foundation of data security. You should pick a platform with security features such as encryption, access controls, and automated updates to protect client information.

Accounting automation software recommendations:

Intrusion detection and prevention systems (IDPS)

IDPS continuously monitor networks for suspicious activities and potential cybersecurity threats. Accountants use these systems to detect and respond to unauthorized access attempts promptly.

IDPS recommendations:

Virtual Private Networks (VPNs)

A VPN could further improve your cybersecurity mechanisms if some of your team members work remotely. VPNs create encrypted Internet connections to protect data transmitted between the accountant's device and the accounting system.

This is particularly useful when accessing sensitive financial data from unsecured public networks.

VPN recommendations:

Endpoint security solutions

Endpoint security tools protect individual devices (also known as endpoints) from malicious activities. Accountants should consider antivirus software and firewalls to secure laptops, desktop computers, and mobile devices with access to financial data.

Endpoint security software recommendations:

Accounting data security: Better safe than sorry

Malicious actors frequently attack accounting firms to exploit confidential information. It’s a risk that can cause serious financial and reputational damage, which forces accounting practices to be proactive rather than reactive.

The good thing is that you have lots of security systems at your disposal — find a few that suit your company and you’ll have a much easier time fending off data security threats.