Life as a mortgage broker can be full-on. On any given day, you have to juggle countless loan applications, navigate the ever-changing regulatory landscape, and ensure seamless communication with your clients.

So how do you stay on top of everything while delivering the best results? The answer is with the right technology.

In this article, we’ll look at the following categories of tools — and how they can help streamline and enhance the mortgage process.

- Customer relationship management platforms (CRMs)

- Loan origination software

- Document signing software

- Process automation tools

- Document collection tools

What are the benefits of using mortgage broker tools?

Mortgage brokers, like any service providers, have one ultimate aim: to serve their clients better and faster. Technology makes this possible with much less effort than you might think.

Today, mortgage brokers are well blessed with a range of tools that span the entire mortgage process. Some of these tools are specifically designed for mortgage brokers, while others are more generic tools that help simplify or automate a specific process.

Whatever the case may be, using the right tech can bring a host of benefits, including:

- More efficient processes

- Enhanced communication and collaboration

- Improved accuracy and compliance

- Data-driven insights

- Better client outcomes — and a superior client experience

Together, these benefits lead to happier customers and a more successful and profitable mortgage business. In other words, leveraging the right tech gives you a competitive advantage.

With that out of the way, let’s dive into our list of must-have tech tools for mortgage brokers.

Customer relationship management platforms (CRM)

If you’re serious about building long-lasting customer relationships, you’ll need a CRM. These platforms span a wide range of client-related processes — everything from sales qualification to client communication.

The best CRMs streamline processes and enhance business operations, acting as the central hub for all your marketing, sales, and client-related activities. Here are three of the best options for mortgage brokers.

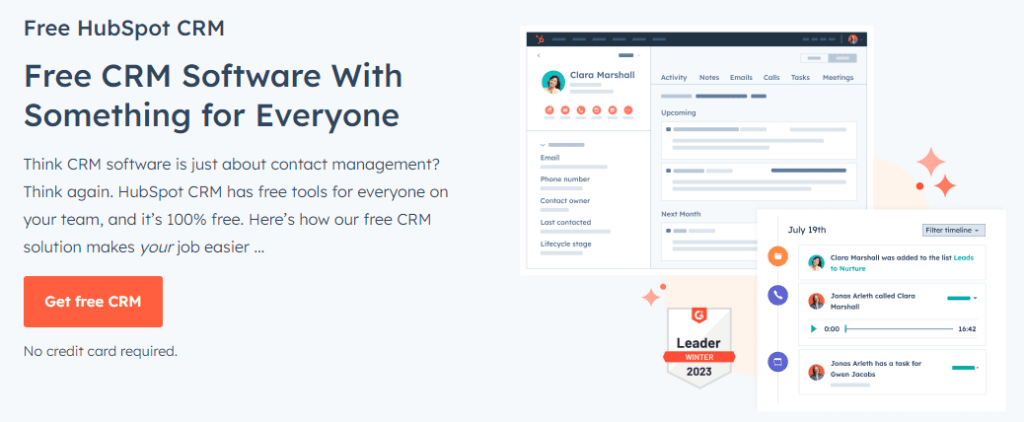

1. HubSpot CRM

HubSpot is a well-known CRM that’s popular with sales and marketing teams, but it's also a great choice for mortgage brokers — not least because it’s free! HubSpot is packed full of handy features that will supercharge your mortgage broker business, including:

- Real-time views of your entire sales pipeline — from lead tracking to conversion

- Detailed reports and analytics

- Email and prospect tracking

- A meeting scheduler

- Live chat to engage prospective clients in real-time

Remarkably for a free tool, Hubspot CRM allows you to manage up to 1 million contacts with no time limits, making it a perfect tool for a fast-scaling business. But if you do find that you’ve outgrown its feature set, you can easily upgrade to Sales Hub, Hubspot’s paid CRM.

Great for: Anyone looking for an excellent free CRM.

2. Keap

Keap might not be the most well-known CRM on the market, but we’ve included it on this list because it’s particularly popular with real estate agents, mortgage brokers, and small businesses. Here are some of its key features:

- Marketing and landing page templates

- Automated workflows

- eCommerce and payment options

- Text message marketing

- Over 2,500 integrations

Perhaps the most notable bonus of Keap, however, is that all of its paid plans include direct access to a ‘growth coach’ who helps you maximise the potential of Keap and scale your business fast.

Great for: Small businesses looking to scale fast, especially those in need of some hands-on guidance.

3. Monday.com

Monday.com is another popular sales CRM. As you can see from this article, the Monday team are aware of the unique challenges mortgage brokers face — and have built a product packed with features to support them, including:

- Lead capturing, qualification, and management

- Powerful automations and integrations

- Intuitive interface with drag-and-drop customisability

- Multiple views — Gantt charts, Kanban boards, timelines, calendars, etc.

- Built-in compliance

Monday.com offers total flexibility across its CRM platform. You can customise it to suit the specific needs of a mortgage broker business, from multi-channel marketing and communications to loan pipelines.

Great for: Mortgage brokers who want a CRM that’s flexible and customisable.

Loan origination software

Loan origination software (LOS) is designed to manage and automate all the steps involved in the loan origination process, from the initial application to submission and approval.

The best loan origination software streamlines the entire loan origination lifecycle, reducing manual processes and paperwork while improving efficiency and accuracy. Here are three of the best.

4. Floify

Floify is a comprehensive platform for mortgage brokers that comprises two distinct products. The first, Floify POS, is a dedicated mortgage point-of-sale (POS) portal, complete with document management and e-signatures. The second, Floifi+, is a complete LOS platform that offers the following features:

- “Interview-style” loan questionnaires

- Automated communications, including deadlines and notifications

- Customisable email templates

- Internal collaboration tools

- Built-in e-signatures

It’s worth noting that Floifi is primarily aimed at US customers, with functionality designed to streamline the process of managing “1003” loan applications.

Great for: US-based mortgage brokers looking for a comprehensive LOS platform.

5. LendingPad

LendingPad is one of the most popular LOS systems among mortgage brokers and loan officers — and for good reason. It packs a wide range of powerful features that span the lending process. These include:

- Complimentary POS system

- Real-time file document collaboration

- Streamlined workflows

- A range of powerful automations

- Campaign management

LendingPad is officially endorsed by the National Association of Mortgage Brokers as well as the Association of Independent Mortgage Experts, which is as reliable a recommendation as you can get in the mortgage industry.

6. Calyx

Calyx is an established mortgage software provider that’s popular with mortgage brokers, banks, and lenders. Its portfolio of products includes three separate LOS platforms,

- Zenly: A user-friendly, cloud-based LOS platform that’s fast to set up and launch

- Point: An industry-leading end-to-end LOS for mortgage brokers

- Path: An enterprise-grade, cloud-based LOS that offers flexible and customisable workflows

The best Calyx solution will depend on your specific needs and the size of your business, but there’s something there for everyone.

Document signing software

Document signing software plays a key role in the mission to provide clients with a slick and seamless digital experience. Instead of messing around with physical copies and all the printing and scanning that go with them, document signing software allows you to keep everything digital.

But there’s more to document signing software than a great client experience. The best tools also offer signature tracking and notifications, document management, and robust security features. Here are three you should look at.

7. DocuSign

DocuSign is the market-leading document signing solution, with over a million customers and a billion individual users worldwide. In addition to its popular e-signature platform, DocuSign offers a suite of products designed to streamline your document processes, including:

- eWitness: A solution that allows you to save the time and costs associated with manual witnessing

- Identify: A tool for verifying signer identity

- Contract Lifecycle Management: A solution for managing and collaborating on contracts

- Gen: A Salesforce-native application for automating document generation

With over 400 ready-made integrations, including Microsoft, Google, and the most popular CRMs, DocuSign fits seamlessly into your existing tech stack.

Great for: Mortgage brokers looking for a complete e-signature and document management solution.

8. PandaDoc

PandaDoc has been steadily growing in popularity since it was founded back in 2013. Today, it has over 50,000 customers and counting. PandaDoc is a comprehensive document management platform that covers the following areas:

- e-Signatures

- Proposals and quotes

- Payments

- Forms

- Contract management

One major plus for PandaDoc is that its free plan offers unlimited legally binding e-signatures for one user. But for additional users, you’ll have to upgrade to a paid plan.

Great for: Independent mortgage brokers looking for a free e-signature tool.

9. SignWell

Formerly known as Docsketch, SignWell has been making waves in the e-signature software space since it was founded in 2019. Today, more than 60,000 businesses worldwide use it to simplify the document signing process. Here’s what it offers:

- Legally compliant e-signatures

- Document workflows that allow you to track outstanding signatures

- Custom templates that speed up document creation

- Detailed audit reports for tracking document history

- Over 5,000 integrations

SignWell offers a range of pricing plans, including a free one. And with the SignWell API, you can easily embed e-signature requests into your website or app.

Great: Anyone looking for a simple yet powerful e-signature tool.

Process automation tools

Being a mortgage broker involves all sorts of repetitive, time-consuming processes. With the right automation tool, you can eliminate a lot of these, freeing you up to focus on delivering more value to your clients.

For example, with the right tool, you could automate the lead generation process, automatically creating a lead in your CRM when someone fills out a mortgage inquiry form on your website. And that’s just one of the virtually infinite processes that are ripe for automation.

Here are three of the best process automation tools on the market.

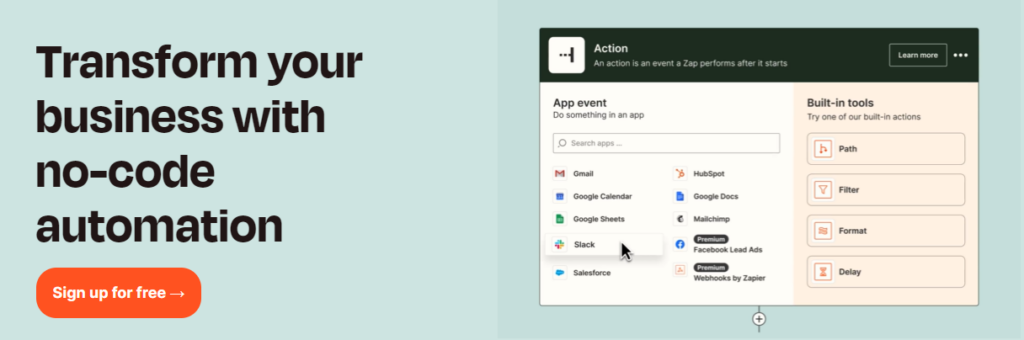

10. Zapier

Zapier is easily the most well-known automation tool. It allows businesses to seamlessly connect applications and build automated workflows. Not only does this save you countless hours, but it also ensures greater accuracy and consistency. Here’s what you can do with Zapier:

- Connect over 5,000 apps with ease

- Build new connections, known as Zaps, via a simple drag-and-drop editor

- Perform up to 100 actions per Zap

- Enhance Zaps with webhooks that allow you to receive data or send requests

- Schedule Zaps to run at specific times or when certain actions are triggered

Zapier is known for being relatively easy to use given the technical complexities involved in creating automated workflows. You don’t need to have a background in coding or web development to get started with it.

Great for: Anyone looking for a relatively simple yet powerful automation tool.

11. Make

You might know Make by its former name, Integromat. Make is generally considered Zapier’s biggest competitor in the automation space. And while it offers fairly similar outcomes, the overall process and UX are slightly different. Here’s what you can do with Make:

- Access a library of ready-to-go automation templates

- Create highly complex automations via a drag-and-drop builder

- Build workflows, known as scenarios, without limits

- Assign detailed permissions for your scenarios

- Leverage advanced features for data manipulation, error handling, and execution history

Make is a much more complex tool than Zapier, and as a result, there’s a steeper learning curve. But the payoff is that you can build much more complex workflows. It all depends on whether you need that or not.

Great for: Brokers looking to automate highly complex workflows and processes.

12. Microsoft Power Automate

Formerly known as Microsoft Flow, Power Automate is a cloud-based automation tool that enables you to build automated workflows between Microsoft products and third-party applications. Here’s what it offers:

- Automate processes with a simple drag-and-drop builder

- Hundreds of ready-made app connections, plus thousands of templates

- Spot process bottlenecks with automated recommendations

- Leverage AI to enhance your automations

Given that it’s part of the Microsoft suite of products, Power Automate is a sensible choice if you already use tools like Power Apps or Power BI.

Great for: Mortgage brokers who already use Microsoft products.

Document collection tools

Mortgage brokers typically need to gather a lot of documents to assess their clients’ suitability for mortgage loans, including proof of income, career history, and identification documents. With the right document collection tool, you can streamline and automate this process. Here are three top options.

13. Google Forms

Google Forms is a popular choice when it comes to capturing information from clients. It’s also completely free, making it a popular tool with small businesses on a tight budget. Here’s what you can do:

- Create simple, embeddable forms with drag-and-drop functionality

- Choose from multiple question types

- Customise form colours, images, and fonts

- Add custom logic, i.e. certain questions are displayed based on previous answers

- Automatic reporting

Naturally, Google Forms doesn’t offer the rich functionality you get with a paid platform. But when it comes to free options, it’s hard to beat.

Great for: Anyone looking for a free tool for capturing client information.

14. Jotform

Jotform is a popular form builder that boasts over 18 million users worldwide. With over 10,000 ready-made templates, you can get the information you need quickly. Alternatively, you can build custom forms to suit your specific needs. Here’s what it offers:

- Drag-and-drop form builder, complete custom logos, fonts, and colours

- Integrations with your existing tech stack

- The option to collect online payments directly through forms

- Form collaboration, with multiple users able to work on forms simultaneously

One issue with Jotform, however, is its lack of an autosave feature when completing online forms. Clients can save their progress and return later to complete the form, but this requires a manual “save and continue” process that some clients may forget to follow.

Great for: Businesses looking for a simple, no-code form builder with tons of templates.

15. Content Snare

Content Snare is a pioneering software platform that streamlines the entire process of requesting and gathering information, documents, and content. It offers a powerful range of features, allowing you to:

- Create custom forms and questionnaires with ease

- Access a growing library of ready-made form templates

- Add context to requests through text, video, or attachments

- Manage approvals, rejections, and client questions without resorting to email

- Schedule automated reminders at different intervals

- View progress across clients via an intuitive dashboard

- Provide a better UX through our autosave feature

And with Content Snare’s Zapier integration, it’s easy to connect to your existing tools, including CRMs and file storage.

Great for: Brokers looking to maximise document-collection efficiency while providing an outstanding client experience.